Attorney-Verified Gift Deed Document for Texas State

Common mistakes

-

Not Including the Full Legal Description of the Property: One common mistake is failing to provide a complete legal description of the property being gifted. This description should include details like the lot number, block number, and subdivision name. Without this, the deed may be considered incomplete.

-

Incorrectly Identifying the Grantor and Grantee: It's crucial to accurately identify both the person giving the gift (the grantor) and the person receiving it (the grantee). Mistakes in names or failing to include middle initials can lead to confusion and legal issues.

-

Not Signing the Deed: A gift deed must be signed by the grantor. Forgetting to sign the document is a frequent oversight that can render the deed invalid. Additionally, if the grantee is required to sign, this must not be overlooked.

-

Failing to Have the Document Notarized: In Texas, a gift deed typically needs to be notarized to be legally binding. Skipping this step can lead to complications in the future, especially if the deed is challenged.

-

Omitting the Date of the Gift: The date when the gift is made should be clearly stated. Not including this information can create ambiguity regarding when ownership was transferred.

-

Not Understanding Tax Implications: Many people overlook the potential tax consequences of gifting property. It’s essential to be aware of any gift tax liabilities that may arise from the transfer, which could impact both the giver and the receiver.

-

Neglecting to Record the Deed: After completing the gift deed, it’s important to record it with the county clerk’s office. Failing to do this can result in problems with proving ownership in the future.

Learn More on This Form

-

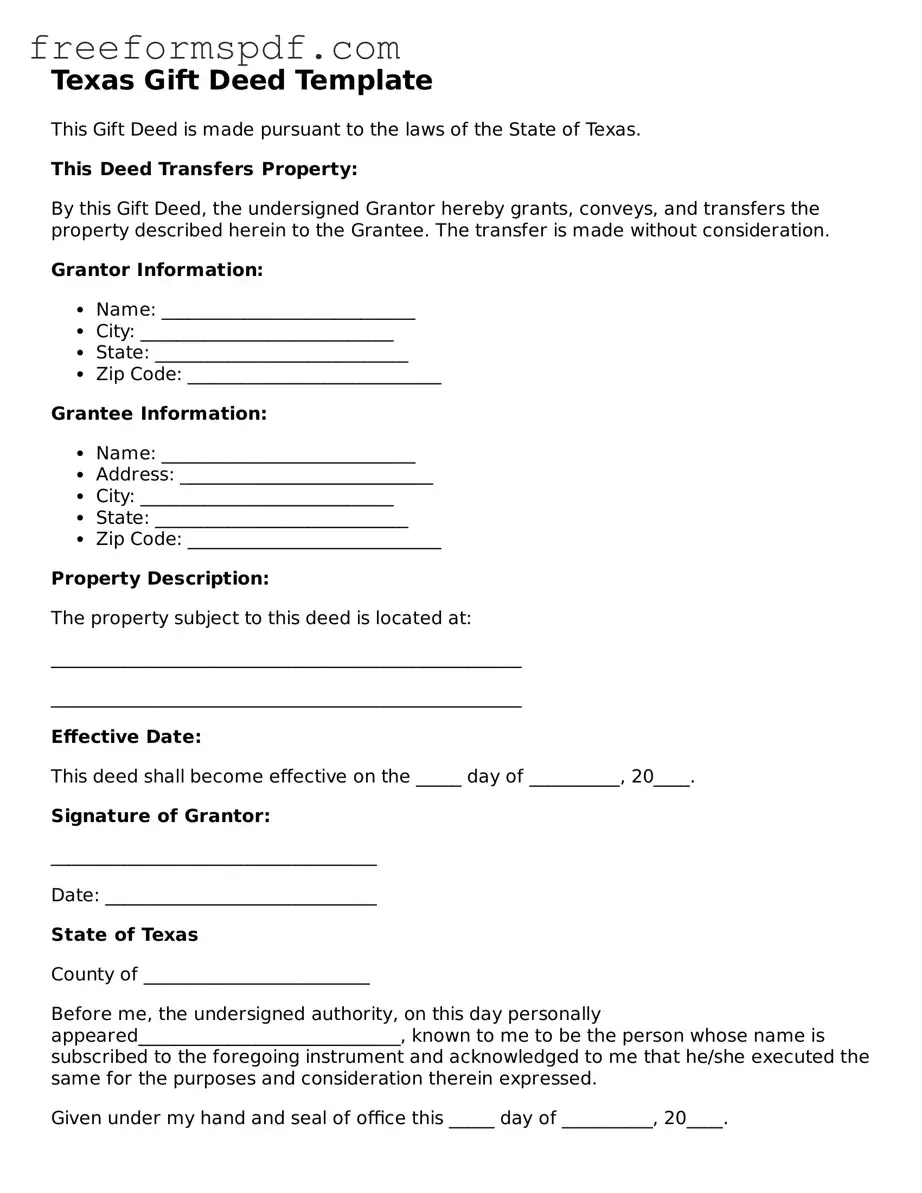

What is a Texas Gift Deed?

A Texas Gift Deed is a legal document used to transfer ownership of real property from one individual to another as a gift, without any exchange of money. This deed serves to formalize the transfer and provide a record of the gift in public property records.

-

Who can create a Gift Deed in Texas?

Any property owner in Texas can create a Gift Deed. The individual giving the gift is known as the "grantor," while the recipient is referred to as the "grantee." Both parties must be legally competent to enter into the agreement.

-

Are there any tax implications associated with a Gift Deed?

Yes, there may be tax implications. The IRS allows individuals to gift up to a certain amount each year without incurring gift tax. As of 2023, the annual exclusion is $17,000 per recipient. Gifts exceeding this amount may require the filing of a gift tax return. Consulting a tax professional is advisable for specific situations.

-

What information is required in a Texas Gift Deed?

A Texas Gift Deed typically includes the following information:

- The names and addresses of the grantor and grantee

- A legal description of the property being transferred

- A statement indicating that the transfer is a gift

- The date of the transfer

- The signatures of the grantor and a notary public

-

Do I need to have the Gift Deed notarized?

Yes, the Gift Deed must be notarized to be legally binding. This ensures that the identities of the parties are verified and that the deed is executed properly.

-

How is a Gift Deed filed in Texas?

After the Gift Deed is completed and notarized, it must be filed with the county clerk's office in the county where the property is located. Filing fees may apply, and it is important to keep a copy for personal records.

-

Can a Gift Deed be revoked?

Once a Gift Deed is executed and recorded, it generally cannot be revoked. However, if the grantor wishes to reclaim the property, they may need to pursue legal action, depending on the circumstances. It is advisable to consult with a legal professional for guidance.

-

Is a Gift Deed the same as a Will?

No, a Gift Deed is not the same as a Will. A Gift Deed transfers ownership of property during the grantor's lifetime, while a Will distributes assets after the grantor's death. Each serves different purposes and has distinct legal implications.

Misconceptions

Understanding the Texas Gift Deed form is essential for anyone considering transferring property as a gift. However, several misconceptions can lead to confusion. Here are nine common misunderstandings:

- Gift Deeds are only for family members. Many believe that a gift deed can only be used to transfer property to family. In reality, anyone can give a gift deed to any person, regardless of their relationship.

- Gift Deeds require compensation. Some people think that a gift deed must involve some form of payment. This is incorrect; a gift deed is intended for a transfer without any compensation.

- All gifts of property must be recorded. While it’s advisable to record a gift deed to protect the interests of both parties, it is not legally required. However, not recording may lead to disputes in the future.

- A gift deed can be revoked at any time. Once a gift deed is executed and delivered, it generally cannot be revoked. This is a key aspect of the legal transfer of property.

- Gift Deeds are the same as wills. A gift deed is a present transfer of property, while a will only transfers property after the person has passed away. They serve different purposes.

- Gift Deeds are only for real estate. Many assume that gift deeds apply solely to real estate. However, they can also be used for personal property, such as vehicles or valuable items.

- There are no tax implications with a gift deed. It’s a common misconception that gifting property incurs no tax consequences. In some cases, the giver may be subject to gift tax, depending on the value of the property.

- All gift deeds are the same. Not all gift deeds follow the same format or requirements. Specific details may vary based on individual circumstances and local laws.

- Legal advice is unnecessary for a gift deed. Some believe that they can create a gift deed without legal assistance. While it is possible, consulting with a legal professional can help ensure that the deed is valid and meets all necessary requirements.

Being aware of these misconceptions can help individuals make informed decisions when considering a gift deed in Texas.

Some Other Gift Deed State Templates

Gift Deed Virginia - A Gift Deed is a legal document used to transfer ownership of property without any exchange of money.

Understanding the requirements of the New York MV51 form is crucial for anyone involved in the sale or transfer of older vehicles. This form not only facilitates legal ownership transfer but also ensures that all sales are properly documented. For those looking to navigate this process efficiently, resources like NY Templates can provide valuable templates and guidance.