Attorney-Verified Real Estate Purchase Agreement Document for Virginia State

Common mistakes

-

Failing to provide accurate property details. It is crucial to include the correct address, parcel number, and legal description of the property.

-

Not specifying the purchase price clearly. Ensure that the price is stated in both numerical and written forms to avoid confusion.

-

Omitting contingencies. Buyers should include necessary contingencies, such as financing or inspection, to protect their interests.

-

Ignoring deadlines. All dates for inspections, financing, and closing should be clearly defined and adhered to.

-

Not including earnest money details. Specify the amount of earnest money and how it will be held, as this demonstrates the buyer's commitment.

-

Leaving out seller disclosures. Sellers must disclose any known issues with the property, such as repairs or hazards.

-

Using vague language. Clarity is key. Avoid ambiguous terms that could lead to misunderstandings later.

-

Neglecting to sign and date the agreement. All parties involved must sign and date the document for it to be legally binding.

-

Failing to include personal property. If any appliances or fixtures are included in the sale, they should be listed explicitly.

-

Not seeking professional advice. Consulting with a real estate agent or attorney can help prevent mistakes and ensure compliance with local laws.

Learn More on This Form

-

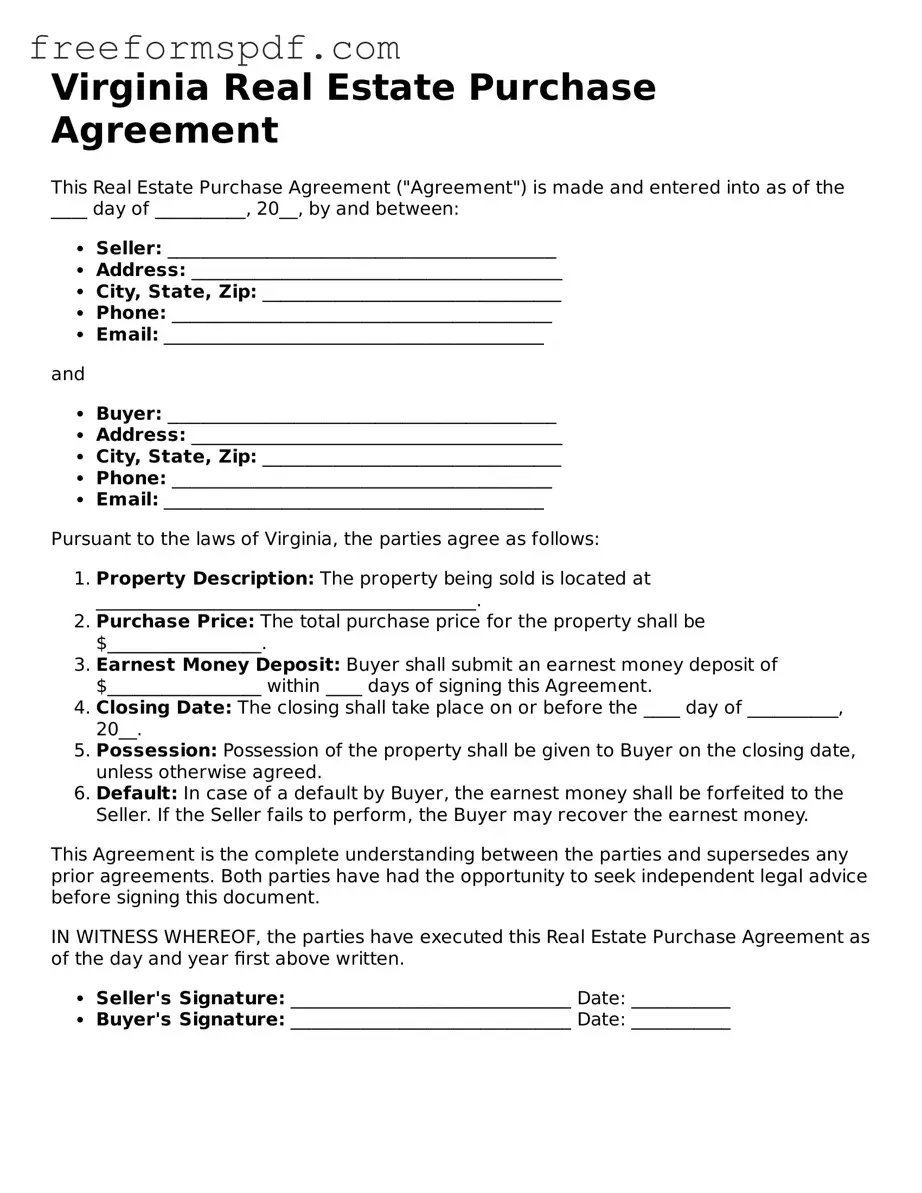

What is a Virginia Real Estate Purchase Agreement?

The Virginia Real Estate Purchase Agreement is a legal document that outlines the terms and conditions of a property sale in Virginia. It serves as a binding contract between the buyer and the seller. This agreement details the purchase price, financing terms, contingencies, and the timeline for closing the sale. It is essential for both parties to understand their rights and obligations as outlined in this document.

-

What are the key components of the agreement?

Several important components make up the Virginia Real Estate Purchase Agreement:

- Purchase Price: The total amount the buyer agrees to pay for the property.

- Earnest Money: A deposit made by the buyer to show commitment, which is held in escrow until closing.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing approval or a satisfactory home inspection.

- Closing Date: The date when the ownership of the property is officially transferred from the seller to the buyer.

- Disclosures: Any known issues with the property that the seller must disclose to the buyer.

-

How can I modify the agreement?

Modifying the Virginia Real Estate Purchase Agreement requires mutual consent from both the buyer and the seller. Any changes should be documented in writing and signed by both parties. It's crucial to ensure that all modifications are clear and specific to avoid misunderstandings. If you are unsure about how to proceed, consulting a real estate attorney can provide guidance.

-

What happens if one party breaches the agreement?

If one party fails to uphold their end of the agreement, it is considered a breach of contract. The non-breaching party has several options, including:

- Seeking specific performance, which compels the breaching party to fulfill their obligations under the agreement.

- Requesting damages for any losses incurred due to the breach.

- Terminating the agreement and seeking a refund of any earnest money or deposits made.

It is advisable to seek legal counsel to understand the best course of action based on the specifics of the situation.

Misconceptions

Understanding the Virginia Real Estate Purchase Agreement form is crucial for anyone involved in a real estate transaction. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

-

The form is only for residential properties.

This is not true. The Virginia Real Estate Purchase Agreement can be used for both residential and commercial properties. It is designed to cover various types of real estate transactions.

-

Once signed, the agreement cannot be changed.

This misconception can create unnecessary worry. In reality, the agreement can be amended if both parties agree to the changes. It’s essential to document any modifications in writing.

-

The agreement guarantees the sale will go through.

Signing the agreement does not guarantee that the transaction will be completed. There are contingencies, such as financing or inspections, that must be satisfied for the sale to proceed.

-

Only real estate agents can fill out the form.

This is a common myth. While real estate agents are experienced in using the form, buyers and sellers can also complete it. However, it’s advisable to seek legal advice to ensure accuracy.

-

The form is the same for every transaction.

This is misleading. Each transaction may require different terms and conditions based on the specific circumstances. Customization of the form is often necessary to meet the needs of both parties.

-

Signing the agreement means you are committed to the purchase.

While signing indicates an intention to proceed, it does not mean you cannot back out under certain conditions. Contingencies can allow a buyer to withdraw without penalty.

Being aware of these misconceptions can help you navigate the real estate process more effectively. Always consider consulting a legal professional for guidance tailored to your situation.

Some Other Real Estate Purchase Agreement State Templates

Oregon Real Estate Purchase Agreement - Specifies the purchase price and payment terms.

This important legal document, known as the Arizona Hold Harmless Agreement, serves to clarify responsibilities and minimize liability risks in various circumstances. For more information, visit the page dedicated to understanding the critical aspects of the Hold Harmless Agreement.

Purchase and Sale Agreement Washington State - It includes provisions for earnest money deposits by the buyer.

Trec Website - Includes agreed-upon methods for communication between parties during the process.