Fill in a Valid USCIS I-864 Template

Common mistakes

-

Inaccurate Income Reporting: Many individuals underestimate or overestimate their income. It’s crucial to report your income accurately, as this affects the financial assessment. Use your most recent tax return and pay stubs to provide a clear picture of your earnings.

-

Neglecting to Include All Household Members: Some applicants forget to list all members of their household. This includes anyone who lives with you and contributes to the household income. Omitting these details can lead to delays or denials.

-

Failing to Sign and Date the Form: A common oversight is not signing or dating the form. Without your signature, the application is considered incomplete. Always double-check that you’ve signed and included the correct date before submission.

-

Not Providing Sufficient Evidence of Income: Simply stating your income is not enough. You must include supporting documents, such as tax returns, W-2 forms, and pay stubs. Insufficient evidence can lead to complications in the processing of your application.

Learn More on This Form

-

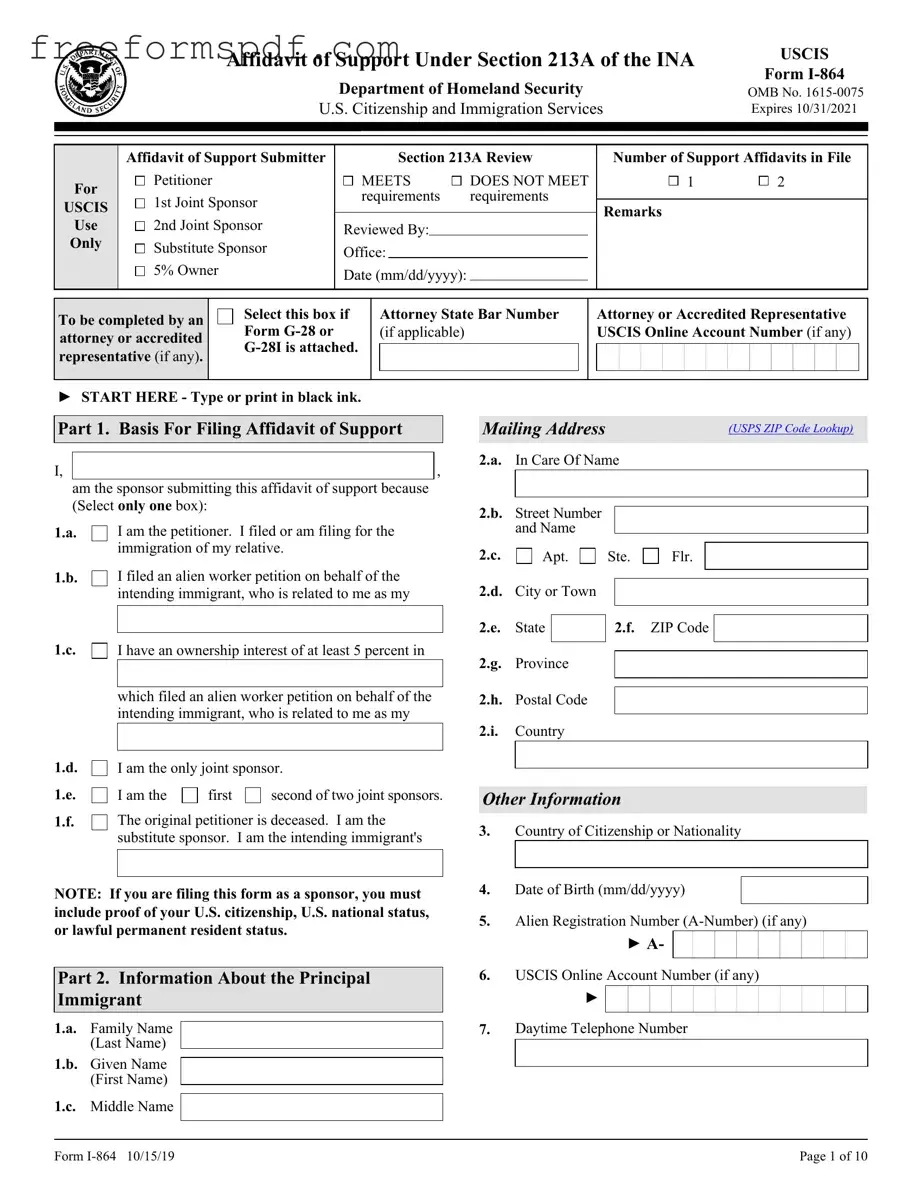

What is the USCIS I-864 form?

The USCIS I-864 form, also known as the Affidavit of Support, is a document required by U.S. immigration authorities. It is used to demonstrate that a sponsor can financially support an immigrant applying for a green card. This form helps ensure that the immigrant will not become a public charge, meaning they will not rely on government assistance for their basic needs.

-

Who needs to file the I-864 form?

The I-864 form must be filed by a U.S. citizen or lawful permanent resident who is sponsoring an immigrant for a green card. This sponsor is typically a family member, but it can also be a friend or employer in certain situations. The sponsor must meet specific income requirements to qualify.

-

What are the income requirements for the sponsor?

The sponsor's income must be at least 125% of the federal poverty level for their household size. This includes the sponsor, the immigrant, and any other dependents. If the sponsor is active duty military and sponsoring their spouse or child, the requirement is only 100% of the federal poverty level.

-

What if the sponsor does not meet the income requirement?

If the sponsor does not meet the income requirement, they can use a joint sponsor. A joint sponsor must also complete an I-864 form and meet the income requirements independently. This allows the immigrant to have additional financial support and increases the chances of approval.

-

What documents are needed to support the I-864 form?

When submitting the I-864 form, the sponsor must provide proof of income and assets. Common documents include recent tax returns, W-2 forms, pay stubs, and bank statements. These documents help demonstrate the sponsor's ability to provide financial support.

-

How long does the sponsor need to support the immigrant?

The obligation to support the immigrant lasts until one of the following occurs: the immigrant becomes a U.S. citizen, the immigrant can be credited with 40 quarters of work (approximately 10 years), or the immigrant leaves the U.S. permanently. This commitment is serious and should be considered carefully.

-

Can the I-864 form be revoked?

Yes, the I-864 form can be revoked under certain circumstances. If the sponsor no longer wishes to support the immigrant, they can submit a written request to USCIS to withdraw the affidavit. However, this does not relieve the sponsor of their financial obligations incurred prior to the revocation.

-

What happens if the sponsor fails to support the immigrant?

If the sponsor fails to meet their financial obligations, the immigrant can take legal action to enforce the support. This may include seeking reimbursement for expenses covered by government assistance. It is crucial for sponsors to understand the responsibilities they are taking on when signing the I-864 form.

-

Where can I find the I-864 form?

The I-864 form is available on the official USCIS website. It is important to ensure that you are using the most current version of the form to avoid any delays in processing. Always check for updates and follow the instructions carefully when completing the form.

Misconceptions

The USCIS I-864 form, also known as the Affidavit of Support, is a crucial document for individuals seeking to sponsor a family member for a green card. However, several misconceptions surround this form, which can lead to confusion and mistakes in the application process. Here are six common misconceptions:

-

Only the sponsor must sign the I-864.

Many people believe that only the sponsor needs to sign the form. However, if there are joint sponsors or household members contributing to the income, they must also sign the form to validate their financial commitment.

-

The I-864 guarantees a green card.

Some individuals think that submitting the I-864 guarantees that the applicant will receive a green card. In reality, the form is just one part of the process. The applicant must still meet all other eligibility requirements.

-

Income from any source counts towards the requirement.

It is a common belief that all income sources can be counted to meet the income requirement. However, only certain types of income, like wages and salaries, can be included. Income from non-legal sources cannot be considered.

-

There is no need for supporting documents.

Some sponsors think they can simply fill out the form without providing any supporting documents. In fact, the USCIS requires proof of income, such as tax returns and pay stubs, to verify the information provided in the I-864.

-

The I-864 is only required for immediate relatives.

Many people assume that the I-864 is only necessary for immediate relatives. However, it is required for most family-based immigration cases, including those involving siblings or adult children.

-

Once signed, the obligations last forever.

Some sponsors believe that their financial obligations last indefinitely. While the obligations do last until the sponsored immigrant becomes a U.S. citizen or can be credited with 40 quarters of work, they can also end if the sponsored immigrant dies or leaves the U.S.

Understanding these misconceptions can help sponsors navigate the I-864 process more effectively and avoid potential pitfalls. Proper preparation and awareness are key to a successful application.

Browse More Forms

Guardianship Documents - Encourages collaborative solutions between parents and caregivers.

The ADP Pay Stub form is a vital tool for employees to keep track of their earnings and deductions accurately. By reviewing your pay stub, you can ensure that all information is correct, which is essential for financial planning. For those looking to create a comprehensive record of their wages, utilizing the ADP Check Stub template can be highly beneficial, making the process straightforward and efficient.

Abn Form Medicare - Healthcare providers must ensure patients understand the significance of this notice.