Attorney-Verified Articles of Incorporation Document for Virginia State

Common mistakes

-

Incorrect Business Name: One common mistake is failing to choose a unique business name. The name must not be similar to existing entities in Virginia. Before filing, a name search should be conducted to ensure availability.

-

Improper Designation of Registered Agent: The registered agent must be a resident of Virginia or a business entity authorized to conduct business in the state. Many people mistakenly list an agent who does not meet these requirements.

-

Missing or Incomplete Information: Applicants often overlook filling out all required fields. Omitting essential details, such as the principal office address or the number of shares authorized, can lead to delays or rejections.

-

Failure to Include Incorporators' Signatures: The form requires the signatures of all incorporators. Some individuals forget to sign or assume that a digital submission does not require a signature, which can invalidate the application.

-

Not Specifying the Purpose of the Corporation: The Articles of Incorporation must include a statement of purpose. Failing to provide a clear purpose or using vague language can lead to confusion and potential legal issues in the future.

Learn More on This Form

-

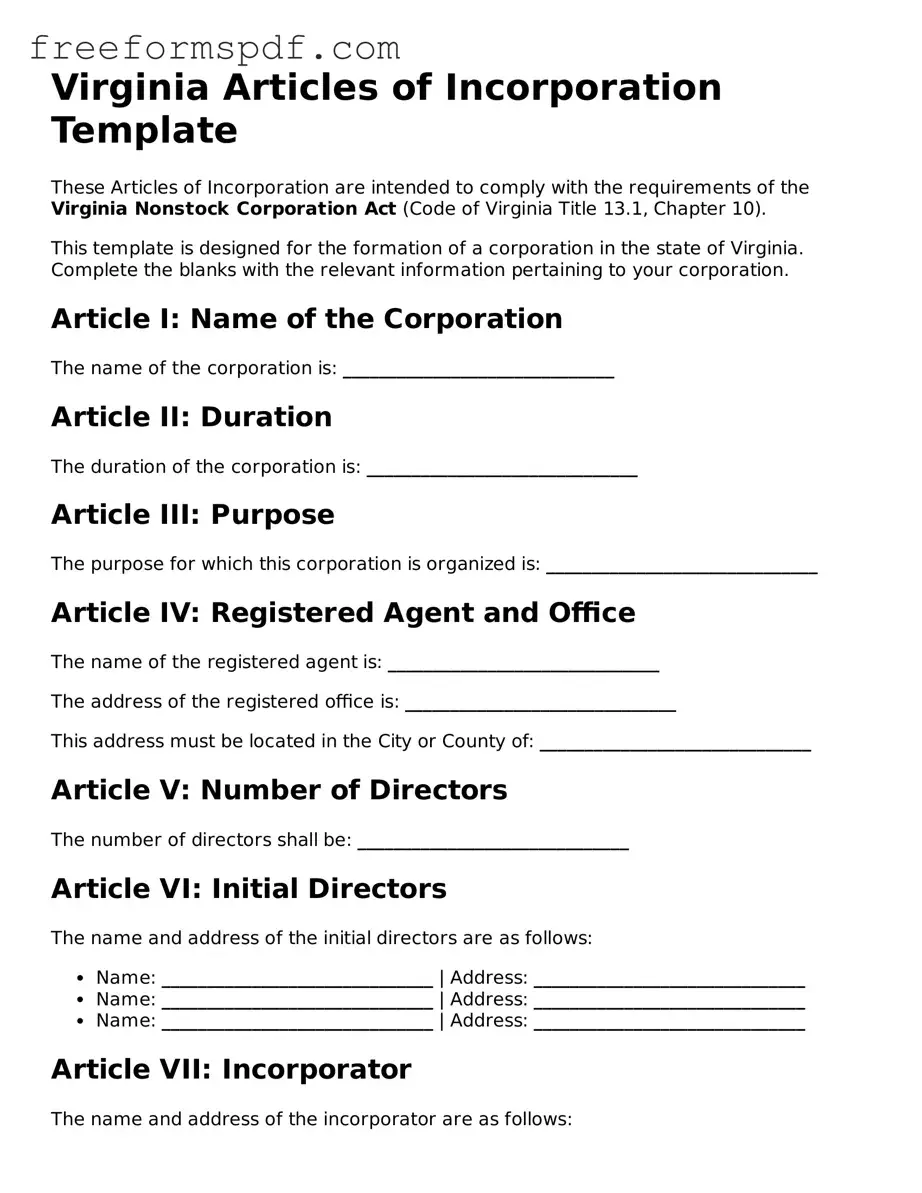

What are the Virginia Articles of Incorporation?

The Virginia Articles of Incorporation is a legal document that establishes a corporation in the state of Virginia. It serves as the foundation for the corporation's existence and outlines key details about the business, such as its name, purpose, and structure.

-

Why do I need to file Articles of Incorporation?

Filing Articles of Incorporation is essential for legally recognizing your business as a corporation. This process provides liability protection for the owners, allows the corporation to enter into contracts, and enables it to conduct business under its own name.

-

What information is required in the Articles of Incorporation?

The Articles typically require several pieces of information, including:

- The name of the corporation

- The purpose of the corporation

- The address of the corporation's initial registered office

- The name and address of the registered agent

- The number of shares the corporation is authorized to issue

-

How do I file the Articles of Incorporation?

To file the Articles of Incorporation, you can submit the form online through the Virginia State Corporation Commission's website, or you can mail a paper form to the appropriate office. Be sure to include any required fees along with your submission.

-

What is a registered agent, and why is it important?

A registered agent is an individual or business entity designated to receive legal documents on behalf of the corporation. Having a registered agent is crucial, as it ensures that the corporation can be reached for important legal matters, such as lawsuits or official government correspondence.

-

How long does it take for the Articles of Incorporation to be processed?

The processing time can vary. Typically, online submissions are processed faster than paper filings. Expect a turnaround of a few days to several weeks, depending on the volume of filings and the method of submission.

-

Can I amend the Articles of Incorporation after filing?

Yes, corporations can amend their Articles of Incorporation if necessary. This may involve changes to the corporate name, purpose, or structure. The amendment must be filed with the Virginia State Corporation Commission, along with any applicable fees.

-

What happens if I do not file the Articles of Incorporation?

Failing to file the Articles of Incorporation means your business will not be recognized as a corporation. This can expose the owners to personal liability for the corporation's debts and obligations. Additionally, the business may face legal challenges and cannot operate under its chosen name.

-

Are there any fees associated with filing the Articles of Incorporation?

Yes, there are fees associated with filing the Articles of Incorporation in Virginia. The amount may vary depending on the type of corporation you are forming and whether you choose to file online or by mail. Always check the latest fee schedule on the Virginia State Corporation Commission's website.

Misconceptions

When it comes to the Virginia Articles of Incorporation, several misconceptions can lead to confusion for those looking to start a business. Understanding these common misunderstandings can make the process smoother and more efficient.

- Misconception 1: You need a lawyer to file Articles of Incorporation.

- Misconception 2: Articles of Incorporation are the same as a business license.

- Misconception 3: You must have a physical office in Virginia to incorporate.

- Misconception 4: The process is too complicated for small business owners.

- Misconception 5: You can change your business name after filing Articles of Incorporation without any issues.

- Misconception 6: Incorporation guarantees personal liability protection.

- Misconception 7: You only need to file Articles of Incorporation once.

- Misconception 8: Articles of Incorporation can be filed at any time without consequences.

- Misconception 9: All businesses must file Articles of Incorporation.

While having legal assistance can be beneficial, it is not mandatory. Many individuals successfully file the form on their own using available resources.

These are two distinct documents. Articles of Incorporation establish your business as a legal entity, while a business license allows you to operate legally in your locality.

It is possible to incorporate in Virginia without a physical office. You can use a registered agent's address for official correspondence.

The process is straightforward. With clear instructions and the right information, small business owners can navigate it without difficulty.

Changing your business name after incorporation requires filing an amendment to your Articles of Incorporation. It’s not as simple as just changing the name on your storefront.

While incorporation generally provides limited liability, it does not eliminate all personal liability. Certain actions, like personal guarantees or illegal activities, can still expose you to risk.

Incorporated businesses must adhere to ongoing compliance requirements, including annual reports and fees, to maintain their status.

Filing at the wrong time, especially if there are deadlines for certain business activities, can lead to penalties or complications in your business operations.

Not every business needs to incorporate. Sole proprietorships and partnerships can operate without filing Articles of Incorporation, depending on their structure and needs.

Some Other Articles of Incorporation State Templates

Oregon Incorporation - Additional details may cover the corporation's purpose and the duration of its existence.

When engaging in a trailer sale, it is essential to complete a Trailer Bill of Sale form, which not only serves as proof of the transaction but also facilitates the proper registration and title transfer in New York. For those looking to obtain a template, you can find one at newyorkform.com/free-trailer-bill-of-sale-template/, ensuring that all necessary details are accurately captured and legally compliant.

Nys Division of Corporations - Clarifies the voting rights of shareholders.