Attorney-Verified Golf Cart Bill of Sale Document for Texas State

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to issues later. Ensure that all sections, including buyer and seller details, are fully completed.

-

Incorrect Vehicle Identification: Providing the wrong identification number for the golf cart can create legal complications. Double-check the Vehicle Identification Number (VIN) and other identifying information.

-

Missing Signatures: Both the buyer and seller must sign the form. Omitting one or both signatures can invalidate the sale.

-

Not Keeping Copies: Failing to make copies of the completed Bill of Sale can lead to disputes. Both parties should retain a copy for their records.

Learn More on This Form

-

What is a Texas Golf Cart Bill of Sale?

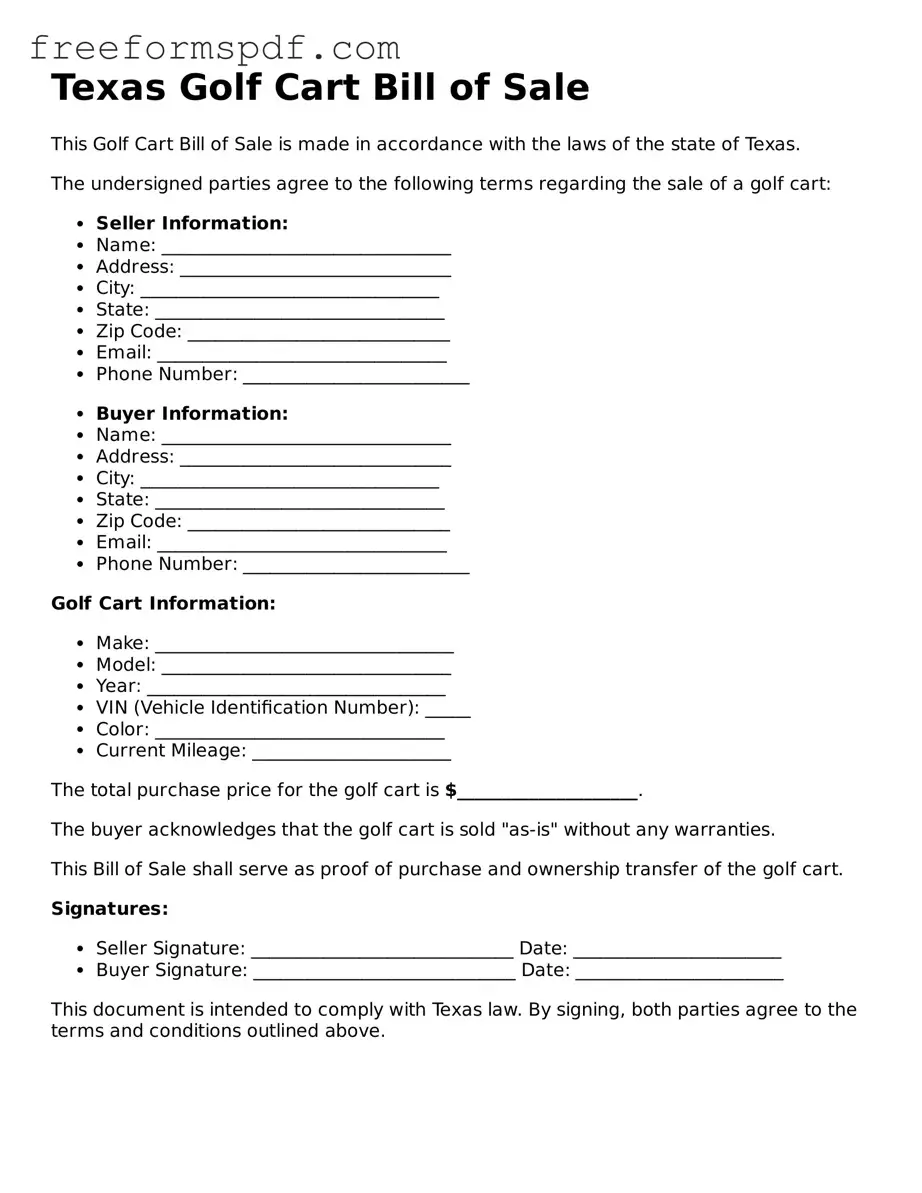

A Texas Golf Cart Bill of Sale is a legal document that records the sale and transfer of ownership of a golf cart in Texas. This form provides essential information about the buyer, seller, and the golf cart itself, ensuring that both parties have a clear understanding of the transaction.

-

Is a Bill of Sale required for a golf cart in Texas?

While a Bill of Sale is not legally required for every golf cart transaction in Texas, it is highly recommended. This document serves as proof of ownership and can protect both the buyer and seller in case of disputes. It can also be useful when registering the golf cart with local authorities.

-

What information should be included in the Bill of Sale?

A complete Texas Golf Cart Bill of Sale should include:

- The names and addresses of both the buyer and seller

- The date of the sale

- A detailed description of the golf cart, including make, model, year, and Vehicle Identification Number (VIN)

- The sale price

- Any warranties or guarantees, if applicable

-

How do I fill out a Golf Cart Bill of Sale?

To fill out a Golf Cart Bill of Sale, start by entering the names and addresses of the buyer and seller. Next, provide the date of the transaction. Describe the golf cart in detail, including its make, model, year, and VIN. Finally, state the sale price and any conditions of the sale. Both parties should sign and date the document to finalize the transaction.

-

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale for a golf cart. As long as it includes all the necessary information and is signed by both parties, it is valid. However, using a template or a standard form can help ensure that you don’t miss any important details.

-

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should keep a copy for their records. If the golf cart is being registered, the buyer may need to present the Bill of Sale to the local Department of Motor Vehicles (DMV) or other relevant authorities to complete the registration process.

Misconceptions

Many individuals have misconceptions about the Texas Golf Cart Bill of Sale form. Understanding these misconceptions can help ensure a smooth transaction when buying or selling a golf cart. Here are nine common misunderstandings:

- Misconception 1: A Bill of Sale is not necessary for golf cart transactions.

- Misconception 2: The Bill of Sale must be notarized.

- Misconception 3: The form is only for new golf carts.

- Misconception 4: You cannot customize the Bill of Sale.

- Misconception 5: The seller must provide a warranty.

- Misconception 6: Only licensed dealers can sell golf carts.

- Misconception 7: The Bill of Sale is not needed for registration.

- Misconception 8: There is a specific format mandated by the state.

- Misconception 9: The Bill of Sale is only for financial transactions.

Some people believe that a Bill of Sale is optional. In Texas, a Bill of Sale serves as a legal record of the transaction, providing protection for both the buyer and the seller.

While notarization can add an extra layer of authenticity, it is not a requirement for the Texas Golf Cart Bill of Sale. A simple signed document suffices.

This is incorrect. The Bill of Sale can be used for both new and used golf carts, making it versatile for all types of transactions.

While there is a standard format, buyers and sellers can customize the Bill of Sale to include specific details about the transaction, such as payment terms or warranties.

Warranties are not mandated by law. If the seller wishes to offer a warranty, they can do so, but it is not a legal requirement.

Any individual can sell their golf cart privately without needing a dealer's license, as long as they follow the necessary legal procedures.

A Bill of Sale is often required for registering a golf cart, especially if the buyer plans to use it on public roads. It proves ownership and facilitates the registration process.

Texas does not impose a specific format for the Bill of Sale. As long as it contains essential information, it is valid.

The Bill of Sale serves multiple purposes, including documenting the transfer of ownership and providing a record of the agreement between the parties involved.

By clarifying these misconceptions, individuals can approach the buying or selling of golf carts in Texas with greater confidence and understanding.