Attorney-Verified Operating Agreement Document for Texas State

Common mistakes

-

Incomplete Information: Many people forget to fill out all required sections. Each member's name and address should be clearly stated.

-

Incorrect Member Roles: Misunderstanding the roles of each member can lead to confusion. Clearly define who is managing the business and who is simply an investor.

-

Missing Signatures: It’s crucial to ensure that all members sign the document. Without signatures, the agreement may not hold up in court.

-

Not Specifying Voting Rights: Failing to outline how decisions will be made can create disputes later. Clearly state how many votes each member has.

-

Ignoring State Laws: Some individuals overlook specific Texas laws that apply to operating agreements. Familiarity with these laws is essential.

-

Vague Language: Using ambiguous terms can lead to misunderstandings. Be precise in your language to avoid potential conflicts.

-

Failure to Update: After changes in membership or structure, people often neglect to update the agreement. Regular reviews are necessary to keep it relevant.

-

Not Consulting a Professional: Some individuals attempt to complete the form without legal advice. Seeking guidance can prevent costly mistakes.

Learn More on This Form

-

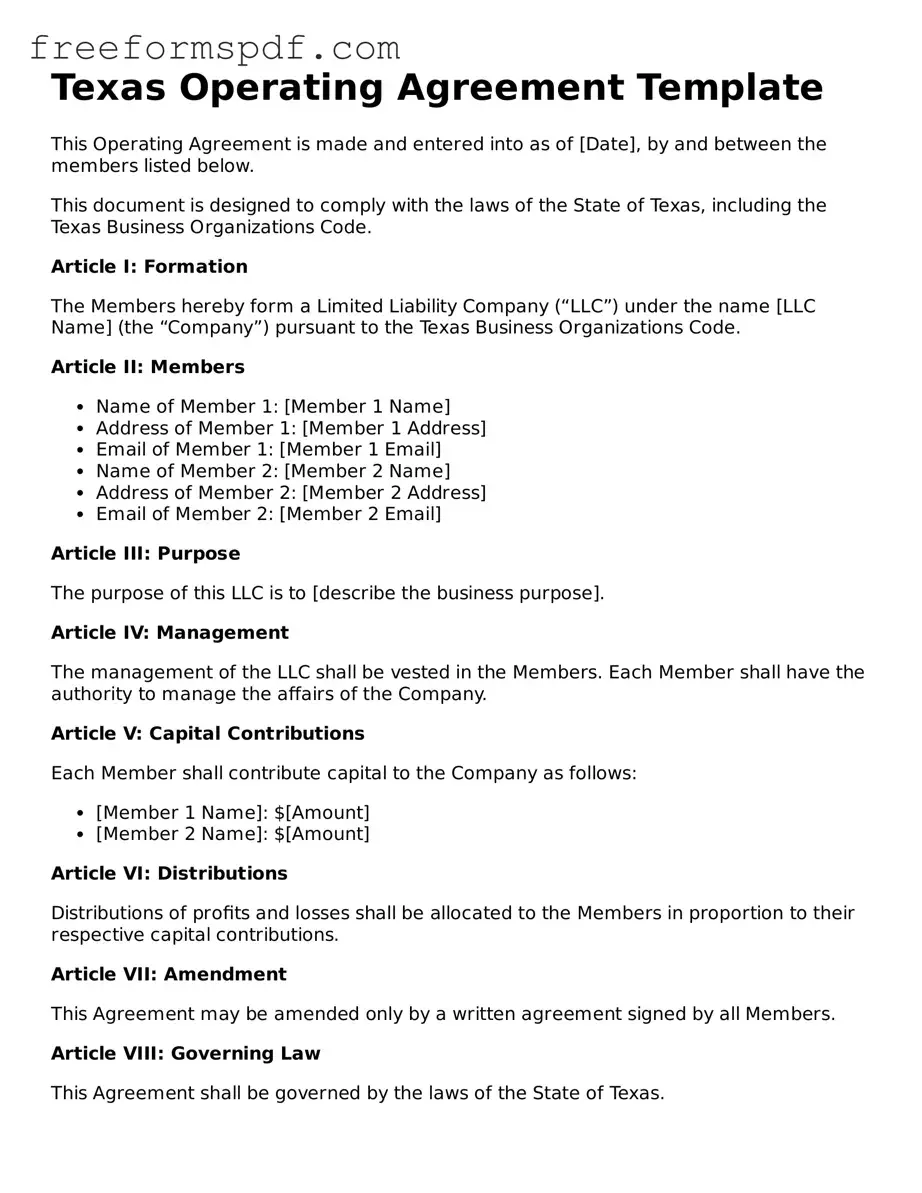

What is a Texas Operating Agreement?

A Texas Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Texas. It serves as an internal guideline for the members of the LLC, detailing how the company will be run and how decisions will be made.

-

Why is an Operating Agreement important?

This document is crucial for several reasons. It helps clarify the roles and responsibilities of each member, reduces the risk of disputes, and provides a framework for resolving issues. Additionally, having an Operating Agreement can enhance the credibility of the LLC and protect the members' limited liability status.

-

Is an Operating Agreement required in Texas?

While Texas law does not mandate LLCs to have an Operating Agreement, it is highly recommended. Without it, the LLC will be governed by default state laws, which may not align with the members' intentions.

-

Who should draft the Operating Agreement?

The members of the LLC can draft the Operating Agreement. However, it may be beneficial to consult with a legal professional to ensure that all necessary provisions are included and that the document complies with Texas laws.

-

What should be included in a Texas Operating Agreement?

A comprehensive Operating Agreement typically includes:

- The name and purpose of the LLC

- The names and contributions of the members

- Management structure and voting rights

- Profit and loss distribution

- Procedures for adding or removing members

- Dispute resolution methods

- Amendment procedures

-

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. The process for making changes should be outlined within the document itself. Typically, amendments require the consent of a majority or all members, depending on what is specified in the agreement.

-

How does an Operating Agreement affect liability?

An Operating Agreement helps to reinforce the limited liability protection of the members. By clearly defining the structure and operations of the LLC, it can help protect members from personal liability for the company's debts and obligations, provided that the LLC is properly maintained.

-

Can a single-member LLC have an Operating Agreement?

Yes, a single-member LLC can and should have an Operating Agreement. Even though there is only one member, having this document helps establish the LLC as a separate legal entity and can clarify the member's intentions regarding management and operations.

-

Where should the Operating Agreement be kept?

The Operating Agreement should be kept in a safe place, along with other important business documents. It is advisable for all members to have access to the agreement and to keep a copy in the company’s records.

-

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, it will be governed by the default rules set by Texas law. This may lead to unintended consequences regarding management, profit distribution, and member responsibilities, which may not reflect the members' actual intentions.

Misconceptions

Understanding the Texas Operating Agreement form is crucial for anyone involved in a business partnership or LLC in Texas. However, several misconceptions can lead to confusion. Here are nine common myths and the truths behind them:

- It’s only for large businesses. Many people think that only large companies need an Operating Agreement. In reality, even small businesses and startups benefit from having one. It helps clarify roles and responsibilities, regardless of the size of the business.

- It’s a legal requirement. While having an Operating Agreement is not legally mandated in Texas, it is highly recommended. Without it, your business may face challenges in governance and decision-making.

- It can’t be changed once created. Some believe that once an Operating Agreement is in place, it cannot be modified. In truth, it can be amended as needed, allowing for flexibility as the business evolves.

- All Operating Agreements are the same. This misconception suggests that one size fits all. However, each Operating Agreement should be tailored to fit the specific needs and goals of the business and its members.

- It’s only about profit distribution. While profit sharing is an important aspect, an Operating Agreement covers much more. It addresses management structure, decision-making processes, and member responsibilities.

- Only lawyers can draft it. Many think that only a legal professional can create an Operating Agreement. While legal advice is beneficial, business owners can draft their own agreements, provided they understand the necessary components.

- It’s not important if you have a verbal agreement. Relying solely on verbal agreements can lead to misunderstandings. An Operating Agreement provides a written record that can help prevent disputes down the line.

- It’s only necessary for multi-member LLCs. Even single-member LLCs can benefit from an Operating Agreement. It helps establish the owner’s rights and responsibilities and can be crucial for clarity and future planning.

- Once signed, it’s set in stone. Many people think that signing an Operating Agreement means it cannot be changed. In reality, as long as all members agree, the document can be updated to reflect changes in the business.

By dispelling these myths, business owners can better understand the importance of the Texas Operating Agreement and how it can serve as a vital tool for their business success.

Some Other Operating Agreement State Templates

Create an Operating Agreement - This document is essential for LLCs to define management structure.

Understanding the importance of a Non-disclosure Agreement in business dealings is crucial for protecting sensitive information. This crucial document forms the backbone of trust in confidential conversations and arrangements between parties. For more information, check out our comprehensive guide on the Non-disclosure Agreement.

Pa Llc Operating Agreement - In essence, this agreement is a foundational document for business governance.

How to Create an Operating Agreement - This form helps establish a clear business hierarchy.