Attorney-Verified Transfer-on-Death Deed Document for Texas State

Common mistakes

-

Incorrect Property Description: Failing to provide a complete and accurate description of the property can lead to confusion or disputes later on.

-

Not Including All Owners: If the property is owned jointly, all owners must sign the deed. Omitting a co-owner can invalidate the deed.

-

Missing Signatures: All required signatures must be present. A missing signature can render the deed ineffective.

-

Improper Witnesses: The deed must be signed in front of two witnesses. Not adhering to this requirement can cause legal issues.

-

Failure to Notarize: The deed must be notarized to be valid. Skipping this step can lead to complications in transferring the property.

-

Not Recording the Deed: After completion, the deed must be filed with the county clerk. Not doing so means the transfer may not be recognized.

-

Inaccurate Beneficiary Information: Providing incorrect details about the beneficiary can result in delays or disputes during the transfer process.

-

Not Updating the Deed: If circumstances change, such as a beneficiary's death, the deed should be updated to reflect the current situation.

-

Ignoring State-Specific Requirements: Each state may have unique rules. Failing to adhere to Texas-specific regulations can invalidate the deed.

Learn More on This Form

-

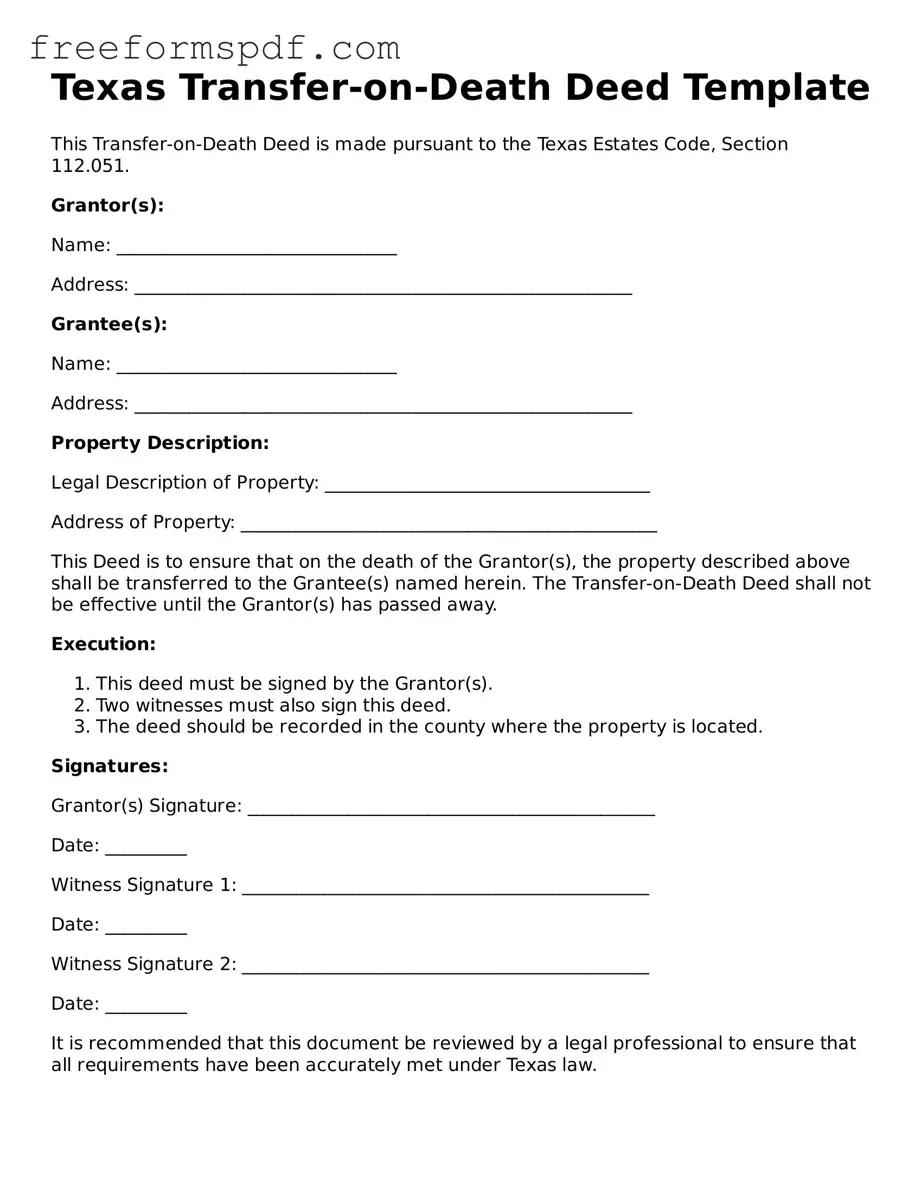

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows an individual to transfer real estate to a beneficiary upon their death without the need for probate. This means that the property can pass directly to the designated person, simplifying the process and potentially saving time and money.

-

Who can use a Transfer-on-Death Deed in Texas?

Any individual who owns real estate in Texas can create a Transfer-on-Death Deed. This includes homeowners and property owners of various types, as long as they are legally capable of transferring their property. It is important to note that the deed must be executed and recorded during the owner's lifetime.

-

How does one create a Transfer-on-Death Deed?

To create a TOD Deed, the property owner must fill out the appropriate form, which includes details about the property and the beneficiary. Once completed, the deed must be signed in front of a notary public and then filed with the county clerk's office where the property is located. This ensures that the deed is legally recognized and enforceable.

-

Can a Transfer-on-Death Deed be revoked or changed?

Yes, a Transfer-on-Death Deed can be revoked or changed at any time before the owner's death. To revoke the deed, the owner must execute a new deed that explicitly states the revocation or file a formal revocation document with the county clerk. It is advisable to consult with a legal professional to ensure that the revocation is properly executed.

-

What happens if the beneficiary predeceases the property owner?

If the beneficiary named in the Transfer-on-Death Deed dies before the property owner, the deed does not automatically transfer the property to the beneficiary's heirs. Instead, the property may pass according to the owner's will or, if there is no will, according to Texas intestacy laws. It is wise to name alternate beneficiaries in the deed to avoid complications.

-

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, transferring property through a Transfer-on-Death Deed does not trigger immediate tax consequences. The property is still part of the owner's estate for tax purposes until their death. However, beneficiaries may be responsible for property taxes after the transfer occurs. Consulting a tax professional can provide clarity on specific situations.

-

Is a Transfer-on-Death Deed the right choice for everyone?

While a Transfer-on-Death Deed offers many benefits, it may not be suitable for everyone. Individuals with complex estates, multiple beneficiaries, or specific wishes regarding property distribution may want to consider other estate planning tools, such as a will or trust. Each person's situation is unique, and seeking guidance from an estate planning attorney can help determine the best approach.

Misconceptions

The Texas Transfer-on-Death Deed (TODD) is a useful tool for estate planning, but several misconceptions surround its use. Understanding these misconceptions can help individuals make informed decisions. Below are nine common misconceptions about the Texas TODD.

- It only applies to real estate. Many believe that the TODD can only be used for real property. While it primarily applies to real estate, it does not cover personal property or other assets.

- It is a will substitute. Some think that a TODD functions exactly like a will. In reality, it is a separate legal instrument that transfers property directly to beneficiaries upon the owner's death, bypassing probate.

- It is irrevocable once signed. There is a belief that once a TODD is executed, it cannot be changed. In fact, the owner can revoke or amend the deed at any time before death.

- All property can be transferred using a TODD. Some assume that any type of property can be included in a TODD. However, certain properties, like those held in a trust or with a life estate, cannot be transferred this way.

- Beneficiaries must accept the property. There is a misconception that beneficiaries are required to accept the property. Beneficiaries can refuse the inheritance if they choose.

- It avoids all taxes. Many people think that using a TODD eliminates all taxes. While it can help avoid probate taxes, it does not eliminate estate taxes or capital gains taxes.

- It is only for married couples. Some believe that only married couples can use a TODD. In truth, any individual can create a TODD to benefit any person or entity.

- It is a complicated process. There is a notion that creating a TODD is overly complicated. In reality, it is a straightforward process that can often be completed without extensive legal assistance.

- It guarantees that the property will be transferred as intended. Some think that a TODD guarantees the transfer will occur without issues. However, disputes can arise, and it is essential to ensure that the deed is properly executed and recorded.

By dispelling these misconceptions, individuals can better navigate their estate planning options and make choices that reflect their wishes.

Some Other Transfer-on-Death Deed State Templates

Where Can I Get a Tod Form - Using this deed ensures your property goes to your chosen heir without court intervention.

Transfer on Death Deed Washington - A Transfer-on-Death Deed can be beneficial in planning for blended families and ensuring equitable distributions.

For those seeking a straightforward approach to vehicle transactions, the necessary Arizona Motor Vehicle Bill of Sale form is a reliable resource to facilitate a smooth transfer of ownership.

Virginia Transfer on Death Deed - Some individuals may choose this method to ensure efficient and specific distribution of real estate assets.