Attorney-Verified Lady Bird Deed Document for Texas State

Common mistakes

-

Not including a legal description of the property: Failing to provide a precise legal description can lead to confusion or disputes over the property’s boundaries.

-

Incorrectly identifying the grantor: The grantor must be clearly identified. Mistakes in names or titles can invalidate the deed.

-

Missing the date: Omitting the date of execution can create issues regarding the timing of the transfer and the rights of the parties involved.

-

Not signing the deed: A deed must be signed by the grantor to be valid. Without a signature, the document has no legal effect.

-

Failing to notarize: A Lady Bird Deed must be notarized to be enforceable. Notarization confirms the identity of the signer and the authenticity of the document.

-

Not providing witness signatures: In Texas, having witnesses sign the deed can strengthen its validity, especially in disputes.

-

Using vague language: Ambiguity in the terms of the deed can lead to misinterpretations. Clear, precise language is essential.

-

Neglecting to record the deed: Failing to file the deed with the county clerk can result in complications regarding ownership and rights.

-

Overlooking tax implications: Not considering the tax consequences of transferring property can lead to unexpected financial burdens.

Learn More on This Form

-

What is a Lady Bird Deed?

A Lady Bird Deed, also known as an enhanced life estate deed, allows a property owner to transfer real estate to a beneficiary while retaining the right to live in and control the property during their lifetime. Upon the owner's death, the property automatically transfers to the named beneficiary without going through probate.

-

How does a Lady Bird Deed work?

With a Lady Bird Deed, the property owner retains full control over the property, including the ability to sell, mortgage, or change the beneficiary at any time. This flexibility makes it a popular choice for estate planning. When the owner passes away, the property transfers directly to the beneficiary, simplifying the transfer process.

-

What are the benefits of using a Lady Bird Deed?

There are several benefits to using a Lady Bird Deed:

- It avoids probate, which can be a lengthy and costly process.

- The property owner retains control over the property during their lifetime.

- It can help protect the property from Medicaid claims, depending on the circumstances.

- It allows for a smooth transfer of property to heirs without the need for court intervention.

-

Who can create a Lady Bird Deed?

Any individual who owns real estate in Texas can create a Lady Bird Deed. It is advisable to consult with an attorney to ensure that the deed is properly drafted and executed according to Texas law.

-

Are there any tax implications associated with a Lady Bird Deed?

Generally, a Lady Bird Deed does not trigger a gift tax because the property owner retains control during their lifetime. However, it is important to consult a tax professional to understand potential implications for estate taxes or capital gains taxes upon the transfer of property.

-

Can a Lady Bird Deed be revoked or changed?

Yes, a Lady Bird Deed can be revoked or modified at any time while the property owner is alive. The property owner simply needs to execute a new deed that clearly states the changes. This flexibility is one of the key advantages of a Lady Bird Deed.

-

Is a Lady Bird Deed valid in all states?

No, a Lady Bird Deed is specific to Texas and is not recognized in all states. Other states may have similar instruments, but the rules and effects can vary significantly. It is important to check local laws or consult an attorney if you are outside Texas.

-

What happens if the beneficiary predeceases the property owner?

If the beneficiary named in a Lady Bird Deed passes away before the property owner, the property will not automatically transfer to that beneficiary. The property owner can choose to name a new beneficiary or allow the property to pass according to their will or state intestacy laws.

-

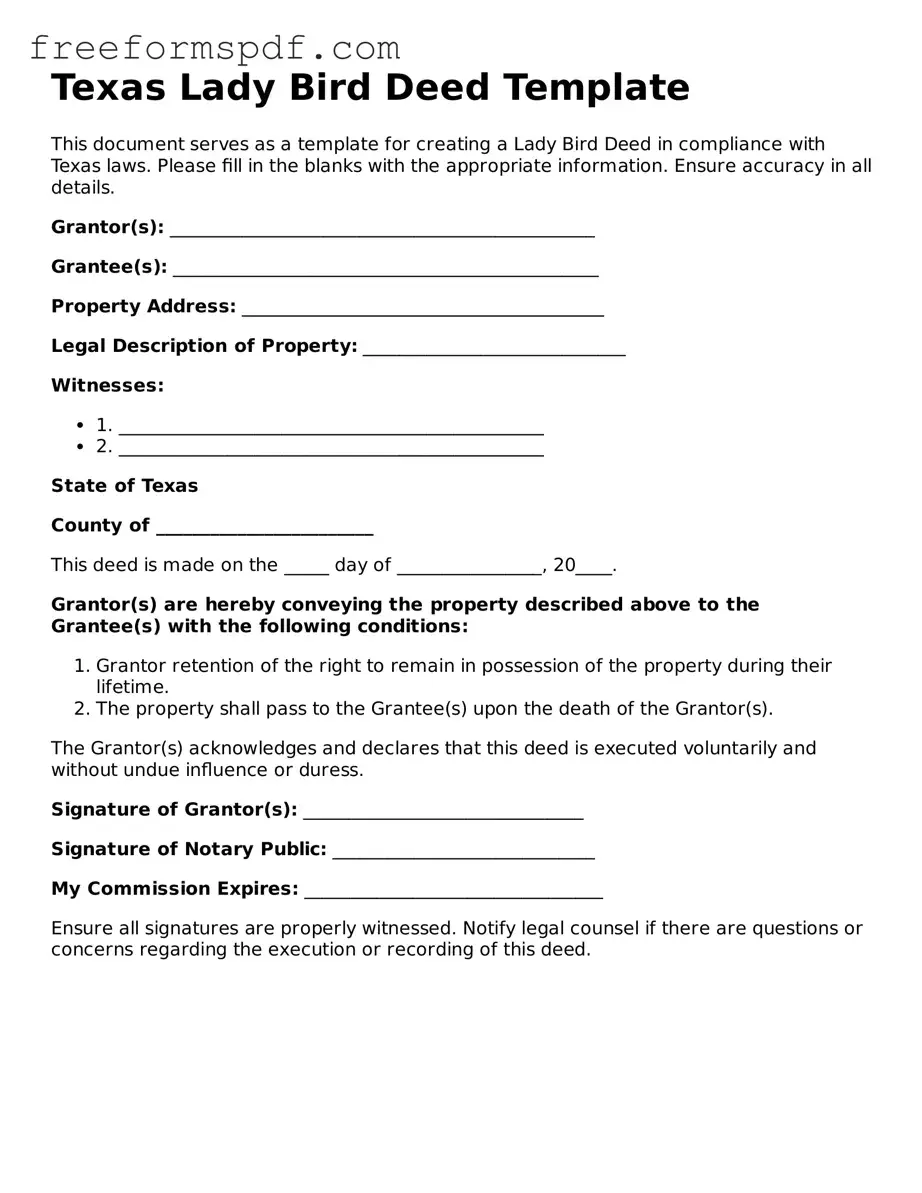

How do I create a Lady Bird Deed?

To create a Lady Bird Deed, the property owner must complete a deed form that includes specific language to establish the life estate and the remainder interest. It is recommended to work with a qualified attorney to ensure that the deed meets all legal requirements and accurately reflects the owner’s intentions.

Misconceptions

The Texas Lady Bird Deed is a useful estate planning tool, but several misconceptions surround it. Here are nine common misunderstandings:

-

It allows for the transfer of property without any restrictions.

While a Lady Bird Deed allows property to pass outside of probate, it does not eliminate all restrictions. The property must still comply with zoning laws and other regulations.

-

It is only for married couples.

This deed can be used by any property owner, regardless of marital status. Single individuals, friends, or family members can all benefit from a Lady Bird Deed.

-

It automatically avoids all taxes.

While it may help avoid probate fees, property taxes still apply. The transfer may also trigger capital gains taxes if the property appreciates significantly.

-

It is a permanent transfer of property.

The property owner retains control and can change or revoke the deed at any time during their lifetime.

-

It is only beneficial for wealthy individuals.

People of all financial backgrounds can use a Lady Bird Deed to simplify the transfer of property and avoid probate.

-

It can only be used for residential property.

Lady Bird Deeds can be applied to various types of real estate, including commercial properties and vacant land.

-

It requires a lawyer to execute.

While it’s advisable to consult a lawyer, individuals can prepare and file the deed themselves if they understand the process.

-

It is not recognized in other states.

While the Lady Bird Deed is specific to Texas, similar deeds exist in other states, allowing for comparable property transfer options.

-

It is only for elderly individuals.

Anyone planning their estate can use a Lady Bird Deed, regardless of age. It is a proactive tool for anyone who owns property.

Understanding these misconceptions can help individuals make informed decisions about their estate planning needs.