Attorney-Verified Quitclaim Deed Document for Texas State

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a complete and accurate description of the property. The legal description should include details such as lot number, block number, and subdivision name. Omitting any of these details can lead to confusion or disputes in the future.

-

Missing Signatures: All parties involved in the transfer must sign the Quitclaim Deed. A common error is neglecting to obtain the necessary signatures, which can invalidate the deed.

-

Not Notarizing the Document: A Quitclaim Deed must be notarized to be legally binding. Failing to have the document notarized can prevent the deed from being accepted by the county clerk or other entities.

-

Incorrect Names: It is crucial to ensure that the names of the grantor (the person transferring the property) and the grantee (the person receiving the property) are spelled correctly and match their legal names. Errors in names can complicate the transfer process.

-

Improper Filing: After completing the Quitclaim Deed, it must be filed with the appropriate county office. Some individuals forget to file or file with the wrong office, which can delay or nullify the property transfer.

-

Not Considering Tax Implications: Many people overlook the potential tax consequences of transferring property through a Quitclaim Deed. Understanding these implications can help avoid unexpected financial burdens.

Learn More on This Form

-

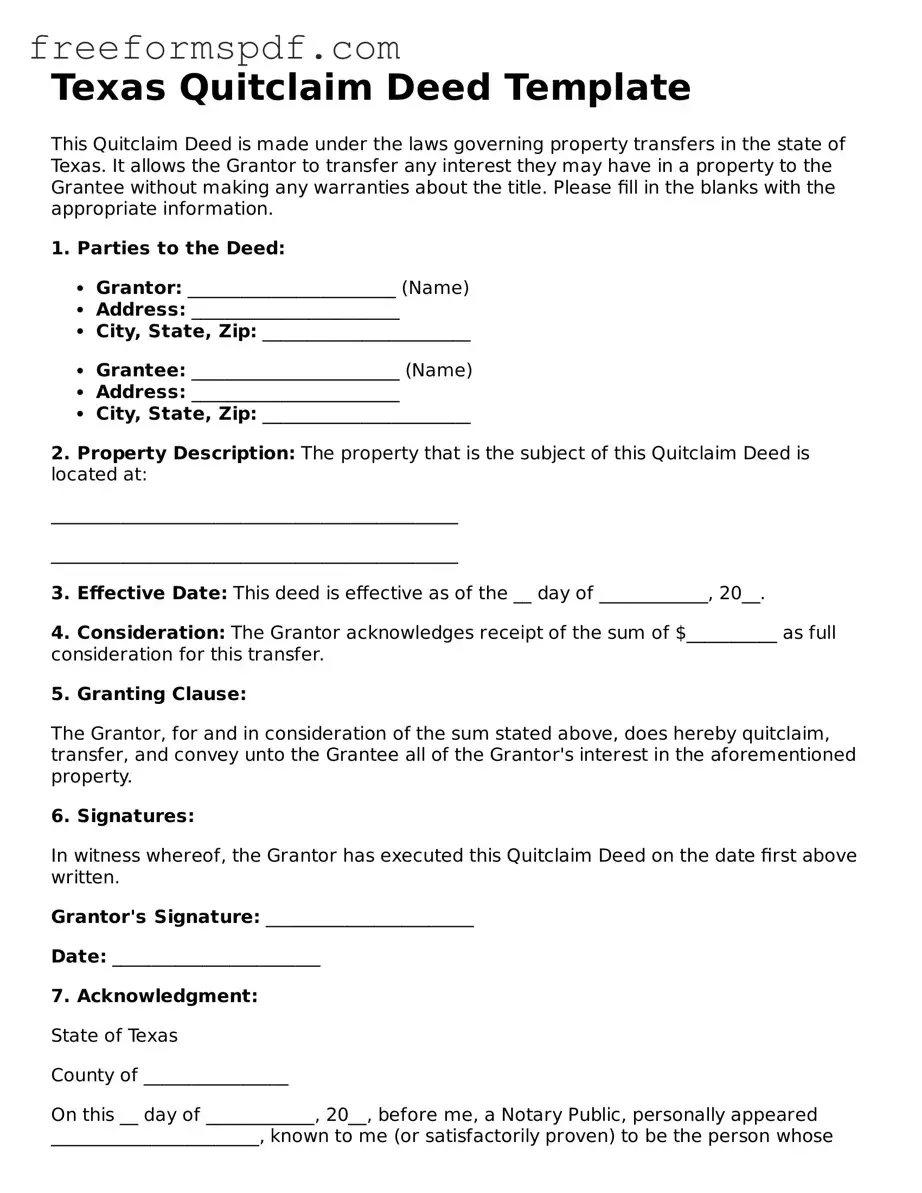

What is a Quitclaim Deed in Texas?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. In Texas, this type of deed allows the grantor (the person transferring the property) to relinquish any claim they may have on the property without guaranteeing that they hold clear title. This means that the grantee (the person receiving the property) receives whatever interest the grantor has, if any, but does not receive any warranties regarding the property’s title. This form is often used in situations such as divorce settlements, transferring property between family members, or clearing up title issues.

-

How do I complete a Quitclaim Deed in Texas?

Completing a Quitclaim Deed in Texas involves several steps. First, obtain the appropriate form, which can typically be found online or at legal supply stores. Next, fill in the names of the grantor and grantee, along with a description of the property being transferred. It is crucial to include the legal description of the property, which can be found on the original deed or through local property records. After completing the form, both parties must sign the document in the presence of a notary public. Finally, to make the transfer official, the deed must be filed with the county clerk in the county where the property is located.

-

Are there any tax implications when using a Quitclaim Deed in Texas?

While transferring property through a Quitclaim Deed itself does not trigger a tax event, it is important to consider potential tax implications. For instance, the transfer may be subject to property taxes, and any change in ownership could affect the assessed value of the property. Additionally, if the property is sold in the future, capital gains taxes may apply based on the difference between the sale price and the original purchase price. It is advisable to consult with a tax professional to understand how the transfer might impact your tax situation.

-

Can a Quitclaim Deed be revoked in Texas?

Once a Quitclaim Deed is executed and filed, it generally cannot be revoked unilaterally. The transfer of ownership is considered final. However, if the parties involved wish to reverse the transaction, they can execute a new deed, often referred to as a "deed of reconveyance" or another Quitclaim Deed, transferring the property back to the original owner. This process must also be properly documented and filed with the county clerk to ensure legal recognition. Consulting with a legal professional is recommended to navigate this process effectively.

Misconceptions

When it comes to the Texas Quitclaim Deed form, there are several misconceptions that can lead to confusion. Understanding these common misunderstandings can help ensure that property transfers are handled smoothly and correctly.

- Misconception 1: A quitclaim deed transfers ownership of property.

- Misconception 2: Quitclaim deeds are only used between family members.

- Misconception 3: A quitclaim deed eliminates all claims to the property.

- Misconception 4: A quitclaim deed is the same as a warranty deed.

- Misconception 5: Quitclaim deeds are not legally binding.

- Misconception 6: You don’t need to record a quitclaim deed.

This is only partially true. A quitclaim deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor actually owns the property or has the right to transfer it.

While quitclaim deeds are often used among family members, they can also be used in various situations, such as divorces or business transactions. They are a flexible tool for any transfer of property interest.

This is incorrect. A quitclaim deed does not remove any liens or encumbrances on the property. Buyers should conduct a title search to understand any existing claims.

This is a significant misunderstanding. A warranty deed provides a guarantee that the grantor holds clear title to the property, while a quitclaim deed offers no such warranty.

On the contrary, quitclaim deeds are legally binding documents once they are properly executed and recorded. They must meet state requirements to be enforceable.

Recording a quitclaim deed is crucial. While it may not be required by law, failing to record it can lead to disputes over property ownership and complicate future transactions.

Some Other Quitclaim Deed State Templates

Printable Quit Claim Deed Form - The Quitclaim Deed does not guarantee that the property has a clean title.

For organizations seeking to streamline their employee onboarding process, utilizing an informative Employee Handbook template can be invaluable. This resource outlines key policies, procedures, and employee rights, ensuring that you set clear expectations from the outset. You can access the Employee Handbook template to guide your organization's documentation and foster a well-understood workplace environment.

Quitclaim Deed Washington - This legal document is particularly useful for changing the names on a title without selling the property.