Attorney-Verified Promissory Note Document for Washington State

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all required information. This includes the names of the borrower and lender, the amount of the loan, and the repayment terms. Leaving out any of these details can lead to confusion later on.

-

Incorrect Dates: Entering the wrong date can create issues, particularly regarding the repayment schedule. It’s crucial to ensure that the date of the agreement and any due dates for payments are accurate and clearly stated.

-

Not Specifying Interest Rates: If the loan includes an interest rate, it must be clearly defined. Omitting this detail can lead to misunderstandings about how much the borrower will owe over time.

-

Failure to Sign: Both parties must sign the document for it to be legally binding. Forgetting to include signatures can render the note invalid, making it unenforceable in case of disputes.

-

Neglecting Witnesses or Notarization: Depending on the circumstances, some promissory notes may require a witness or notarization. Ignoring this requirement can lead to complications, especially if the note is challenged later.

-

Using Ambiguous Language: Clarity is key in any legal document. Using vague terms or jargon can lead to different interpretations of the agreement. It’s important to use straightforward language to ensure both parties understand the terms.

Learn More on This Form

-

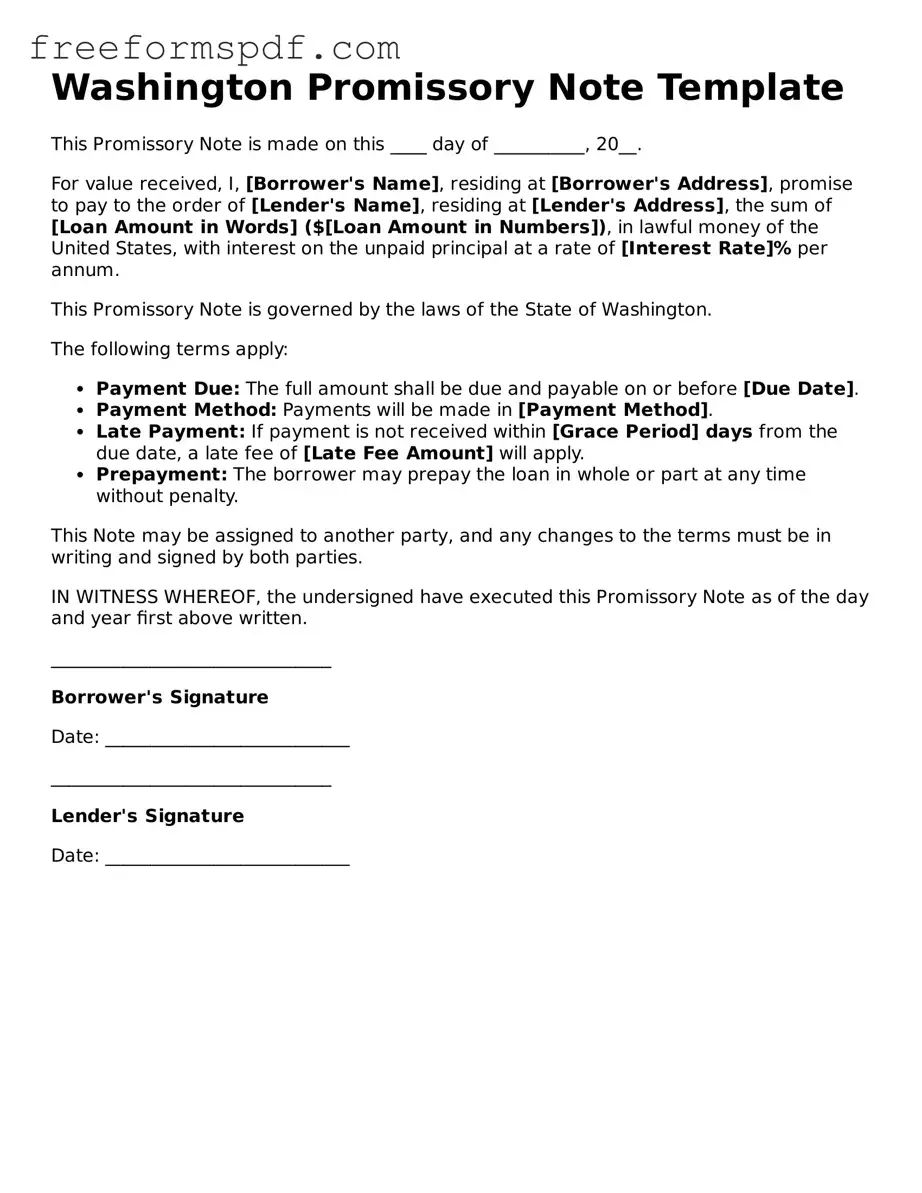

What is a Washington Promissory Note?

A Washington Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This note serves as a written record of the debt and includes important details such as the loan amount, interest rate, payment schedule, and any collateral involved.

-

Who can use a Promissory Note in Washington?

Any individual or business can use a Promissory Note in Washington. It is commonly used by lenders and borrowers, including friends, family members, and financial institutions. The note can be tailored to fit various lending situations, making it a versatile tool for personal and business transactions.

-

What are the key components of a Washington Promissory Note?

A typical Washington Promissory Note includes several essential components:

- The names and addresses of the borrower and lender

- The principal amount borrowed

- The interest rate, if applicable

- The repayment schedule, including due dates

- Any late fees or penalties for missed payments

- Details about collateral, if any

- Signatures of both parties

-

Is a Promissory Note legally binding in Washington?

Yes, a Promissory Note is legally binding in Washington as long as it meets certain requirements. Both parties must agree to the terms, and the note should be signed and dated. It's advisable to have the document notarized to enhance its enforceability, although it is not strictly required.

-

What happens if the borrower fails to repay the loan?

If the borrower fails to repay the loan as outlined in the Promissory Note, the lender has the right to take legal action to recover the owed amount. This could involve filing a lawsuit or pursuing other collection methods. The specifics will depend on the terms laid out in the note and applicable state laws.

-

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the revised terms. This helps prevent misunderstandings and ensures that everyone is on the same page regarding the new terms.

Misconceptions

Here are some common misconceptions about the Washington Promissory Note form:

-

It must be notarized.

Many people believe that a promissory note needs to be notarized to be valid. In Washington, notarization is not required for the note to be enforceable.

-

Only banks can issue promissory notes.

This is not true. Individuals can create and sign promissory notes as well, as long as they meet the necessary requirements.

-

It has to be in a specific format.

While it's important to include key information, there is no strict format that must be followed. The note should clearly state the terms of the loan.

-

Promissory notes are only for large loans.

People often think these notes are only for big amounts. However, they can be used for any amount, large or small.

-

Once signed, the terms cannot be changed.

It is possible to modify the terms of a promissory note, but both parties must agree to the changes and document them properly.

-

There are no consequences for non-payment.

Failing to repay a promissory note can lead to serious consequences, including legal action. It’s important to take repayment seriously.

-

All promissory notes are the same.

Each note can vary based on the agreement between the parties involved. Customizing the terms to fit the specific situation is common.

-

They are only used for personal loans.

While many people use promissory notes for personal loans, they are also used in business transactions and real estate deals.

Some Other Promissory Note State Templates

Texas Promissory Note Form - It's advisable for both borrowers and lenders to keep copies of signed promissory notes for their records.

A New York Non-disclosure Agreement (NDA) is a legal document designed to protect sensitive information shared between parties. By signing this agreement, individuals or businesses commit to keeping specific details confidential, ensuring that proprietary information remains secure. For more resources on drafting such agreements, you can refer to NY Templates, which offers useful templates and examples. Understanding the nuances of this form is essential for anyone looking to safeguard their intellectual property or trade secrets.

How to Create a Promissory Note - This form outlines the terms under which the borrower agrees to repay the lender.

New York Promissory Note - Promissory Notes can be used for both personal and business loans, enhancing clarity in transactions.

Promissory Note Template Oregon - Detailed notes can outline the consequences of defaulting on payment.