Attorney-Verified Promissory Note Document for Texas State

Common mistakes

-

Missing Date: One common mistake is failing to include the date on which the note is signed. This date is crucial for establishing the timeline of the agreement.

-

Incorrect Borrower Information: Providing inaccurate or incomplete information about the borrower can lead to confusion. Ensure that the borrower's full name and address are correct.

-

Omitting Loan Amount: Forgetting to specify the loan amount can create disputes later. Clearly state the exact amount borrowed to avoid misunderstandings.

-

Interest Rate Errors: Miscalculating the interest rate or leaving it blank can result in legal complications. Double-check the rate and make sure it complies with Texas law.

-

Improper Signatures: Both the borrower and lender must sign the note. Failing to obtain the necessary signatures can render the document unenforceable.

-

Not Including Payment Terms: Leaving out the payment schedule or terms can lead to confusion about when and how payments are to be made. Clearly outline these details in the note.

Learn More on This Form

-

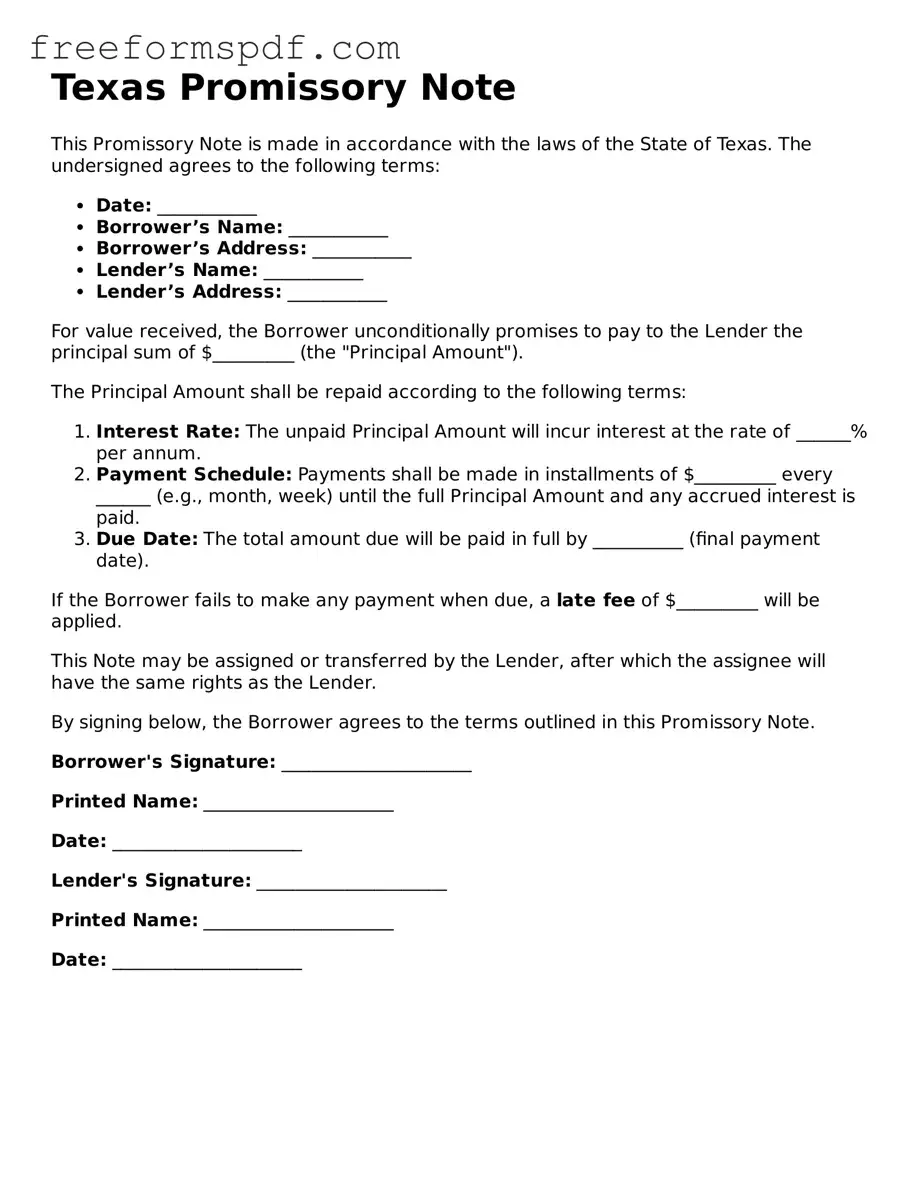

What is a Texas Promissory Note?

A Texas Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. It serves as a legal document that outlines the terms of the loan, including the interest rate and repayment schedule.

-

Who uses a Promissory Note in Texas?

Individuals, businesses, and financial institutions commonly use Promissory Notes. For example, if you lend money to a friend or if a business borrows funds from a bank, a Promissory Note can formalize the agreement.

-

What are the key components of a Texas Promissory Note?

A typical Promissory Note includes:

- The amount being borrowed

- The interest rate

- The repayment schedule

- The maturity date

- The names and addresses of the borrower and lender

- Any collateral securing the loan

-

Do I need a lawyer to create a Promissory Note?

While it's not required to have a lawyer draft a Promissory Note, consulting one can help ensure that the document meets legal standards and adequately protects your interests. If the loan amount is significant or if there are complex terms, legal advice is advisable.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower fails to make payments as agreed, the lender has the right to take legal action to recover the owed amount. This could involve filing a lawsuit or pursuing other collection methods, depending on the terms outlined in the note.

-

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified if both parties agree to the changes. It's important to document any modifications in writing and have both parties sign the updated agreement to avoid misunderstandings later on.

-

Is a Promissory Note enforceable in Texas?

Yes, a properly executed Promissory Note is enforceable in Texas courts. To be enforceable, the note must contain all essential elements and be signed by the borrower. If disputes arise, the note can be presented as evidence in court.

Misconceptions

Understanding the Texas Promissory Note form can be complicated due to various misconceptions. Here are ten common misunderstandings about this document:

- All promissory notes are the same. Many believe that all promissory notes are identical. In reality, they can vary significantly based on state laws and specific terms outlined in the agreement.

- A promissory note does not require signatures. Some think that a promissory note can be valid without signatures. However, a signature from both parties is typically necessary to enforce the agreement.

- Only banks can issue promissory notes. It is a common belief that only financial institutions can create promissory notes. In fact, any individual or business can issue one as long as it meets legal requirements.

- Promissory notes are always secured. Many people assume that all promissory notes involve collateral. However, some notes are unsecured, meaning they do not require any assets to back them up.

- Interest rates must be included. Some believe that every promissory note must specify an interest rate. While many do, it is possible to create a note without one.

- Texas law does not govern promissory notes. There is a misconception that Texas has no specific laws regarding promissory notes. In truth, Texas law provides guidelines that govern these documents.

- Once signed, a promissory note cannot be changed. Some think that once a promissory note is signed, it is set in stone. However, parties can agree to modify the terms, provided both sides consent to the changes.

- A promissory note guarantees repayment. It is often assumed that a promissory note guarantees that the borrower will repay the loan. While it is a legal promise, it does not eliminate the risk of default.

- All promissory notes are enforceable in court. Many believe that every promissory note can be enforced legally. However, if a note does not meet certain legal requirements, it may not be enforceable.

- Only written promissory notes are valid. Some think that oral promissory notes are invalid. While written notes are preferred for clarity, oral agreements can also be enforceable under certain conditions.

These misconceptions can lead to confusion about the use and implications of promissory notes in Texas. Understanding the facts can help individuals navigate their financial agreements more effectively.

Some Other Promissory Note State Templates

New York Promissory Note - Borrowers should read the terms carefully to understand their obligations before signing.

To facilitate the application process, individuals can access helpful resources, such as templates and guides, which can be found on sites like NY Templates, that assist applicants in correctly filling out the NYC Housing Application Form.

Promissory Note Template Oregon - Having a written agreement is a proactive measure for any lending scenario.

Promissory Note Template Washington State - This document may be required by lenders for obtaining formal financing or loans.

Create a Promissory Note - Interest due on promissory notes is often classified as income for the lender.