Attorney-Verified Motor Vehicle Bill of Sale Document for Texas State

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all required details. This includes missing the names, addresses, or signatures of the buyer and seller. Each piece of information is crucial for the document to be valid.

-

Incorrect Vehicle Identification Number (VIN): The VIN must be accurate. A simple typo can lead to significant issues when registering the vehicle. Double-checking this number against the title can prevent future headaches.

-

Omitting Sale Price: The sale price should always be included. Leaving this field blank can create complications for both parties, especially when it comes to tax assessments and future ownership disputes.

-

Not Keeping a Copy: After filling out the form, it is essential to retain a copy for personal records. Failing to do so can lead to difficulties in proving ownership or the terms of the sale in the future.

Learn More on This Form

-

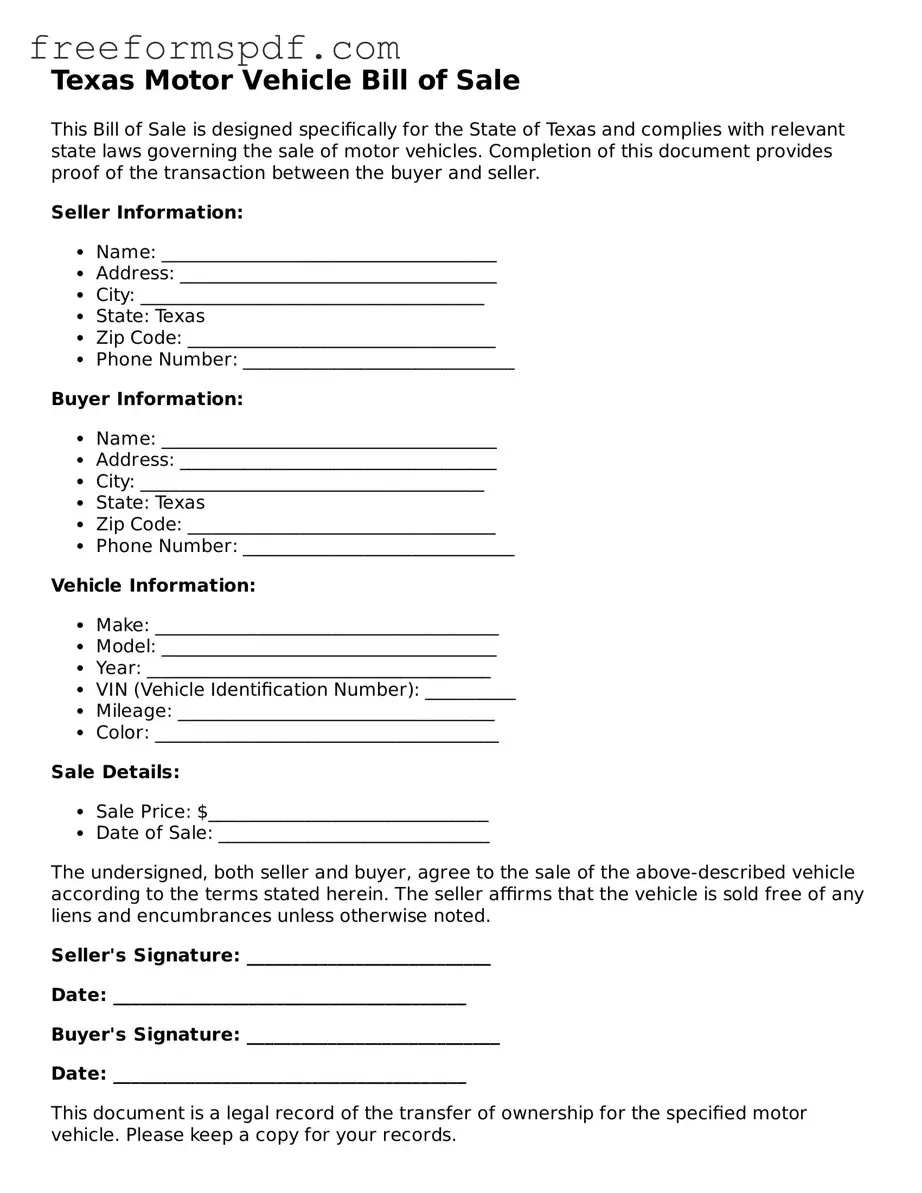

What is a Texas Motor Vehicle Bill of Sale?

A Texas Motor Vehicle Bill of Sale is a legal document that records the transfer of ownership of a vehicle from one party to another. This form serves as proof of the transaction and includes essential details such as the vehicle's identification number (VIN), make, model, year, and the sale price. It is crucial for both the buyer and seller to have this document for their records.

-

Is a Bill of Sale required in Texas?

While a Bill of Sale is not legally required for every vehicle transaction in Texas, it is highly recommended. Having a Bill of Sale can protect both parties by providing a written record of the sale. It can be especially important for tax purposes and when registering the vehicle with the Texas Department of Motor Vehicles (DMV).

-

What information is needed to complete the Bill of Sale?

To complete a Texas Motor Vehicle Bill of Sale, you will need the following information:

- Names and addresses of both the buyer and seller

- Vehicle identification number (VIN)

- Make, model, and year of the vehicle

- Sale price

- Date of sale

- Odometer reading at the time of sale

All parties should ensure that the information is accurate to avoid any issues in the future.

-

Do I need to have the Bill of Sale notarized?

In Texas, notarization of the Bill of Sale is not mandatory. However, having it notarized can add an extra layer of security and authenticity to the document. This can be particularly useful if there are any disputes regarding the sale in the future.

-

How does the Bill of Sale affect vehicle registration?

When registering a vehicle in Texas, the Bill of Sale is an important document to provide to the DMV. It serves as proof of ownership and may be required to complete the registration process. The buyer should keep a copy of the Bill of Sale for their records, as it may be necessary for future transactions or if questions arise about ownership.

-

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale as long as it includes all the necessary information. However, using a standardized form can help ensure that you do not miss any critical details. Many online resources provide templates that comply with Texas laws, making it easier to create a valid document.

-

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should sign the document. Each party should keep a copy for their records. The buyer should then take the Bill of Sale to the local DMV office to register the vehicle in their name. It is also advisable for the seller to notify the DMV of the sale to avoid any future liability associated with the vehicle.

Misconceptions

The Texas Motor Vehicle Bill of Sale form is an important document for anyone buying or selling a vehicle in Texas. However, several misconceptions surround this form that can lead to confusion. Here are six common misconceptions:

- The Bill of Sale is not necessary for vehicle sales. Many believe that a Bill of Sale is optional. In Texas, while it is not legally required, having one is highly recommended as it provides proof of the transaction.

- The Bill of Sale can be handwritten. Some people think that any written agreement suffices. While a handwritten Bill of Sale is valid, using a standardized form can help ensure that all necessary information is included.

- Only the seller needs to sign the Bill of Sale. It is a common belief that only the seller's signature is required. In reality, both the buyer and seller should sign the document to confirm the transaction.

- The Bill of Sale serves as the title transfer. Many assume that the Bill of Sale automatically transfers ownership. However, it is important to complete the title transfer process separately to officially change ownership.

- The Bill of Sale is only for private sales. Some think this document is only necessary for private transactions. However, it can also be used in dealer sales to provide additional proof of purchase.

- A Bill of Sale does not need to include vehicle details. Some people believe that a simple statement of sale is sufficient. In fact, the Bill of Sale should include specific details about the vehicle, such as the VIN, make, model, and year, to be effective.

Understanding these misconceptions can help ensure that the buying or selling process goes smoothly and that all parties are protected.

Some Other Motor Vehicle Bill of Sale State Templates

Bill of Sale Pennsylvania - Documenting vehicle sales can help reduce potential future disputes.

Utilizing the right Employment Verification form template can facilitate the accurate processing of employment status inquiries and help streamline related administrative tasks.

Vehicle Bill of Sale With Notary - The document may need to be notarized to ensure its authenticity, depending on state requirements.

Vehicle Bill of Sale Virginia - It's a critical piece of paperwork that both parties should treat with care.