Vehicle Repayment Agreement Document

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all necessary details. This includes personal information, vehicle identification numbers, and loan amounts. Omitting even a small piece of information can delay processing.

-

Incorrect Vehicle Identification Number (VIN): The VIN must be accurate and match the vehicle being financed. A simple typographical error can lead to significant complications, including issues with registration and insurance.

-

Not Reviewing Terms: Many individuals rush through the agreement without fully understanding the repayment terms. It’s crucial to read the entire document, as this will help avoid misunderstandings about interest rates, payment schedules, and penalties for late payments.

-

Missing Signatures: Failing to sign the agreement is a frequent oversight. All parties involved must provide their signatures to validate the document. Without these, the agreement may not be legally binding.

-

Ignoring Contact Information: Providing outdated or incorrect contact information can hinder communication. If lenders need to reach out regarding payments or changes, having accurate contact details is essential for a smooth process.

Learn More on This Form

-

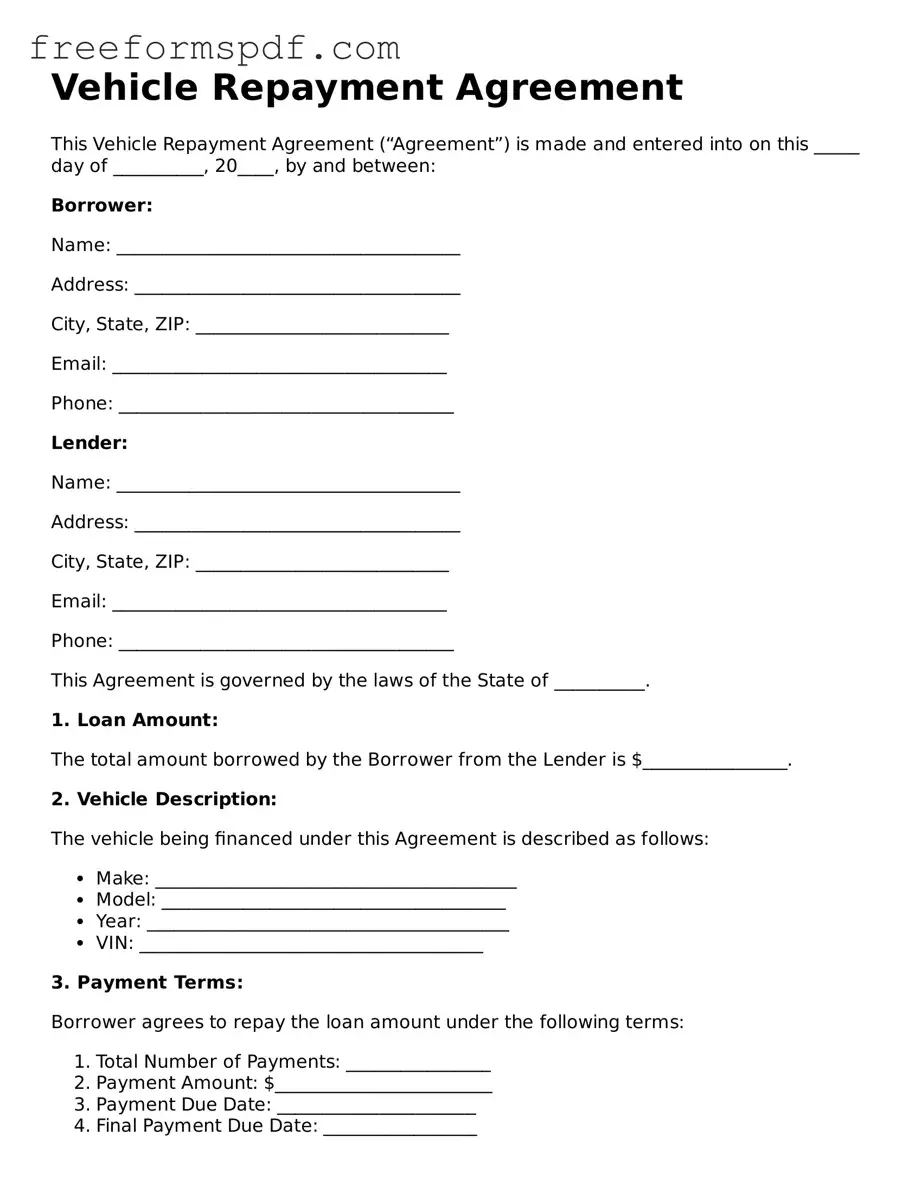

What is a Vehicle Repayment Agreement form?

The Vehicle Repayment Agreement form is a document that outlines the terms and conditions under which a borrower agrees to repay a loan taken out for the purchase of a vehicle. This form serves to protect both the lender and the borrower by clearly stating the repayment schedule, interest rates, and any penalties for late payments.

-

Who needs to fill out the Vehicle Repayment Agreement form?

Both the borrower and the lender must fill out the Vehicle Repayment Agreement form. The borrower is typically the individual or entity purchasing the vehicle, while the lender is the financial institution or individual providing the loan. Accurate information from both parties is essential for the agreement to be valid.

-

What information is required on the form?

The form requires several key pieces of information, including:

- The names and contact information of both the borrower and lender

- The vehicle identification number (VIN)

- The total loan amount

- The interest rate

- The repayment schedule (including due dates)

- Any applicable fees or penalties

-

How is the repayment schedule determined?

The repayment schedule is typically determined by the lender based on the total loan amount, the interest rate, and the agreed-upon loan term. Borrowers may have the option to choose from various repayment plans, which can vary in length and payment amounts.

-

What happens if a payment is missed?

If a payment is missed, the borrower may incur late fees as specified in the agreement. Additionally, the lender may take further action, which could include reporting the missed payment to credit agencies or initiating repossession of the vehicle, depending on the terms outlined in the agreement.

-

Can the terms of the agreement be modified?

Yes, the terms of the Vehicle Repayment Agreement can be modified, but both parties must agree to any changes. It is advisable to document any modifications in writing and have both parties sign the updated agreement to ensure clarity and enforceability.

-

Is the Vehicle Repayment Agreement legally binding?

Yes, once signed by both parties, the Vehicle Repayment Agreement is legally binding. This means that both the borrower and the lender are obligated to adhere to the terms outlined in the agreement. Failure to comply can result in legal consequences.

-

Where can I obtain a Vehicle Repayment Agreement form?

Vehicle Repayment Agreement forms can typically be obtained from financial institutions, legal websites, or through legal counsel. It is important to ensure that the form used complies with local laws and regulations.

-

What should I do if I have questions about the form?

If there are questions regarding the Vehicle Repayment Agreement form, it is advisable to consult with a financial advisor or legal professional. They can provide guidance specific to your situation and ensure that all aspects of the agreement are understood before signing.

Misconceptions

Understanding the Vehicle Repayment Agreement form can be tricky. Many people have misconceptions about what this document entails and how it functions. Here are seven common misunderstandings:

- It’s only for people with bad credit. Many believe this form is solely for those who have poor credit histories. In reality, anyone financing a vehicle can use this agreement, regardless of their credit score.

- Signing means you’re stuck with the terms forever. Some think that once they sign, they cannot change the terms. However, agreements can often be renegotiated if both parties consent.

- It guarantees loan approval. A common belief is that filling out this form guarantees that a loan will be approved. In truth, approval depends on various factors, including creditworthiness and the lender's policies.

- It’s the same as a lease agreement. Many confuse a Vehicle Repayment Agreement with a lease. While both involve a vehicle, a repayment agreement is for ownership, while a lease is for temporary use without ownership.

- Only the borrower is responsible for payments. Some people think that only the person who signs the agreement is liable for payments. However, co-signers or joint borrowers can also share responsibility.

- It has no impact on your credit score. Many underestimate the effect of this agreement on their credit. Failing to meet the terms can negatively impact your credit score, while timely payments can improve it.

- It’s a one-size-fits-all document. Some assume that the Vehicle Repayment Agreement is the same for everyone. In reality, the terms can vary widely based on the lender and the specific circumstances of the loan.

By clearing up these misconceptions, individuals can better navigate the complexities of vehicle financing and make informed decisions.

Popular Forms:

Cease and Desist Trespassing Letter Template - This letter is an official request for compliance with property laws.

The Vehicle Release of Liability form is a critical document that transfers the responsibility from the seller to the buyer upon the sale of a vehicle. It serves as official proof that the seller is no longer responsible for the vehicle after the transaction is complete. By submitting this form, sellers protect themselves from future liabilities related to the vehicle, and it is important to use a proper Vehicle Release of Liability form to ensure all legal obligations are met.

How to Get Acord Insurance Certificate - Utilizing the Acord 50 WM promotes accuracy in health insurance underwriting.