Attorney-Verified Promissory Note Document for Virginia State

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all necessary details. This includes not filling out the names of the borrower and lender completely, or neglecting to include the date of the agreement. Each piece of information is crucial for the validity of the note.

-

Incorrect Loan Amount: Entering the wrong amount for the loan can lead to confusion and disputes later on. It's essential to double-check the figures and ensure they match what was agreed upon verbally or in previous documents.

-

Missing Signatures: A promissory note is not legally binding without the necessary signatures. Both the borrower and the lender must sign the document. Forgetting to sign can invalidate the agreement.

-

Ambiguous Terms: Clarity is key in a promissory note. Vague terms regarding repayment schedules, interest rates, or penalties can lead to misunderstandings. Be specific about every term to avoid potential conflicts.

-

Neglecting to Include Interest Rates: If the loan involves interest, it must be clearly stated. Failing to include this information can create confusion about how much the borrower owes over time.

-

Not Keeping Copies: After completing the form, it’s vital to retain copies for both parties. This ensures that everyone has access to the terms and conditions agreed upon, which can be helpful in case of disputes.

Learn More on This Form

-

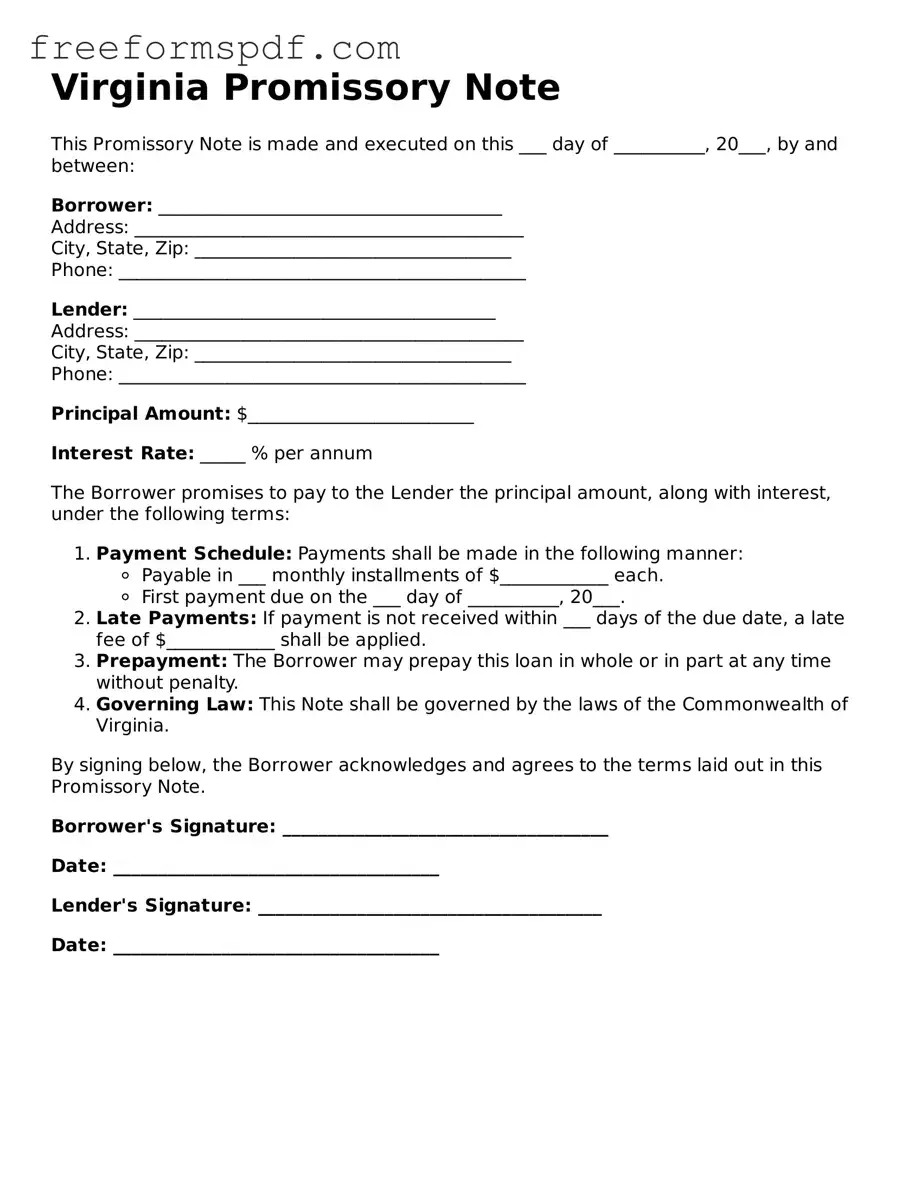

What is a Virginia Promissory Note?

A Virginia Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender. It includes terms such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. This document serves as a record of the loan agreement between the parties involved.

-

Who needs a Promissory Note?

Anyone who is lending or borrowing money can benefit from a Promissory Note. This includes individuals, businesses, and organizations. It is especially important when large sums of money are involved or when the loan terms are complex. Having a written agreement helps protect both parties and clarifies the expectations.

-

What information should be included in the note?

A Virginia Promissory Note should contain the following key information:

- The names and addresses of both the borrower and the lender.

- The principal amount of the loan.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Any late fees or penalties for missed payments.

- Signatures of both parties.

-

Is a Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding. Once signed by both parties, it creates an enforceable obligation. If the borrower fails to repay the loan as agreed, the lender can take legal action to recover the owed amount. It is crucial that both parties understand the terms before signing.

-

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended note. This ensures that there is a clear record of the new terms and helps prevent future disputes.

-

Where can I find a Virginia Promissory Note template?

You can find templates for a Virginia Promissory Note online through various legal websites or by consulting with a legal professional. Many templates are customizable to fit your specific needs. However, it is always recommended to review the document with a qualified attorney to ensure compliance with Virginia laws.

Misconceptions

Understanding the Virginia Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions often arise regarding its use and implications. Here are ten common misunderstandings:

- A promissory note is a legally binding contract. Many believe that a promissory note is just a simple agreement. In reality, it is a formal document that outlines the borrower's promise to repay a specific amount of money under agreed-upon terms.

- All promissory notes must be notarized. While notarization can add an extra layer of authenticity, it is not a requirement for a promissory note to be valid in Virginia. The key is that both parties understand and agree to the terms.

- Promissory notes can only be used for large loans. Some people think that these notes are only for significant amounts of money. However, they can be utilized for any loan amount, big or small, making them versatile financial tools.

- Interest rates on promissory notes must be fixed. This is a common myth. Interest rates can be either fixed or variable, depending on what the lender and borrower agree upon in the note.

- Once signed, a promissory note cannot be changed. While it is true that changes can complicate matters, promissory notes can be amended if both parties consent to the modifications and document the changes appropriately.

- Promissory notes are only for personal loans. Many assume that these notes are exclusively for personal lending. In fact, they are widely used in business transactions as well, including loans between companies and for real estate transactions.

- A promissory note guarantees repayment. Although a promissory note is a commitment to repay, it does not guarantee that the borrower will have the funds available to do so. It is still important for lenders to assess the borrower's creditworthiness.

- Promissory notes do not require a repayment schedule. Some believe that repayment terms are optional. However, a well-structured promissory note should clearly outline the repayment schedule to avoid confusion later on.

- Only individuals can issue promissory notes. This is a misconception. Businesses and organizations can also issue promissory notes, making them a useful financial instrument for various entities.

- Promissory notes are outdated and not used in modern transactions. Contrary to this belief, promissory notes remain relevant today. They are still widely used in various financial dealings, proving their enduring utility in the lending landscape.

By dispelling these misconceptions, individuals can better navigate the complexities of promissory notes and make informed decisions in their financial transactions.

Some Other Promissory Note State Templates

Promissory Note Template Oregon - It fosters a sense of responsibility in the borrower regarding their financial commitments.

In New York, utilizing a Motor Vehicle Bill of Sale form is vital for ensuring a smooth transaction when buying or selling a vehicle. This document not only formalizes the transfer of ownership but also outlines essential details such as the vehicle's condition and the agreed price. For those looking to download a free template to simplify this process, you can find one at https://newyorkform.com/free-motor-vehicle-bill-of-sale-template.

Texas Promissory Note Form - A promissory note functions as a primary financial contract that outlines obligations between borrower and lender.

New York Promissory Note - A Promissory Note can also detail the consequences of defaulting on the loan.

Promissory Note Template Washington State - By using a Promissory Note, lenders can strengthen their position in case of non-payment.