Attorney-Verified Operating Agreement Document for Washington State

Common mistakes

-

Inaccurate Member Information: One common mistake is providing incorrect or incomplete information about the members of the LLC. This includes names, addresses, and ownership percentages. Accurate details are essential for legal recognition and clarity.

-

Missing Signatures: Failing to obtain the necessary signatures from all members can invalidate the agreement. Each member must sign to show their consent and commitment to the terms outlined in the document.

-

Not Defining Roles and Responsibilities: It's crucial to clearly outline the roles and responsibilities of each member. Without this clarity, confusion can arise, leading to conflicts or misunderstandings down the line.

-

Ignoring State-Specific Requirements: Washington may have unique requirements that differ from other states. Not adhering to these can result in complications. It’s important to familiarize oneself with state regulations to ensure compliance.

-

Overlooking Dispute Resolution Procedures: Many people forget to include a plan for resolving disputes among members. Establishing a clear process can help prevent conflicts from escalating and provides a framework for resolution.

-

Inadequate Financial Provisions: Failing to address how profits and losses will be distributed among members can lead to disagreements. It’s vital to specify these financial arrangements to avoid future issues.

-

Not Reviewing the Agreement Regularly: An Operating Agreement is not a one-time document. Regular reviews and updates are necessary to reflect changes in membership or business operations. Neglecting this can result in outdated terms that no longer serve the LLC’s needs.

Learn More on This Form

-

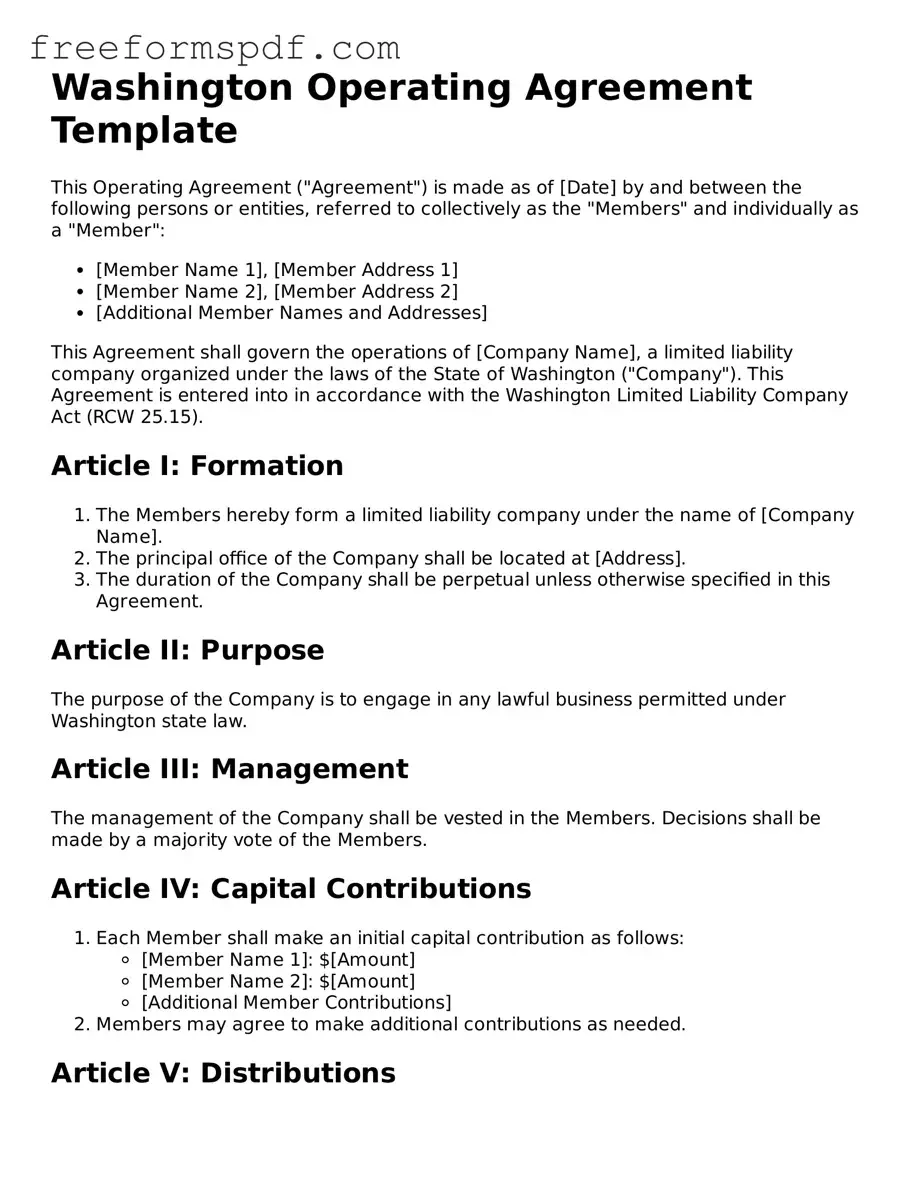

What is a Washington Operating Agreement?

A Washington Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Washington State. It serves as a foundational agreement among members, detailing their rights, responsibilities, and the overall governance of the LLC.

-

Is an Operating Agreement required in Washington?

No, Washington State does not legally require LLCs to have an Operating Agreement. However, it is highly recommended. Having an Operating Agreement can help prevent misunderstandings among members and provide clarity on how the business will operate.

-

What should be included in the Operating Agreement?

An Operating Agreement typically includes:

- The name and purpose of the LLC

- The names and contributions of members

- Management structure (member-managed or manager-managed)

- Voting rights and decision-making processes

- Distribution of profits and losses

- Procedures for adding or removing members

- Dispute resolution methods

-

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. Members may choose to update the agreement as the business evolves or as circumstances change. It's essential to follow the procedures outlined in the original Operating Agreement for making amendments to ensure compliance and clarity.

-

How does an Operating Agreement benefit members?

An Operating Agreement benefits members by establishing clear guidelines for the operation of the LLC. It helps protect personal assets by reinforcing the limited liability status of the LLC. Additionally, it can help resolve disputes among members by providing a clear framework for decision-making and conflict resolution.

-

Where can I find a template for a Washington Operating Agreement?

Templates for a Washington Operating Agreement can be found online through legal service websites, or you may consult with a legal professional to draft a customized agreement. It's important to ensure that any template used complies with Washington State laws and fits the specific needs of your LLC.

-

Do I need a lawyer to create an Operating Agreement?

While it is not mandatory to hire a lawyer to create an Operating Agreement, consulting with one can be beneficial. A legal professional can provide guidance tailored to your specific business needs and ensure that all necessary provisions are included to protect your interests.

Misconceptions

Understanding the Washington Operating Agreement form is essential for anyone involved in a limited liability company (LLC). However, several misconceptions can lead to confusion. Here are nine common misunderstandings:

-

It’s not necessary for single-member LLCs.

Many believe that only multi-member LLCs need an Operating Agreement. However, having one is beneficial even for single-member LLCs. It helps clarify management structure and protects personal assets.

-

All Operating Agreements must be filed with the state.

Some think that the Operating Agreement needs to be submitted to the state. In reality, this document is kept internally and does not require state filing.

-

It’s a one-time document that doesn’t need updates.

Many assume that once the Operating Agreement is created, it remains unchanged. In truth, it should be reviewed and updated regularly to reflect changes in the business or membership.

-

Operating Agreements are the same as Articles of Organization.

Some confuse the Operating Agreement with the Articles of Organization. While the Articles are required to form an LLC, the Operating Agreement outlines internal operations and management.

-

All members must sign the Operating Agreement.

While it’s advisable for all members to sign, it is not a strict requirement. An agreement can still be valid even if not all members have signed, as long as it reflects the mutual understanding.

-

It can only be drafted by a lawyer.

Many think that only legal professionals can draft an Operating Agreement. However, members can create their own, as long as they follow state guidelines and cover essential topics.

-

It doesn’t need to cover financial matters.

Some believe that financial details are unnecessary in the Operating Agreement. In fact, addressing profit distribution, capital contributions, and financial responsibilities is crucial for clarity.

-

Once it’s signed, it’s set in stone.

Many assume that the Operating Agreement cannot be changed after signing. However, it can be amended with the consent of the members, allowing for flexibility as the business evolves.

-

It’s only for legal protection.

While the Operating Agreement does provide legal protection, it also serves practical purposes. It helps establish clear roles, responsibilities, and procedures, which can enhance business operations.

Being aware of these misconceptions can help ensure that your LLC operates smoothly and effectively. An informed approach to the Operating Agreement can lead to better management and stronger business relationships.

Some Other Operating Agreement State Templates

Create an Operating Agreement - An Operating Agreement can reduce misunderstandings among members.

When it comes to selling or purchasing a motor vehicle, having the right documentation is crucial. For those looking for a streamlined process, utilizing a step-by-step guide for the Motor Vehicle Bill of Sale can simplify the transaction and ensure all necessary information is captured accurately.

Operating Agreement Llc Oregon - It establishes guidelines for the allocation of capital contributions among members.

Pa Llc Operating Agreement - Some agreements also include non-compete clauses to protect business interests.