Attorney-Verified Gift Deed Document for Virginia State

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all necessary details. Ensure that the names, addresses, and other relevant information for both the giver and receiver are fully filled out.

-

Incorrect Property Description: It's crucial to accurately describe the property being gifted. Omitting important details or using vague descriptions can lead to confusion or disputes later.

-

Improper Signatures: All parties involved must sign the deed. Failing to secure the required signatures can render the document invalid.

-

Not Notarizing the Document: In Virginia, a Gift Deed typically needs to be notarized. Skipping this step can cause issues with the legality of the deed.

-

Forgetting to Date the Document: Every legal document should have a date. Forgetting to include this can create uncertainty about when the transfer of property occurred.

-

Ignoring State-Specific Requirements: Each state has its own rules regarding Gift Deeds. Not adhering to Virginia's specific requirements can lead to complications.

-

Failing to Consider Tax Implications: Gift taxes may apply depending on the value of the property. Not consulting a tax professional can result in unexpected financial obligations.

-

Not Keeping Copies: After completing the deed, it’s essential to keep copies for your records. Losing the original document can create problems in the future.

Learn More on This Form

-

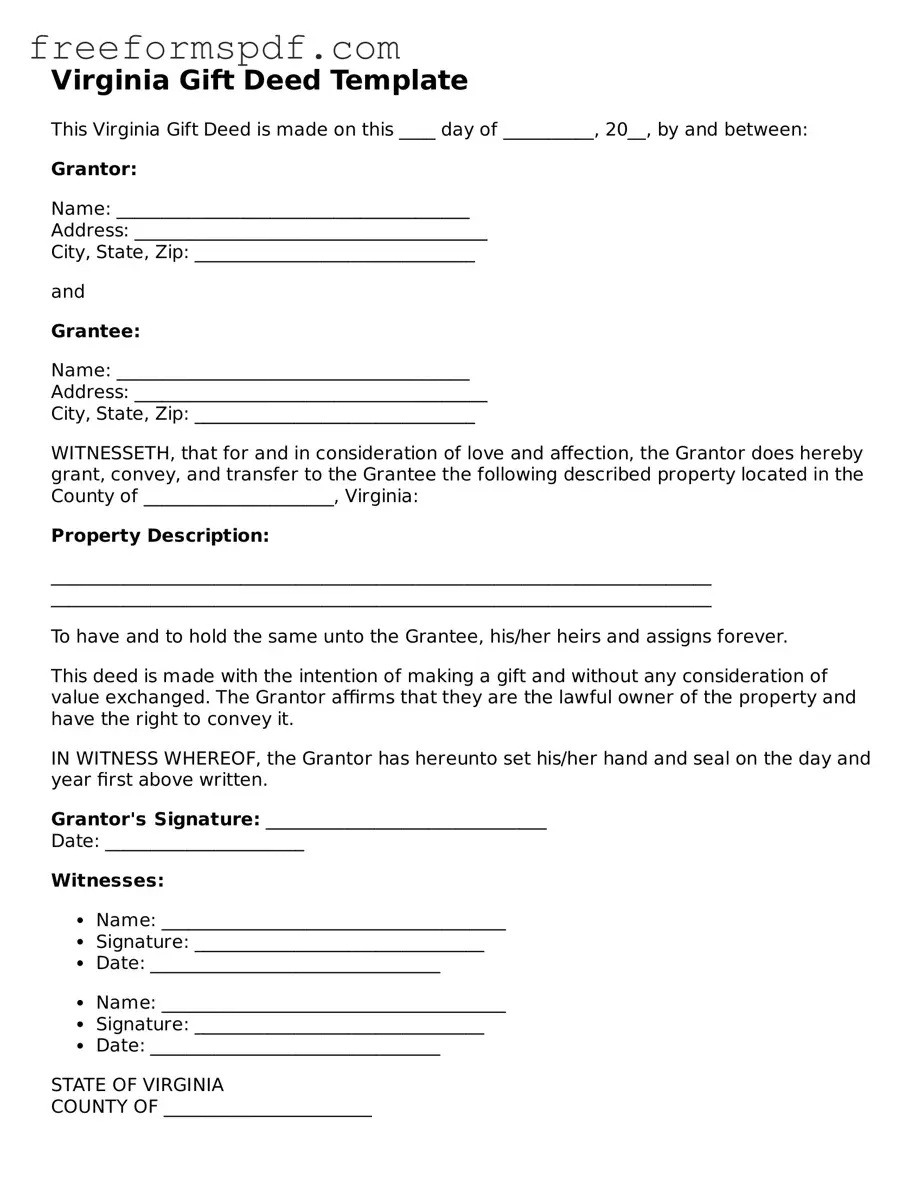

What is a Virginia Gift Deed?

A Virginia Gift Deed is a legal document used to transfer ownership of real property from one person to another without any exchange of money. This type of deed signifies a gift, meaning the recipient does not have to pay for the property.

-

Who can use a Gift Deed in Virginia?

Any property owner in Virginia can use a Gift Deed to transfer their property to another individual. This is often used among family members, such as parents gifting property to their children.

-

Are there any tax implications when using a Gift Deed?

Yes, there may be tax implications. The IRS allows individuals to gift up to a certain amount each year without incurring a gift tax. However, if the value of the property exceeds this limit, the donor may need to file a gift tax return. It is advisable to consult a tax professional for guidance.

-

What information is required to complete a Gift Deed?

A Gift Deed typically requires the following information: the names and addresses of the donor (the person giving the gift) and the recipient (the person receiving the gift), a legal description of the property, and the date of the gift. It should also be signed by the donor.

-

Does a Gift Deed need to be notarized?

Yes, in Virginia, a Gift Deed must be notarized to be legally valid. This means that the donor must sign the deed in the presence of a notary public, who will then provide their official seal.

-

How is a Gift Deed different from a Sale Deed?

A Gift Deed is used to transfer property without any payment, while a Sale Deed involves a transaction where the buyer pays the seller for the property. The intent behind a Gift Deed is to give the property freely, whereas a Sale Deed signifies a commercial exchange.

-

Can a Gift Deed be revoked?

Once a Gift Deed is executed and delivered, it generally cannot be revoked. However, if the donor has not yet delivered the deed to the recipient, they may still have the ability to revoke the gift.

-

What happens if the donor dies before the Gift Deed is executed?

If the donor passes away before the Gift Deed is executed, the property will be treated as part of the donor's estate. The intended recipient may need to go through probate to receive the property.

-

Is it necessary to record a Gift Deed?

While it is not legally required to record a Gift Deed, it is highly recommended. Recording the deed with the local county clerk's office provides public notice of the transfer and protects the recipient's ownership rights.

-

Where can I obtain a Virginia Gift Deed form?

You can obtain a Virginia Gift Deed form from various sources, including legal stationery stores, online legal document services, or through an attorney. Ensure that the form complies with Virginia state laws.

Misconceptions

Understanding the Virginia Gift Deed form is essential for anyone considering transferring property as a gift. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings about the Virginia Gift Deed form, along with clarifications for each.

- Misconception 1: A gift deed is the same as a sale deed.

- Misconception 2: The donor can change their mind after signing the gift deed.

- Misconception 3: A gift deed does not require witnesses.

- Misconception 4: There are no tax implications for the recipient of a gift deed.

- Misconception 5: A gift deed can be used for any type of property.

- Misconception 6: The recipient automatically becomes responsible for property taxes after receiving a gift deed.

- Misconception 7: A verbal agreement is sufficient for a gift deed.

A gift deed transfers property without any exchange of money, whereas a sale deed involves a transaction where the buyer pays the seller. This fundamental difference is crucial to understand.

Once a gift deed is executed and delivered, it is generally irrevocable. The donor cannot simply change their mind and reclaim the property without the consent of the recipient.

In Virginia, a gift deed must be signed in the presence of a notary public and, in some cases, witnessed by individuals who can attest to the signing. This requirement helps ensure the validity of the document.

While the recipient may not pay income tax on the gift, they could be subject to gift tax regulations. It is important to consult with a tax advisor to understand any potential tax liabilities.

While gift deeds can be used for many types of property, certain restrictions may apply, especially regarding real estate. Understanding these restrictions is vital before proceeding.

Property tax responsibilities typically transfer to the recipient upon completion of the deed transfer. However, it is wise to confirm local regulations regarding tax obligations.

A verbal agreement is not legally binding for property transfers. A written gift deed is necessary to ensure that the transfer is recognized under the law.

Some Other Gift Deed State Templates

Gift Deed Texas - Clear language in the Gift Deed minimizes misunderstandings between parties.

For anyone navigating the intricacies of vehicle transactions, familiarity with the necessary documentation is crucial. One such essential document is the Motor Vehicle Bill of Sale, which ensures a clear transfer of ownership and outlines vital details about the vehicle. To streamline this process, you can access a helpful template at newyorkform.com/free-motor-vehicle-bill-of-sale-template, making it easier to create a comprehensive bill of sale that meets legal requirements.