Attorney-Verified Deed Document for Texas State

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a complete and accurate description of the property. The description should include the legal description, which often consists of lot numbers, block numbers, and subdivision names. Without this, the deed may not be valid.

-

Missing Signatures: It's essential to have the appropriate parties sign the deed. If a signature is missing, the document may not be enforceable. All grantors (sellers) must sign, and in some cases, witnesses may also be required.

-

Improper Notarization: Deeds typically need to be notarized. Failing to have the document properly notarized can lead to issues down the line. Notaries confirm the identities of the signers and witness the signing, which adds an extra layer of authenticity.

-

Omitting the Consideration Amount: The deed should state the consideration amount, which is the price paid for the property. Leaving this blank or writing “for love and affection” can create confusion and may not meet legal requirements.

Learn More on This Form

-

What is a Texas Deed form?

A Texas Deed form is a legal document used to transfer ownership of real property in Texas. It outlines the details of the transaction, including the names of the parties involved, a description of the property, and any conditions of the transfer.

-

What types of deeds are available in Texas?

Texas recognizes several types of deeds, including:

- General Warranty Deed: Offers the highest level of protection to the buyer, guaranteeing that the seller has clear title to the property.

- Special Warranty Deed: Similar to a general warranty deed but only covers the time the seller owned the property.

- Quitclaim Deed: Transfers whatever interest the seller has in the property, with no guarantees about the title.

- Deed of Trust: Used in financing transactions, it secures a loan with the property as collateral.

-

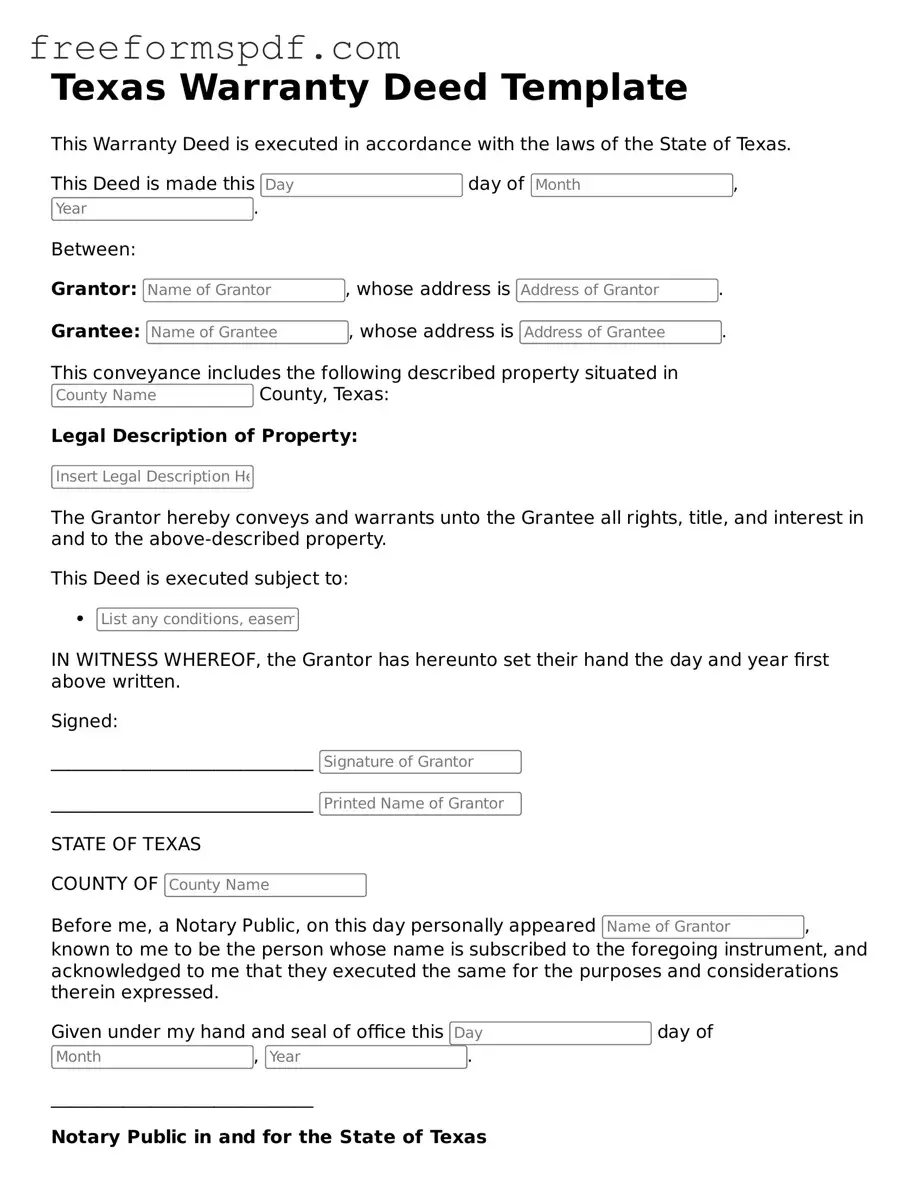

How do I fill out a Texas Deed form?

To fill out a Texas Deed form, include the following information:

- The names and addresses of the grantor (seller) and grantee (buyer).

- A legal description of the property, which can often be found on the property tax statement or previous deed.

- The date of the transaction.

- Any specific conditions or restrictions related to the transfer.

-

Do I need a lawyer to create a Texas Deed?

While it is not legally required to hire a lawyer to create a Texas Deed, it is advisable. A lawyer can ensure that the deed is filled out correctly and complies with Texas law, which helps avoid future disputes.

-

Where do I file a Texas Deed?

A Texas Deed must be filed with the county clerk's office in the county where the property is located. This filing makes the transfer public and protects the grantee's ownership rights.

-

Is there a fee to file a Texas Deed?

Yes, there is typically a filing fee associated with recording a Texas Deed. Fees vary by county, so it is important to check with the local county clerk’s office for the exact amount.

-

What happens after I file the Texas Deed?

Once the Texas Deed is filed, it becomes a matter of public record. The grantee will receive a copy of the recorded deed, which serves as proof of ownership. This record protects the grantee’s interest in the property.

-

Can a Texas Deed be revoked?

A Texas Deed cannot be unilaterally revoked once it has been executed and recorded. However, if both parties agree, they can execute a new deed to reverse the transaction.

-

What should I do if there is a mistake on the Texas Deed?

If a mistake is found on the Texas Deed, it is important to correct it as soon as possible. This can often be done by filing a corrective deed with the same county clerk’s office where the original deed was recorded.

Misconceptions

Understanding the Texas Deed form can be challenging due to various misconceptions. Here are nine common misunderstandings, clarified for your benefit.

-

All deeds are the same.

Not all deeds serve the same purpose. Different types of deeds, such as warranty deeds and quitclaim deeds, have distinct functions and implications for property ownership.

-

A deed must be notarized to be valid.

While notarization is common and often recommended, it is not strictly required for all types of deeds in Texas. Some deeds may be valid without a notary, depending on specific circumstances.

-

Deeds are only needed for selling property.

Deeds are also necessary for transferring property ownership through gifts, inheritance, or other arrangements, not just sales.

-

Once a deed is signed, it cannot be changed.

Deeds can be modified or revoked, but doing so requires specific legal procedures to ensure the changes are valid and enforceable.

-

All property transfers require a lawyer.

While having legal assistance can be beneficial, it is not mandatory for every property transfer. Many individuals handle simple transactions independently.

-

The Texas Deed form is the same for all counties.

While the basic format may be similar, some counties have specific requirements or additional forms that must be included with the deed.

-

A deed must be recorded to be valid.

A deed can be valid without being recorded, but recording it provides public notice and protects the owner's rights against future claims.

-

Only the buyer needs to sign the deed.

In most cases, both the seller and the buyer must sign the deed for it to be legally binding and effective.

-

All deeds are permanent and cannot be undone.

While deeds are generally permanent, there are legal processes available, such as a court order, that can reverse a deed under certain conditions.

By understanding these misconceptions, you can navigate the Texas Deed form with greater confidence and clarity.

Some Other Deed State Templates

Clark County Register of Deeds - There’s usually a fee associated with recording the Deed in public records.

Filling out the Nyc Apartment Registration Form correctly is not only a legal requirement but also an opportunity for landlords and property managers to present their properties effectively. By utilizing resources such as NY Templates, one can ensure that all necessary details are accurately captured, which is vital for meeting housing regulations and fostering trust with potential renters.

What Does a House Deed Look Like in Pa - Often the foundation of real estate law.

Virginia Property Deed - Properly executed deeds protect against future legal claims on the property.

Oregon Warranty Deed Form - Executing a Deed signifies the conclusion of an agreement between the parties.