Attorney-Verified Loan Agreement Document for Texas State

Common mistakes

-

Not Reading the Instructions: Many people skip the instructions provided with the loan agreement. This can lead to errors in filling out the form.

-

Incorrect Personal Information: Failing to provide accurate personal details, such as name, address, or Social Security number, can delay the loan process.

-

Missing Signatures: Some individuals forget to sign the form or have the wrong person sign it. This oversight can render the agreement invalid.

-

Not Providing Required Documentation: Often, applicants neglect to include necessary documents, like proof of income or identification. This can result in a denial of the loan.

-

Overlooking Terms and Conditions: People sometimes fail to read the terms and conditions carefully. This can lead to misunderstandings about interest rates and repayment terms.

Learn More on This Form

-

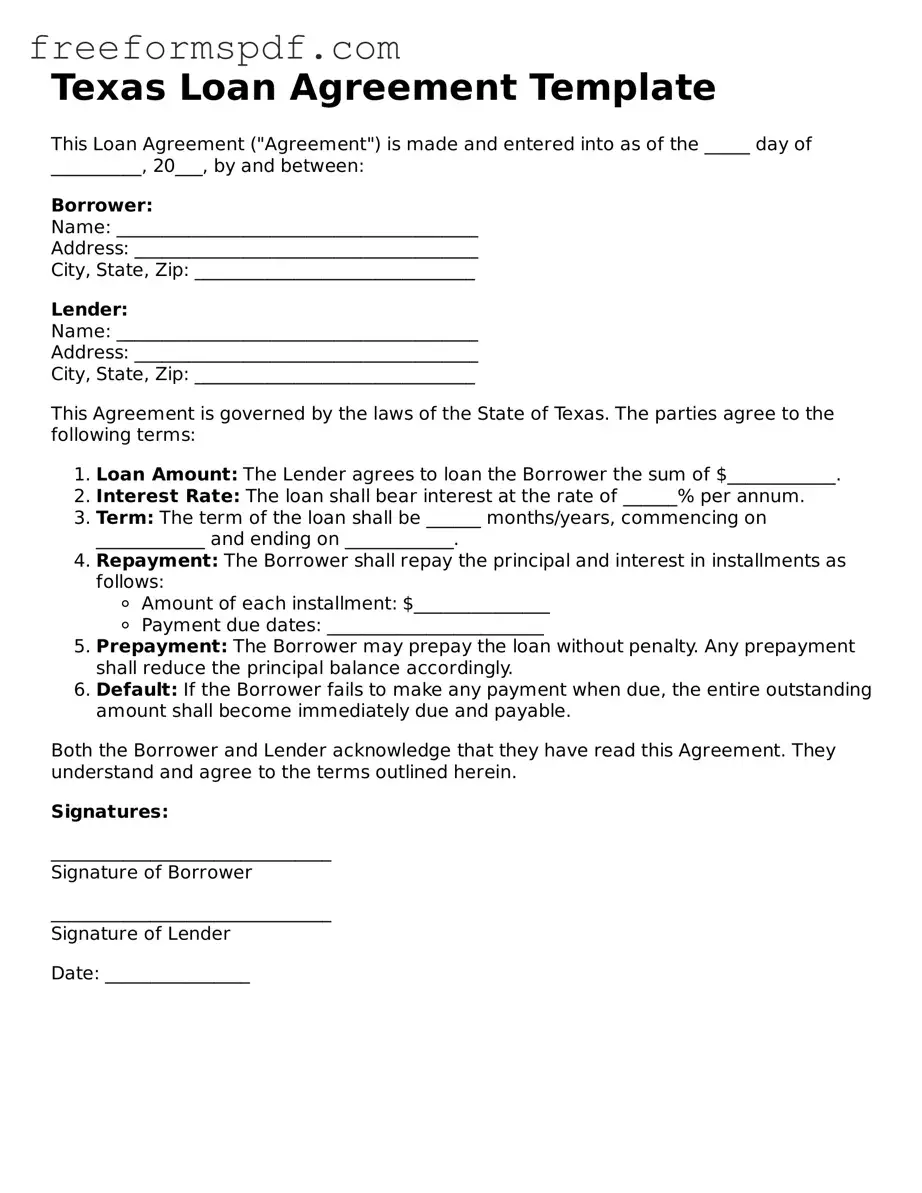

What is a Texas Loan Agreement?

A Texas Loan Agreement is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in the state of Texas. It specifies the amount borrowed, interest rates, repayment terms, and any collateral involved. This agreement serves to protect both parties by clearly defining their rights and responsibilities.

-

Who can use a Texas Loan Agreement?

Any individual or business looking to borrow or lend money in Texas can use this agreement. This includes personal loans between friends or family, business loans, and more formal arrangements between financial institutions and borrowers.

-

What should be included in a Texas Loan Agreement?

A comprehensive Texas Loan Agreement should include:

- The names and addresses of the lender and borrower

- The principal amount of the loan

- The interest rate and how it is calculated

- The repayment schedule, including due dates

- Any late fees or penalties for missed payments

- Details about collateral, if applicable

- Signatures of both parties

-

Is it necessary to have a Texas Loan Agreement in writing?

While verbal agreements can be legally binding, having a written Texas Loan Agreement is highly recommended. A written document provides clear evidence of the terms agreed upon and can help prevent misunderstandings or disputes in the future.

-

Can a Texas Loan Agreement be modified?

Yes, a Texas Loan Agreement can be modified, but both parties must agree to the changes. It is best to document any modifications in writing, and both parties should sign the updated agreement to ensure clarity and enforceability.

-

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. This may include seizing collateral if specified in the agreement or pursuing a court judgment. The specifics will depend on the terms outlined in the Texas Loan Agreement.

-

Do I need a lawyer to create a Texas Loan Agreement?

While it is not legally required to have a lawyer draft a Texas Loan Agreement, consulting with one can be beneficial. A lawyer can ensure that the agreement complies with state laws and adequately protects your interests.

Misconceptions

Understanding the Texas Loan Agreement form can be challenging, and several misconceptions may lead to confusion. Below are some common misunderstandings regarding this important document.

- Misconception 1: The Texas Loan Agreement is only for large loans.

- Misconception 2: All loan agreements in Texas are the same.

- Misconception 3: A verbal agreement is sufficient without a written loan agreement.

- Misconception 4: The Texas Loan Agreement does not require signatures.

This is not true. The Texas Loan Agreement can be used for various loan amounts, whether small or large. It serves as a formal record of the terms agreed upon by both the lender and the borrower, regardless of the loan size.

Each loan agreement can vary significantly based on the specifics of the loan, including the amount, interest rate, repayment terms, and any collateral involved. It is essential to review the terms of each agreement carefully, as they are tailored to the particular situation.

While verbal agreements may be legally binding in some cases, having a written loan agreement is crucial for clarity and protection. A written document provides a clear reference for both parties, reducing the potential for misunderstandings or disputes in the future.

Signatures are a vital part of the Texas Loan Agreement. Both the lender and the borrower must sign the document to acknowledge their acceptance of the terms. This step is essential for the agreement to be enforceable.

Some Other Loan Agreement State Templates

New York Promissory Note - It can help with planning by detailing future financial commitments.

When navigating the homeschooling journey, understanding the requirements for a thorough Homeschool Letter of Intent submission is vital for compliance with state regulations. This document helps ensure that parents clearly express their intent to educate their children at home, creating a foundation for a successful homeschooling experience.