Attorney-Verified Transfer-on-Death Deed Document for Virginia State

Common mistakes

-

Not including all property owners: If there are multiple owners of the property, all must be listed on the deed. Omitting any owner can lead to disputes or complications later.

-

Failing to sign the deed: The deed must be signed by the property owner(s). Without a signature, the document is not valid.

-

Not having the deed notarized: A Transfer-on-Death Deed must be notarized to be legally binding. Skipping this step can invalidate the deed.

-

Incorrectly identifying the beneficiaries: Ensure that the beneficiaries are clearly identified by their full names. Ambiguities can create issues in the future.

-

Using outdated forms: Always use the most current version of the Transfer-on-Death Deed form. Outdated forms may not comply with current laws.

-

Not recording the deed: After completing the deed, it must be recorded with the local land records office. Failing to do so means it may not be recognized upon the owner's death.

-

Overlooking state-specific requirements: Virginia has specific rules regarding Transfer-on-Death Deeds. Ignoring these can lead to legal issues.

-

Neglecting to review the deed: Before submitting, review the deed for errors or omissions. Small mistakes can have significant consequences.

-

Not consulting a professional: It’s wise to seek legal advice when filling out the deed. A professional can help ensure that everything is completed correctly.

Learn More on This Form

-

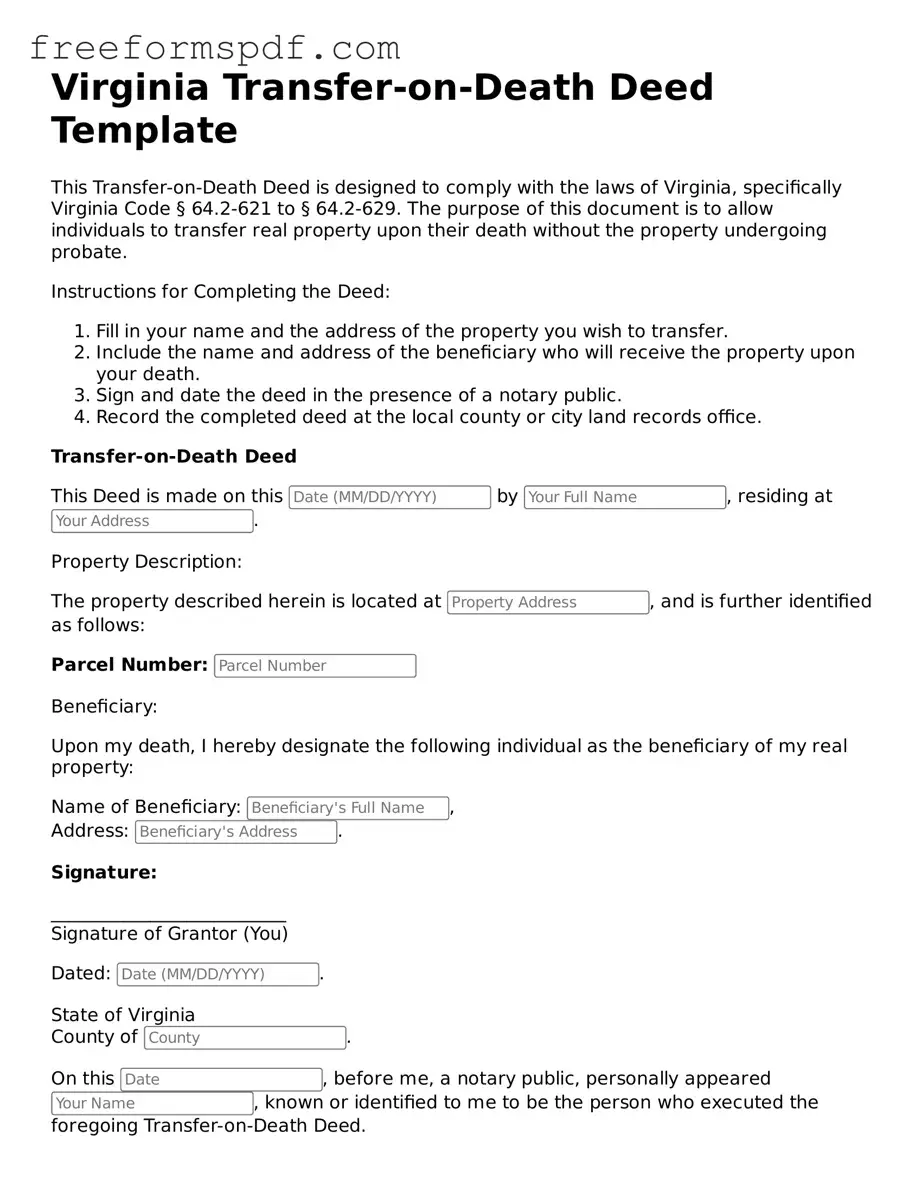

What is a Virginia Transfer-on-Death Deed?

A Virginia Transfer-on-Death Deed (TODD) allows property owners to transfer their real estate to designated beneficiaries upon their death, without going through probate. This deed provides a straightforward way to ensure that your property is passed on to your loved ones according to your wishes.

-

Who can use a Transfer-on-Death Deed in Virginia?

Any individual who owns real estate in Virginia can use a Transfer-on-Death Deed. However, the property must be residential real estate, such as a house or a condo. It is important to note that the deed must be executed while the property owner is alive and competent.

-

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you must complete the form provided by the state. This includes filling out information about the property and the beneficiaries. After completing the form, it must be signed in front of a notary public and then recorded with the local circuit court in the county where the property is located.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you must create a new deed that explicitly states the changes or revocation. This new deed must also be signed, notarized, and recorded to be effective.

-

What happens if I do not name a beneficiary?

If you do not name a beneficiary in your Transfer-on-Death Deed, the property will not transfer as intended. Instead, it will be treated as part of your estate and will go through probate. To avoid complications, always ensure you name a beneficiary or beneficiaries when executing the deed.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger immediate tax consequences. The property is not considered a gift until the owner passes away. However, beneficiaries may be responsible for property taxes and may face capital gains taxes when they sell the property. It is advisable to consult a tax professional for specific guidance.

-

Is legal assistance required to complete a Transfer-on-Death Deed?

While legal assistance is not strictly required, it can be beneficial. A lawyer can help ensure that the deed is completed correctly and that all legal requirements are met. If you have complex circumstances or questions, seeking professional advice is recommended.

Misconceptions

The Virginia Transfer-on-Death Deed (TODD) form is a valuable tool for estate planning, yet several misconceptions surround its use. Understanding these misconceptions can help individuals make informed decisions about their property and inheritance. Below are seven common misconceptions:

- The TODD form allows for immediate transfer of property. Many people believe that once the TODD form is signed, the property is immediately transferred to the beneficiary. In reality, the transfer only occurs upon the death of the property owner.

- Using a TODD form avoids probate entirely. While a TODD can help avoid probate for the property it covers, other assets not designated by a TODD may still go through probate. It is essential to have a comprehensive estate plan.

- All types of property can be transferred using a TODD. This is not true. The TODD form is typically limited to real estate and does not apply to personal property or financial accounts.

- Beneficiaries can change the terms of the TODD after the owner's death. Once the property owner passes away, the terms of the TODD are fixed. Beneficiaries cannot alter the deed or its provisions.

- Filing a TODD form is the same as a will. A TODD is a specific type of deed that transfers property, while a will encompasses a broader range of directives for the distribution of an estate. They serve different purposes in estate planning.

- Only one beneficiary can be named on a TODD. This is a misconception. Multiple beneficiaries can be designated, allowing for shared ownership of the property after the owner’s death.

- The TODD form must be notarized. While it is recommended to have the TODD form notarized for added validity, it is not a strict requirement. However, proper execution is crucial for the deed to be effective.

By dispelling these misconceptions, individuals can better navigate their estate planning options and ensure their wishes are honored. Understanding the nuances of the Virginia Transfer-on-Death Deed can lead to more effective management of one’s property and inheritance for future generations.

Some Other Transfer-on-Death Deed State Templates

Where Can I Get a Tod Form - Successful completion of this deed can lead to an effective plan for property management.

Transfer on Death Deed Pennsylvania - Even though the process is simple, informed decision-making is key to maximizing benefits.

Completing a Motor Vehicle Bill of Sale form accurately is crucial for ensuring a smooth transfer of ownership and protecting both the buyer and seller. This document not only serves as proof of the transaction but also outlines key details such as the vehicle’s condition and sale price. To assist in this process, you can find a helpful template at newyorkform.com/free-motor-vehicle-bill-of-sale-template/, which simplifies the task of creating a valid and comprehensive bill of sale.

What Is a Transfer on Death Deed - Eligible real estate includes your home, land, or other real property.

Oregon Transfer on Death Deed - Owners may designate specific conditions or instructions regarding the property.