Attorney-Verified Horse Bill of Sale Document for Texas State

Common mistakes

-

Incomplete Information: Failing to fill in all required fields can lead to issues later. Ensure that both the buyer and seller provide full names, addresses, and contact information.

-

Incorrect Horse Description: Omitting details like breed, age, color, and registration number can create confusion. Be specific to avoid disputes.

-

Missing Signatures: Both parties must sign the form. Without signatures, the bill of sale is not valid.

-

Failure to Date the Document: Not including the date of the sale can complicate ownership verification. Always write the date clearly.

-

Ignoring Payment Details: Clearly state the sale price and payment method. Lack of clarity can lead to misunderstandings.

-

Not Including Health Records: If applicable, attach any health records or veterinary information. This builds trust between buyer and seller.

-

Neglecting to Keep Copies: Both parties should retain a copy of the signed bill of sale. This serves as proof of the transaction.

-

Not Consulting Local Laws: Each state may have specific requirements. Familiarize yourself with Texas laws regarding horse sales.

-

Assuming Verbal Agreements Are Enough: Relying solely on verbal agreements can lead to disputes. Always document the sale in writing.

Learn More on This Form

-

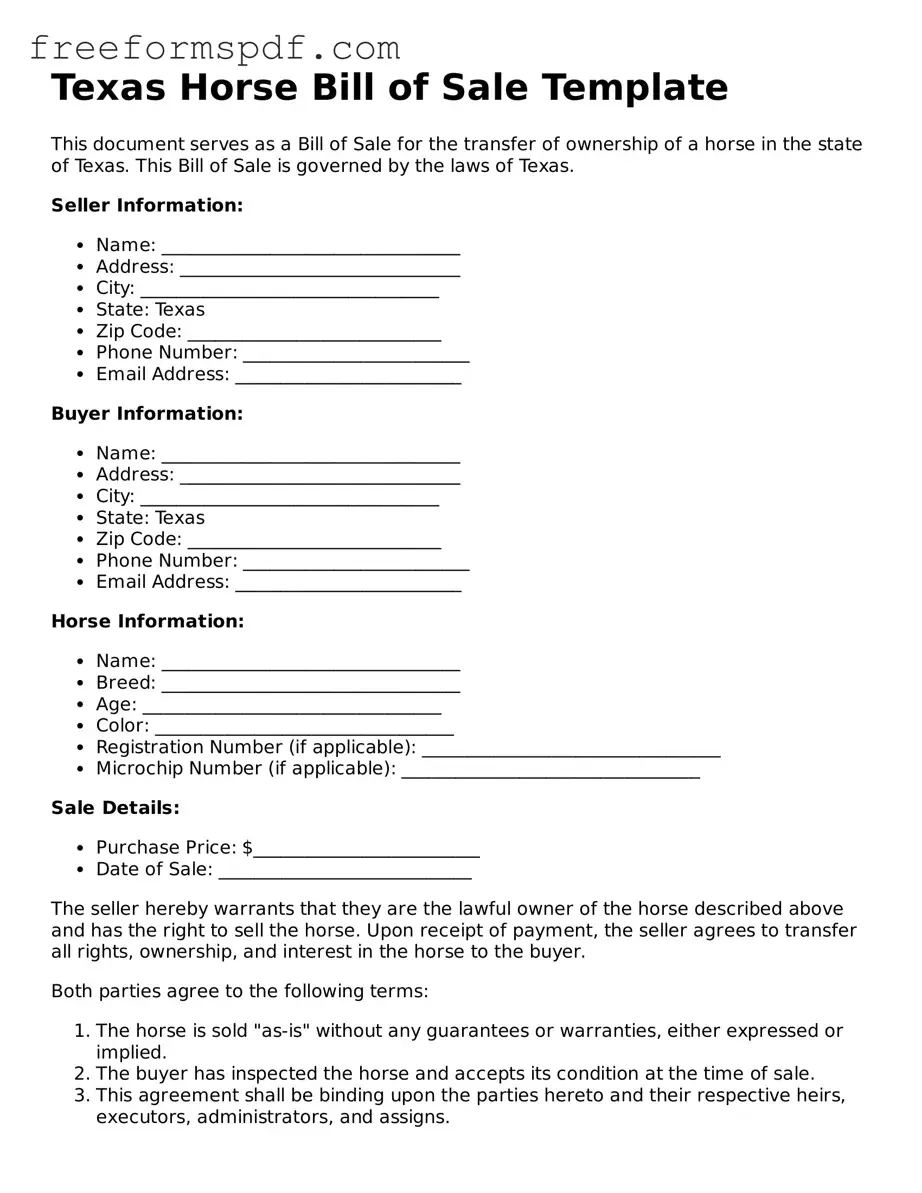

What is a Texas Horse Bill of Sale?

A Texas Horse Bill of Sale is a legal document that records the transfer of ownership of a horse from one party to another. This form provides essential details about the horse, the buyer, and the seller, ensuring that both parties have a clear understanding of the transaction.

-

Why do I need a Bill of Sale for a horse?

A Bill of Sale serves as proof of ownership and protects both the buyer and seller in the transaction. It can help resolve disputes regarding ownership and provides legal documentation in case of any future issues related to the horse.

-

What information is included in a Texas Horse Bill of Sale?

The form typically includes:

- The names and addresses of both the buyer and seller.

- A description of the horse, including its name, breed, age, color, and any identifying marks.

- The sale price.

- The date of the transaction.

- Any warranties or guarantees regarding the horse’s health or condition.

-

Is a Bill of Sale required by law in Texas?

No, a Bill of Sale is not legally required in Texas for horse transactions. However, it is highly recommended to have one to provide clarity and protect your interests.

-

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale. Just ensure that it includes all necessary details and is signed by both parties. There are also templates available online that can help you draft one.

-

What happens if the horse has health issues after the sale?

This depends on what was agreed upon in the Bill of Sale. If the seller provided warranties about the horse’s health, they may be held accountable. If no warranties were given, the buyer assumes the risk once the sale is completed.

-

Do I need to have the Bill of Sale notarized?

While notarization is not required in Texas, having the Bill of Sale notarized can add an extra layer of protection and authenticity to the document.

-

How should I store the Bill of Sale after the transaction?

Keep the Bill of Sale in a safe place. It’s advisable to have both a physical copy and a digital copy stored securely. This ensures that you can easily access it if needed in the future.

Misconceptions

When it comes to buying or selling horses in Texas, the Horse Bill of Sale form plays a crucial role. However, several misconceptions can lead to confusion. Here are five common misunderstandings about this important document:

- It is not legally required. Many people believe that a Horse Bill of Sale is optional. In reality, while it's not mandated by law, having a written agreement protects both the buyer and seller in case of disputes.

- It only needs to be signed by one party. Some think that only the seller needs to sign the form. In fact, both parties should sign it to ensure that both agree to the terms of the sale.

- It doesn’t need to include specific details. There’s a misconception that a simple note suffices. A comprehensive Bill of Sale should include details like the horse's name, registration number, and health status to avoid misunderstandings.

- It is the same as a receipt. While a receipt confirms a transaction, a Bill of Sale serves a broader purpose. It outlines the terms of the sale and can provide legal protection, making it more than just a proof of payment.

- It can’t be modified. Some believe that once the form is filled out, it’s set in stone. In reality, both parties can agree to modifications, but these changes should be documented and signed by both parties to maintain clarity.

Understanding these misconceptions can help ensure a smooth transaction when buying or selling a horse in Texas. Always prioritize clear communication and documentation to protect your interests.

Some Other Horse Bill of Sale State Templates

Horse Bill of Sale Template - Overall, it protects the rights of both parties involved in the transaction.

The New York Trailer Bill of Sale form is not only essential for documenting a sale but also plays a key role in clarifying the ownership transfer. For those interested in creating their own document, a useful resource can be found at https://newyorkform.com/free-trailer-bill-of-sale-template, which provides a free template to facilitate the process.