Attorney-Verified Articles of Incorporation Document for Washington State

Common mistakes

When filling out the Washington Articles of Incorporation form, individuals may encounter several common mistakes. Here are four mistakes to avoid:

-

Incorrect Business Name: The chosen name must be unique and not already in use by another entity in Washington. Failing to check name availability can lead to delays or rejections.

-

Missing Registered Agent Information: Every corporation must designate a registered agent. This person or entity is responsible for receiving legal documents. Omitting this information can result in incomplete filings.

-

Inaccurate Purpose Statement: The purpose of the corporation should be clearly stated. Vague or overly broad descriptions may not meet state requirements, leading to potential complications.

-

Improper Filing Fees: Each filing requires a specific fee. Submitting the incorrect amount can delay processing or cause the application to be rejected.

By paying attention to these details, individuals can help ensure a smoother incorporation process in Washington.

Learn More on This Form

-

What is the purpose of the Articles of Incorporation?

The Articles of Incorporation serve as a foundational document for a corporation. They establish the corporation's existence in the eyes of the law and outline key details such as the corporation's name, purpose, and structure. This document is essential for obtaining legal recognition and protecting the owners from personal liability.

-

Who needs to file Articles of Incorporation in Washington?

Any individual or group looking to create a corporation in Washington State must file Articles of Incorporation. This includes for-profit businesses, non-profit organizations, and professional corporations. It is a necessary step to legally operate within the state.

-

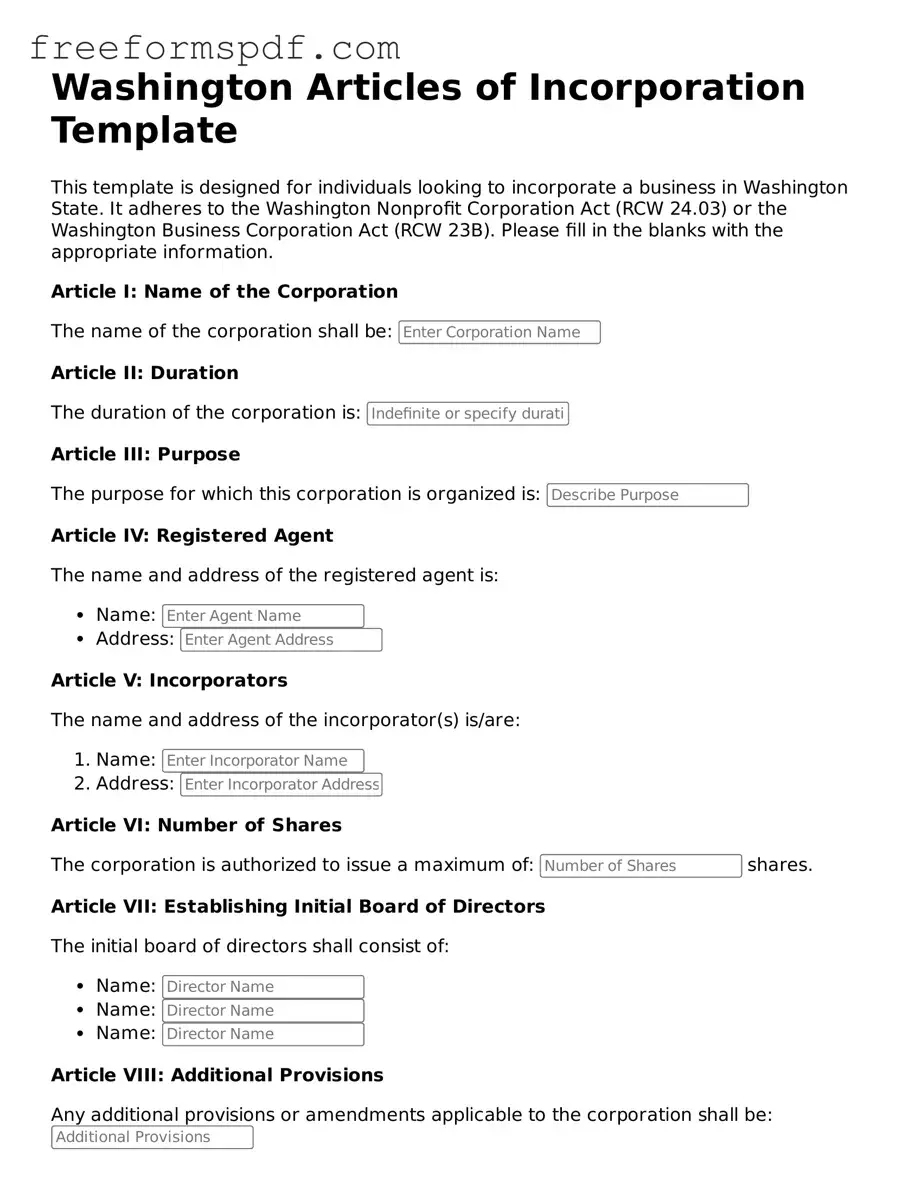

What information is required in the Articles of Incorporation?

The Articles of Incorporation must include several key pieces of information: the corporation's name, the duration of the corporation (if not perpetual), the purpose of the corporation, the registered agent's name and address, and the number of shares the corporation is authorized to issue. Additional details may be required based on the type of corporation being formed.

-

How do I file the Articles of Incorporation?

To file the Articles of Incorporation in Washington, you can submit the form online through the Washington Secretary of State's website or send a paper form by mail. The filing fee must be paid at the time of submission. Ensure that all required information is complete and accurate to avoid delays in processing.

-

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Washington varies based on the type of corporation. Typically, the fee ranges from $180 to $200 for most corporations. It is advisable to check the Washington Secretary of State's website for the most current fee schedule and any additional costs that may apply.

-

How long does it take to process the Articles of Incorporation?

The processing time for the Articles of Incorporation can vary. Generally, online submissions are processed more quickly than paper filings. Expect a turnaround time of about 5 to 10 business days for online filings, while paper submissions may take longer. Expedited processing options may be available for an additional fee.

-

What happens after the Articles of Incorporation are approved?

Once the Articles of Incorporation are approved, the corporation is officially formed. You will receive a certificate of incorporation from the Washington Secretary of State. This document serves as proof of your corporation's legal status. Following this, it is important to comply with ongoing requirements, such as obtaining necessary licenses and permits.

-

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after they have been filed. If there are changes to the corporation's name, structure, or purpose, an amendment must be filed with the Washington Secretary of State. This process involves submitting the appropriate form and paying any associated fees.

-

Is legal assistance necessary for filing the Articles of Incorporation?

While legal assistance is not required to file the Articles of Incorporation, it can be beneficial. An attorney can help ensure that the document is completed correctly and that all legal requirements are met. This can save time and prevent potential issues in the future.

Misconceptions

The Washington Articles of Incorporation form is a crucial document for establishing a corporation in the state. However, several misconceptions surround it. Below are eight common misunderstandings, along with clarifications.

- Misconception 1: The Articles of Incorporation are only necessary for large businesses.

- Misconception 2: You can file the Articles of Incorporation at any time without consequences.

- Misconception 3: The Articles of Incorporation can be completed without legal assistance.

- Misconception 4: Once filed, the Articles of Incorporation cannot be changed.

- Misconception 5: The Articles of Incorporation are the same as a business license.

- Misconception 6: You must have a physical office in Washington to file.

- Misconception 7: The Articles of Incorporation are a one-time requirement.

- Misconception 8: The filing fee is the only cost involved in incorporating.

This is not true. Any business entity, regardless of size, must file Articles of Incorporation to be recognized as a corporation in Washington.

Filing must occur before conducting business as a corporation. Delaying this step can lead to legal complications and potential fines.

Changes can be made through amendments. However, the process requires additional filings and adherence to specific procedures.

This is incorrect. The Articles of Incorporation establish the corporation, while a business license allows the corporation to operate legally.

A registered agent with a physical address in Washington can represent the corporation, allowing for filing without a physical office.

While the initial filing is essential, ongoing compliance with state regulations, including annual reports, is required to maintain good standing.

In addition to the filing fee, there may be other costs, such as legal fees, registered agent fees, and additional state fees for amendments or compliance.

Some Other Articles of Incorporation State Templates

Pennsylvania Corporation Commission - The Articles of Incorporation establish a corporation as a legal entity.

For those looking to understand the intricacies of a non-disclosure agreement, this detailed Non-disclosure Agreement guide offers valuable insights into its importance in protecting sensitive information shared in various professional settings.

Virginia Business License Cost - Clarifies procedures for any financial audits.

Nys Division of Corporations - Articles of Incorporation define your business as a legal entity.

Oregon Incorporation - States often offer expedited processing options for filing the Articles.