Attorney-Verified Durable Power of Attorney Document for Virginia State

Common mistakes

-

Not Specifying Powers Clearly: One common mistake is failing to clearly outline the specific powers granted to the agent. The form allows for various powers, including financial decisions and health care choices. If these powers are vague or too broad, it can lead to confusion and disputes down the line.

-

Neglecting to Date the Document: Another frequent oversight is forgetting to date the Durable Power of Attorney. A date is essential as it establishes when the document becomes effective. Without a date, there may be questions about its validity, especially if the principal’s circumstances change over time.

-

Failing to Sign in Front of Witnesses: The form requires the principal’s signature, but it must also be witnessed properly. Not having the required witnesses present during the signing can invalidate the document. It's crucial to follow Virginia's witnessing requirements to ensure the form is legally binding.

-

Ignoring the Need for Regular Updates: Lastly, many individuals overlook the importance of reviewing and updating their Durable Power of Attorney. Life changes, such as marriage, divorce, or the birth of children, may necessitate revisions. Regularly checking the document ensures that it reflects current wishes and circumstances.

Learn More on This Form

-

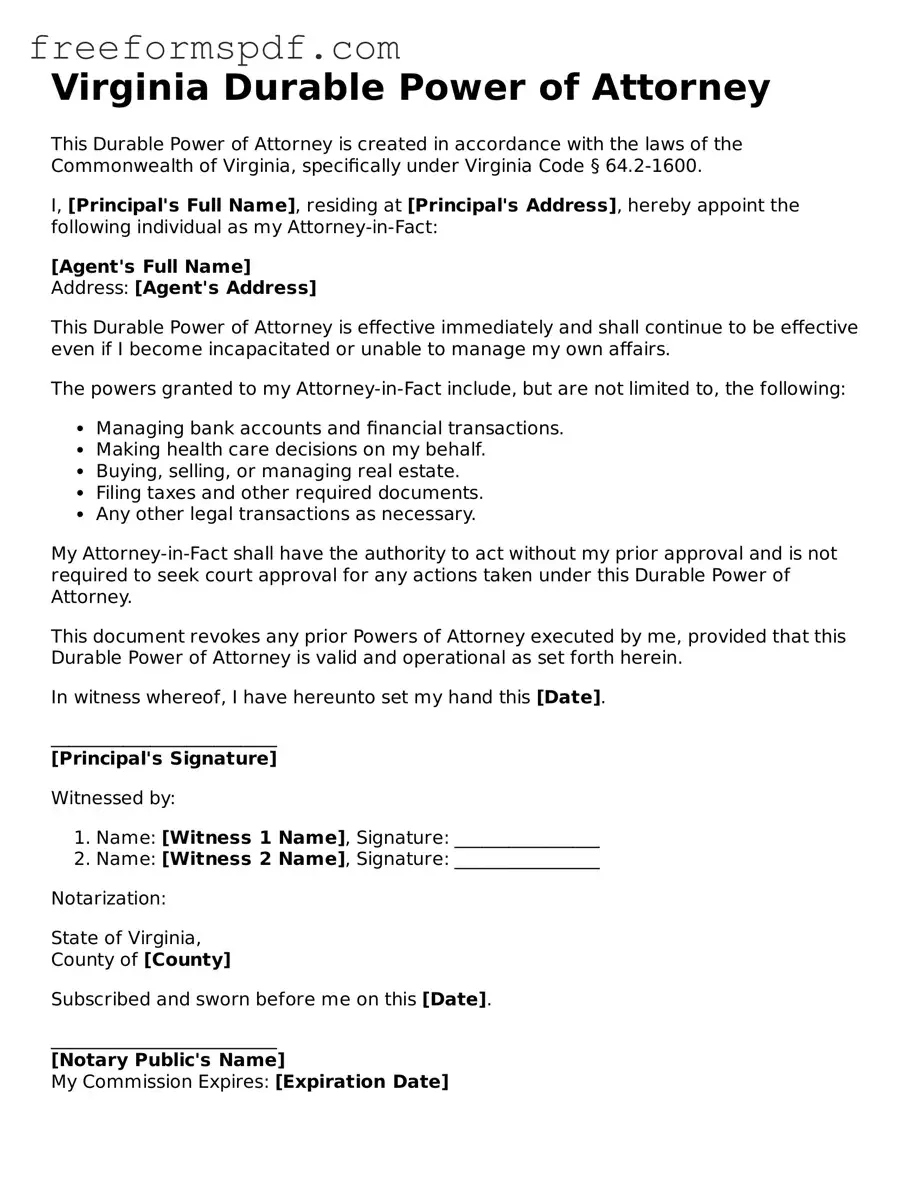

What is a Durable Power of Attorney in Virginia?

A Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the principal, to designate another person, called the agent or attorney-in-fact, to make decisions on their behalf. This authority remains effective even if the principal becomes incapacitated. In Virginia, this document is particularly important for ensuring that your financial and health care decisions are handled according to your wishes when you cannot do so yourself.

-

How do I create a Durable Power of Attorney in Virginia?

Creating a DPOA in Virginia involves a few key steps. First, you need to select a trusted individual to act as your agent. Then, you should complete the Virginia Durable Power of Attorney form, which can be obtained from various legal resources or online. It is crucial to ensure that the document is signed in the presence of a notary public or two witnesses, as required by Virginia law. Once executed, the DPOA should be kept in a safe place, and copies should be provided to your agent and relevant financial institutions or healthcare providers.

-

What powers can I grant to my agent through a Durable Power of Attorney?

The powers granted to an agent can be quite broad or limited, depending on your preferences. Common powers include managing bank accounts, paying bills, making investment decisions, and handling real estate transactions. Additionally, you can specify health care decisions if you choose to include those provisions. It is essential to clearly outline the scope of authority in the DPOA to ensure your agent acts in accordance with your wishes.

-

Can I revoke a Durable Power of Attorney in Virginia?

Yes, you can revoke a Durable Power of Attorney at any time as long as you are mentally competent. To do so, you should create a written revocation document that clearly states your intention to revoke the previous DPOA. This document should be signed and dated, and it is advisable to notify your agent and any institutions that had received the original DPOA. This ensures that there is no confusion regarding your current wishes.

-

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney in place and become incapacitated, your loved ones may need to go through a legal process called guardianship or conservatorship to make decisions on your behalf. This process can be time-consuming, costly, and emotionally taxing for your family. By establishing a DPOA, you can avoid this situation and ensure that your preferences are respected even when you cannot communicate them.

Misconceptions

Understanding the Virginia Durable Power of Attorney form is crucial for ensuring that your financial and medical decisions are handled according to your wishes. However, several misconceptions can lead to confusion. Here are four common misconceptions:

- Misconception 1: A Durable Power of Attorney is only for the elderly or those with health issues.

- Misconception 2: The agent has unlimited power over my finances.

- Misconception 3: Once I create a Durable Power of Attorney, I cannot change it.

- Misconception 4: A Durable Power of Attorney is only necessary for financial matters.

This is not true. While many people associate this document with older adults, anyone can benefit from having a Durable Power of Attorney in place. It is a proactive measure that can protect your interests in case of unexpected circumstances.

While the agent does have significant authority, their powers are not unlimited. The Durable Power of Attorney can specify what decisions the agent can make, allowing you to maintain control over your preferences and limits.

This is a common misunderstanding. You can revoke or modify your Durable Power of Attorney at any time, as long as you are mentally competent. Keeping your document updated is essential to reflect your current wishes.

While it primarily addresses financial decisions, a Durable Power of Attorney can also cover medical decisions if specified. This makes it a versatile tool for managing both financial and healthcare preferences.

Some Other Durable Power of Attorney State Templates

Oregon Durable Power of Attorney - Some states have specific requirements for signing and witnessing this document.

For those seeking to establish clear guidelines regarding confidential information, the importance of a well-structured Non-disclosure Agreement cannot be overstated. Such agreements are vital for protecting sensitive data shared in both personal and professional interactions. To learn more about creating a robust agreement, visit our resource on how to draft a Non-disclosure Agreement effectively.

New York State Power of Attorney Form 2023 Pdf - A Durable Power of Attorney can provide peace of mind to the principal and their family during uncertain times.