Attorney-Verified Transfer-on-Death Deed Document for Washington State

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details on the form. Omitting important information, such as the legal description of the property or the names of beneficiaries, can lead to complications later on.

-

Incorrect Legal Description: It’s crucial to accurately describe the property. Errors in the legal description can render the deed invalid. Always double-check against the property’s title or deed records.

-

Not Signing the Form: A common oversight is neglecting to sign the deed. Without a signature, the document cannot be considered valid, and the intended transfer will not occur.

-

Failure to Notarize: In Washington, the Transfer-on-Death Deed must be notarized. Skipping this step can lead to the deed being challenged or deemed ineffective.

-

Improper Filing: Some people do not file the deed with the appropriate county office. It’s essential to record the deed in the county where the property is located to ensure it is legally recognized.

-

Not Updating the Deed: Life changes, such as marriage or divorce, can affect beneficiaries. Failing to update the deed to reflect these changes can create confusion and potential disputes in the future.

Learn More on This Form

-

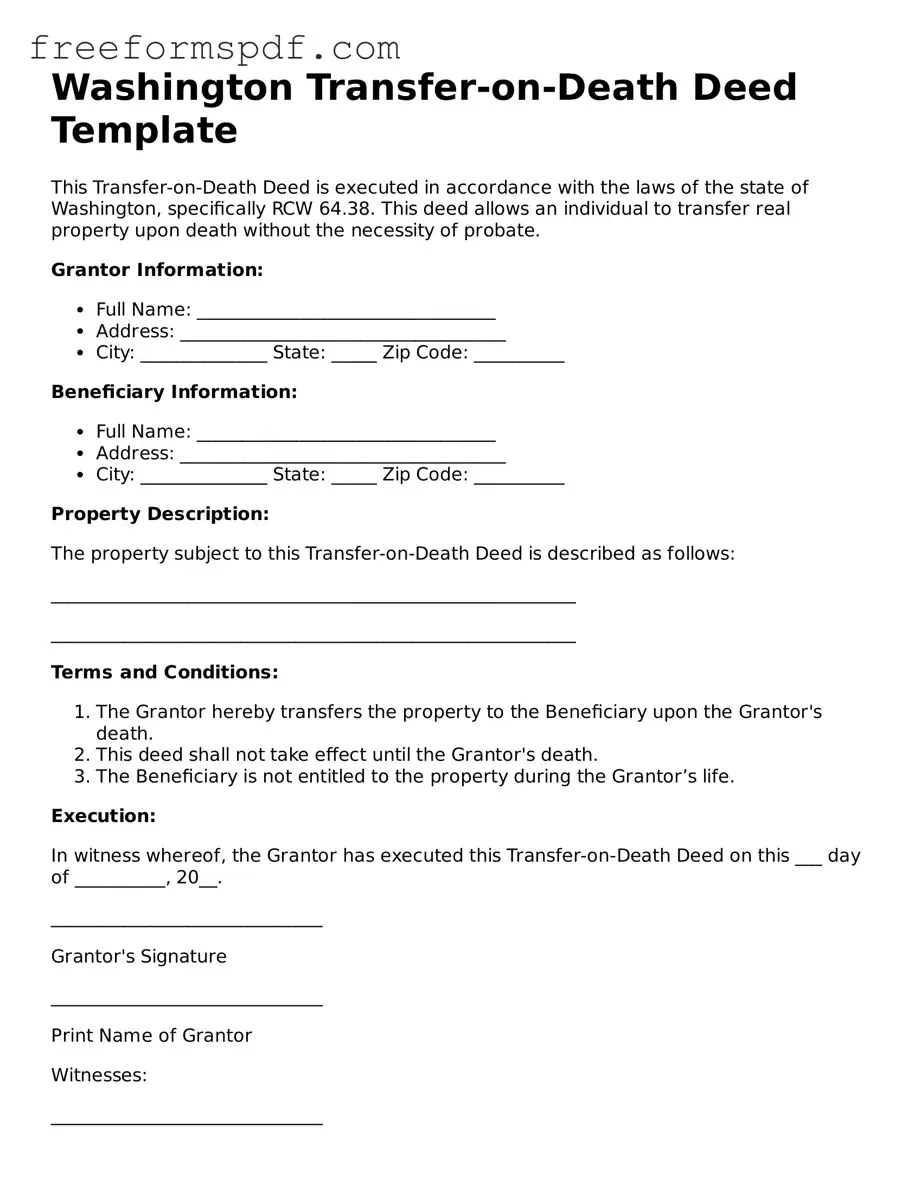

What is a Transfer-on-Death Deed in Washington?

A Transfer-on-Death Deed (TODD) allows property owners in Washington to transfer their real estate to a designated beneficiary upon their death, without the need for probate. This deed is recorded while the owner is still alive and becomes effective only after the owner's death. The beneficiary receives the property directly, simplifying the transfer process.

-

How do I create a Transfer-on-Death Deed?

To create a TODD, the property owner must complete the appropriate form, which includes details about the property and the designated beneficiary. The deed must be signed by the owner in the presence of a notary public. After signing, the deed should be recorded with the county auditor's office where the property is located. It is important to ensure that all information is accurate to avoid complications later.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked or changed at any time while the owner is alive. To revoke the deed, the owner must record a new deed that explicitly states the revocation. If the owner wishes to change the beneficiary, they can create a new TODD that replaces the old one. It is crucial to follow the proper legal procedures to ensure that the changes are valid.

-

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary dies before the property owner, the TODD will not automatically transfer the property to that beneficiary's heirs. Instead, the property will become part of the owner's estate and will be distributed according to the owner's will or, if there is no will, according to state intestacy laws. To avoid this situation, property owners should consider naming an alternate beneficiary in the deed.

Misconceptions

Understanding the Washington Transfer-on-Death Deed form is essential for property owners looking to streamline the transfer of their assets. However, several misconceptions can lead to confusion. Below is a list of six common misconceptions regarding this legal document.

- It only applies to residential properties. Many believe that the Transfer-on-Death Deed can only be used for homes. In reality, it can also apply to other types of real estate, such as commercial properties and vacant land.

- It requires the consent of the beneficiaries. Some think that beneficiaries must agree to the transfer while the property owner is still alive. This is incorrect; the owner can designate beneficiaries without their prior consent.

- The deed can be revoked only through a complicated process. There is a misconception that revoking a Transfer-on-Death Deed is difficult. In fact, the owner can revoke it at any time by executing a new deed or by filing a revocation document with the county.

- Beneficiaries automatically inherit the property upon the owner's death. While the deed allows for the transfer of property upon death, beneficiaries must still ensure that the deed is properly recorded to avoid complications.

- It avoids all taxes and fees associated with property transfer. Many believe that using a Transfer-on-Death Deed eliminates taxes or fees entirely. However, beneficiaries may still be subject to property taxes and other fees upon transfer.

- It is a permanent solution with no implications for the owner's estate. Some individuals think that once a Transfer-on-Death Deed is executed, it has no impact on the owner’s estate. This is misleading, as it can affect the overall estate plan and distribution of assets.

By clarifying these misconceptions, property owners can make more informed decisions regarding their estate planning and the use of Transfer-on-Death Deeds in Washington.

Some Other Transfer-on-Death Deed State Templates

Virginia Transfer on Death Deed - The Transfer-on-Death Deed is particularly appealing to those wishing to maintain privacy regarding their estate plans.

When dealing with the nuances of vehicle transactions in New York, understanding the importance of the New York MV51 form is crucial. This form not only facilitates the sale or transfer of vehicles from 1972 or older but also applies to non-titled vehicles, making it a key element in private sales. To ensure smooth transactions, this certification should be accompanied by appropriate documents such as bills of sale to verify ownership history. For those looking for templates to help with this process, NY Templates can provide the necessary resources for completing the form accurately.

Oregon Transfer on Death Deed - It can provide security and clarity for heirs during an emotionally challenging time.