Transfer-on-Death Deed Document

Transfer-on-Death Deed - Customized for Each State

Common mistakes

-

Not including all required information. Make sure to fill in all sections of the form completely. Missing details can lead to delays or rejection.

-

Using incorrect property descriptions. Clearly identify the property you want to transfer. Vague descriptions can create confusion.

-

Failing to sign the deed. Remember, your signature is crucial. Without it, the document is not valid.

-

Not having the deed notarized. Most states require notarization for the deed to be legally binding.

-

Neglecting to check state laws. Each state has different rules regarding Transfer-on-Death Deeds. Familiarize yourself with local regulations.

-

Forgetting to inform beneficiaries. Communicate your intentions to the people named in the deed. This helps avoid confusion later.

-

Not recording the deed properly. After filling out the form, ensure it is filed with the appropriate county office. This step is essential for it to take effect.

-

Ignoring tax implications. Understand how transferring property may affect taxes for both you and your beneficiaries.

-

Assuming the deed is revocable. Remember that while you can revoke it, certain steps must be followed to do so legally.

-

Not seeking professional advice. If you have questions or uncertainties, consult with a legal expert. It's better to be safe than sorry.

Learn More on This Form

-

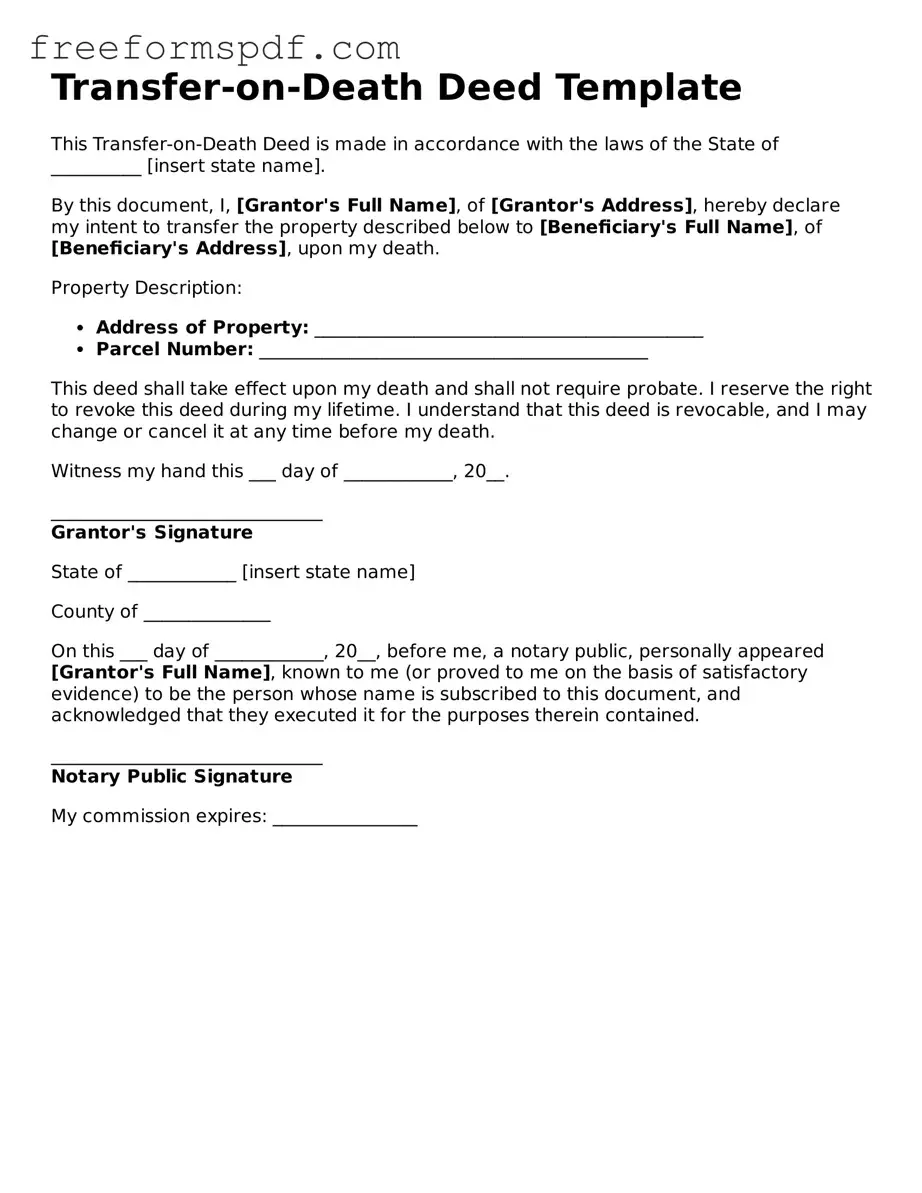

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows you to transfer ownership of real estate to a beneficiary upon your death. This deed avoids the probate process, meaning your property can pass directly to your chosen beneficiary without going through court. It provides a straightforward way to ensure your wishes are honored without unnecessary delays or expenses.

-

How do I create a Transfer-on-Death Deed?

To create a TOD Deed, you must complete the appropriate form for your state. This typically involves providing details about the property, the owner, and the designated beneficiary. After filling out the form, you need to sign it in front of a notary public. Finally, the deed must be recorded with the local county recorder's office to be effective. Each state may have specific requirements, so it’s important to check your local laws.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you must create a new TOD Deed that either designates a different beneficiary or revokes the previous deed. It’s essential to record the new deed with the county recorder’s office to ensure that your changes are legally recognized.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger immediate tax consequences. The property remains part of your estate for tax purposes until your death. However, the beneficiary may be responsible for property taxes after the transfer occurs. Additionally, it’s wise to consult a tax professional to understand any potential implications related to inheritance taxes or capital gains taxes.

Misconceptions

Transfer-on-Death Deeds (TOD Deeds) are useful estate planning tools, but several misconceptions can lead to confusion. Here are four common misunderstandings:

- Misconception 1: A Transfer-on-Death Deed automatically transfers property upon signing.

- Misconception 2: You cannot change or revoke a Transfer-on-Death Deed once it's created.

- Misconception 3: A Transfer-on-Death Deed avoids all probate issues.

- Misconception 4: Only certain types of property can be transferred using a Transfer-on-Death Deed.

This is not true. A TOD Deed only takes effect after the property owner passes away. Until that time, the owner retains full control over the property.

In reality, a TOD Deed can be revoked or modified at any time before the owner's death. This flexibility allows for adjustments as circumstances change.

While a TOD Deed does allow property to pass outside of probate, it does not eliminate the need for probate in all cases. For example, if there are debts or disputes, probate may still be necessary.

Actually, many types of real estate can be transferred via a TOD Deed, but it’s important to check local laws. Some jurisdictions may have specific rules regarding the types of property eligible for this transfer method.

Other Types of Transfer-on-Death Deed Forms:

Deed in Lieu of Foreclosure Template - The lender usually benefits by obtaining the property without a costly foreclosure process.

In order to manage a tenancy effectively, it’s important for landlords and tenants to familiarize themselves with essential documents like the Notice to Quit, which can be obtained through resources such as NY Templates. This form not only clarifies the obligations of both parties but also helps to prevent misunderstandings that may lead to disputes in the future.

Free Printable Gift Deed Form - Use the Gift Deed to celebrate special occasions by transferring property as a meaningful gift.