Attorney-Verified Prenuptial Agreement Document for Washington State

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details about their assets and debts. It is crucial to list all properties, bank accounts, and liabilities accurately. Leaving out any significant item can lead to complications later.

-

Not Seeking Legal Advice: Some people assume they can complete the form without professional guidance. This can result in misunderstandings about the implications of the agreement. Consulting with a lawyer can ensure that all parties fully understand their rights and obligations.

-

Inadequate Disclosure: Full transparency is essential in a prenuptial agreement. Failing to disclose financial information or hiding assets can invalidate the agreement. Both parties must be honest about their financial situations to create a fair document.

-

Ignoring State Laws: Each state has specific requirements for prenuptial agreements. Some individuals overlook these legal stipulations, which can lead to enforceability issues. Familiarizing oneself with Washington state laws is vital for a valid agreement.

Learn More on This Form

-

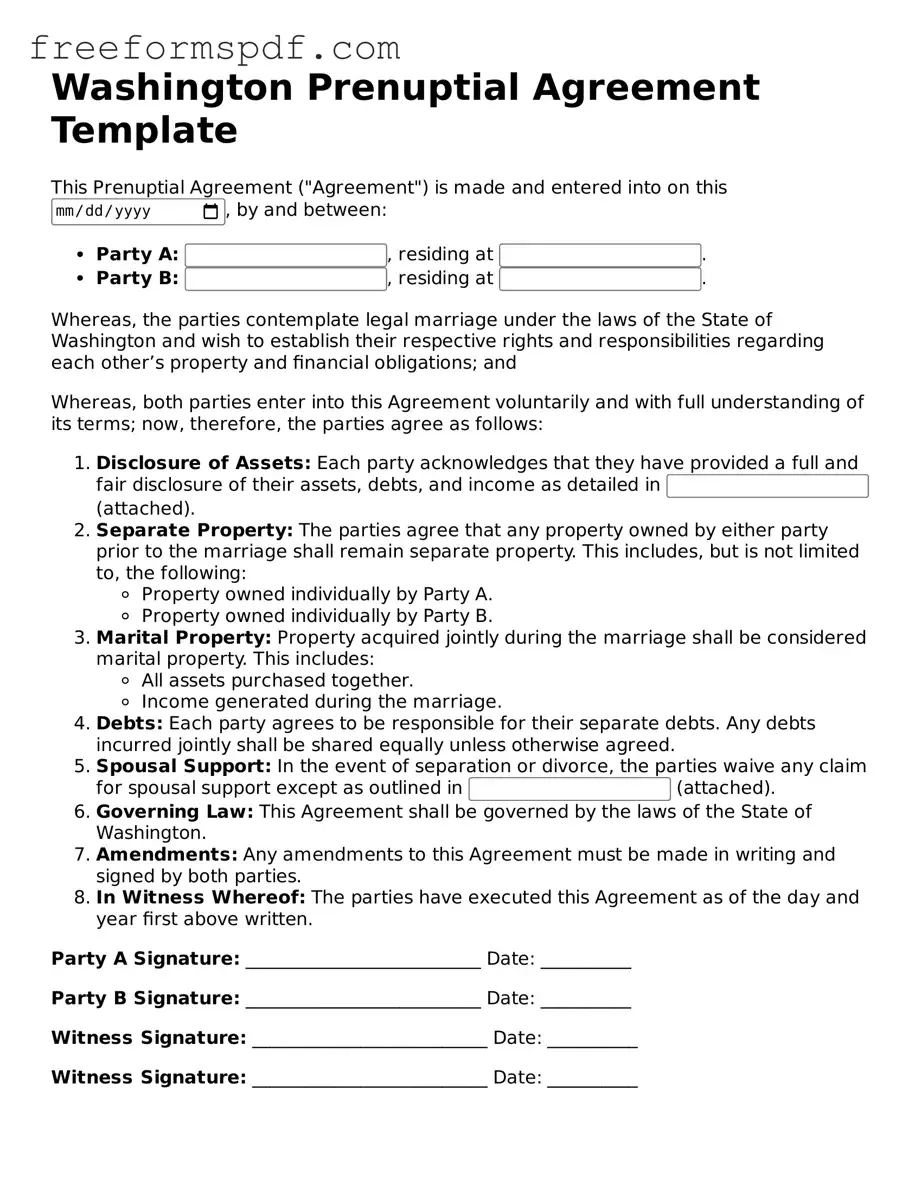

What is a Washington Prenuptial Agreement?

A Washington Prenuptial Agreement is a legal document created by two individuals before they get married. It outlines the distribution of assets and responsibilities in the event of a divorce or separation. This agreement helps both parties clarify their financial rights and obligations, providing a framework for managing their assets during the marriage and in case of dissolution.

-

What are the benefits of having a Prenuptial Agreement in Washington?

Having a prenuptial agreement can offer several benefits. It allows couples to protect individual assets acquired before marriage, ensures that both parties have a clear understanding of their financial situation, and can reduce conflicts during a divorce. Additionally, it can help safeguard family inheritances and business interests, providing peace of mind for both partners.

-

What should be included in a Prenuptial Agreement?

A comprehensive prenuptial agreement typically includes details about the couple’s assets, debts, and income. It may outline how property will be divided in the event of a divorce, specify spousal support terms, and address any other financial matters relevant to the couple. It is important for both parties to fully disclose their financial situations to ensure fairness and transparency.

-

How is a Prenuptial Agreement enforced in Washington?

In Washington, a prenuptial agreement is enforceable if it meets certain requirements. Both parties must voluntarily sign the agreement, and it must be in writing. Additionally, the agreement should be fair and not unconscionable at the time of enforcement. Courts may review the agreement for compliance with these standards if disputes arise.

-

Can a Prenuptial Agreement be modified after marriage?

Yes, a prenuptial agreement can be modified after marriage. Both parties must agree to the changes, and the modifications should be documented in writing and signed by both individuals. It is advisable to consult with legal professionals when making changes to ensure that the updated agreement remains valid and enforceable.

-

Do I need a lawyer to create a Prenuptial Agreement in Washington?

While it is not legally required to have a lawyer when creating a prenuptial agreement, it is highly recommended. Legal professionals can provide guidance on the drafting process, ensure that the agreement complies with Washington law, and help both parties understand their rights and responsibilities. Having independent legal counsel can also enhance the enforceability of the agreement.

Misconceptions

When it comes to prenuptial agreements in Washington, several misconceptions can lead to confusion. Understanding these myths can help couples make informed decisions about their financial future. Here are eight common misconceptions:

- Prenuptial agreements are only for the wealthy. Many people believe that only those with significant assets need a prenup. In reality, anyone can benefit from a prenuptial agreement, regardless of their financial situation. It can protect both parties’ interests.

- Prenuptial agreements are unromantic. Some view prenups as a lack of trust in the relationship. However, discussing financial matters openly can actually strengthen a relationship by fostering communication and mutual understanding.

- Prenuptial agreements are only for divorce. While they do outline what happens in the event of a divorce, they can also provide clarity on financial responsibilities during the marriage, helping to prevent misunderstandings.

- Prenuptial agreements are difficult to enforce. When drafted correctly, these agreements are legally binding and can be enforced in court. It’s essential to ensure that both parties fully disclose their assets and understand the terms.

- Prenuptial agreements can’t be changed. Many believe that once a prenup is signed, it cannot be altered. In fact, couples can modify their agreement at any time, as long as both parties agree to the changes.

- Prenuptial agreements are only for heterosexual couples. This is a common myth. In Washington, same-sex couples can also create prenuptial agreements to protect their interests and assets.

- Prenuptial agreements are only necessary for first marriages. Individuals entering second or subsequent marriages often face unique financial situations. A prenup can help protect children from previous relationships and ensure fair distribution of assets.

- Prenuptial agreements are too complicated to create. While the process may seem daunting, working with a knowledgeable attorney can simplify it. They can guide couples through the necessary steps to create a clear and fair agreement.

By debunking these misconceptions, couples can approach prenuptial agreements with clarity and confidence, ensuring their financial interests are well-protected.

Some Other Prenuptial Agreement State Templates

New York Prenup - This contract encourages couples to discuss difficult topics, which can strengthen their relationship before marriage.

In order to streamline the rental process in New York City, landlords and property managers should utilize the Nyc Apartment Registration Form to collect vital information regarding their apartments and ownership details. For those looking for reliable resources, NY Templates offers templates that can greatly aid in the accurate completion of this essential document, ensuring adherence to local housing regulations.

Virginia Prenup - It can include provisions for pets and custody arrangements should a separation occur.

Oregon Prenup - This document can help both parties feel secure in their financial future together.