Attorney-Verified Tractor Bill of Sale Document for Washington State

Common mistakes

-

Incorrect Vehicle Identification Number (VIN): One of the most common mistakes is entering an incorrect VIN. This number must match the one on the tractor's title and registration documents.

-

Omitting Seller and Buyer Information: Failing to provide complete names and addresses for both the seller and buyer can lead to confusion or disputes later on.

-

Neglecting to Include the Date of Sale: Not specifying the date of the transaction can create issues regarding ownership and liability.

-

Not Specifying the Sale Price: Leaving out the sale price can complicate tax assessments and future transactions.

-

Failing to Sign the Document: Both parties must sign the bill of sale. A missing signature invalidates the document.

-

Using Incorrect Form Version: Using an outdated or incorrect version of the bill of sale form can lead to legal complications.

-

Not Keeping a Copy: Failing to retain a copy of the completed bill of sale can lead to issues if disputes arise later.

-

Inaccurate Description of the Tractor: Providing an incomplete or inaccurate description of the tractor can create confusion about the item being sold.

-

Ignoring State-Specific Requirements: Not adhering to Washington state-specific requirements for the bill of sale can result in the document being rejected.

Learn More on This Form

-

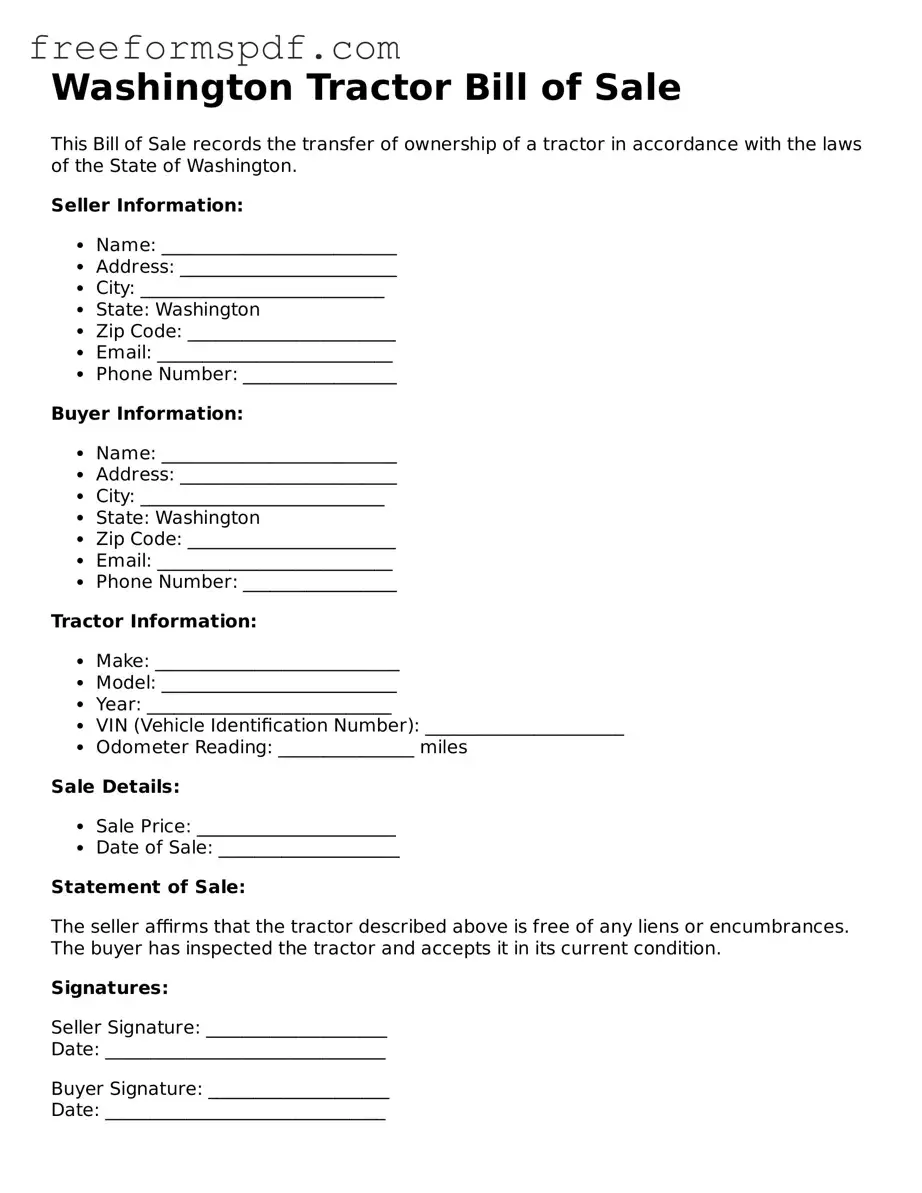

What is a Washington Tractor Bill of Sale form?

The Washington Tractor Bill of Sale form is a legal document used to record the sale of a tractor in the state of Washington. It includes essential details about the transaction, such as the buyer's and seller's information, the tractor's description, and the sale price. This document serves as proof of ownership transfer from the seller to the buyer.

-

Is the Bill of Sale required for all tractor sales in Washington?

While a Bill of Sale is not legally required for every tractor sale, it is highly recommended. Having a Bill of Sale provides a clear record of the transaction, which can be useful for both parties. It helps protect the seller from future liability and ensures the buyer has proof of ownership.

-

What information should be included in the form?

The form should include the following information:

- The full names and addresses of both the buyer and seller

- A detailed description of the tractor, including make, model, year, and Vehicle Identification Number (VIN)

- The sale price

- The date of the sale

- Signatures of both parties

-

How do I complete the Washington Tractor Bill of Sale?

To complete the Bill of Sale, fill in all required fields with accurate information. Both the buyer and seller should sign the document. It’s advisable to keep copies for personal records. If you are unsure about any details, consult with a professional for assistance.

-

Can I use a generic Bill of Sale form for my tractor sale?

While you can use a generic Bill of Sale form, it is best to use a specific Washington Tractor Bill of Sale form. This ensures that all necessary information is included and complies with state regulations. A tailored form minimizes the risk of missing critical details that could affect the transaction.

-

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both parties should keep a signed copy for their records. The buyer may need to present this document when registering the tractor with the Department of Licensing. It’s also wise to notify your insurance company about the sale.

Misconceptions

-

Misconception 1: The Washington Tractor Bill of Sale form is only necessary for new tractors.

This is not true. The form is required for both new and used tractors. Whether you are buying or selling, having a Bill of Sale protects both parties and provides a record of the transaction.

-

Misconception 2: The Bill of Sale is not legally binding.

In fact, a properly completed Bill of Sale is a legal document. It serves as proof of ownership transfer and can be used in court if disputes arise. Both parties should keep a copy for their records.

-

Misconception 3: You don’t need to include the sale price on the form.

Including the sale price is important. It provides clarity on the transaction and is often required for tax purposes. Omitting this information can lead to misunderstandings later on.

-

Misconception 4: Only the seller needs to sign the Bill of Sale.

Both the buyer and the seller should sign the document. This ensures that both parties agree to the terms of the sale. Without both signatures, the document may not hold up as well in legal situations.

Some Other Tractor Bill of Sale State Templates

How to Transfer Ownership of a Tractor - Valuable for both large-scale and small-scale agricultural operations.

When handling the sale or transfer of vehicles, especially those that are 1972 or older, it's crucial to utilize the proper documentation, such as the New York MV51 form. This form not only serves to certifiably document the transaction but also ensures that ownership is legally transferred between parties. For comprehensive templates and more detailed guidance, you can refer to NY Templates, which can assist in ensuring all necessary paperwork is correctly completed.