Attorney-Verified Deed in Lieu of Foreclosure Document for Texas State

Common mistakes

-

Inaccurate Property Description: One common mistake is failing to provide a precise and complete description of the property. This includes not specifying the exact address, legal description, or parcel number. A vague description can lead to confusion and potential disputes later on.

-

Improper Signatures: Another frequent error is neglecting to ensure that all necessary parties sign the document. In Texas, both the borrower and the lender must sign the deed. If any required signatures are missing, the deed may not be legally binding.

-

Not Including Necessary Documentation: People often forget to attach required documents, such as a copy of the mortgage or a statement of the loan balance. These documents provide context and support for the deed, making it essential to include them.

-

Failure to Understand Tax Implications: Many individuals overlook the potential tax consequences of signing a deed in lieu of foreclosure. It is crucial to consult with a tax advisor to understand how this action may affect one’s tax situation, especially regarding cancellation of debt income.

Learn More on This Form

-

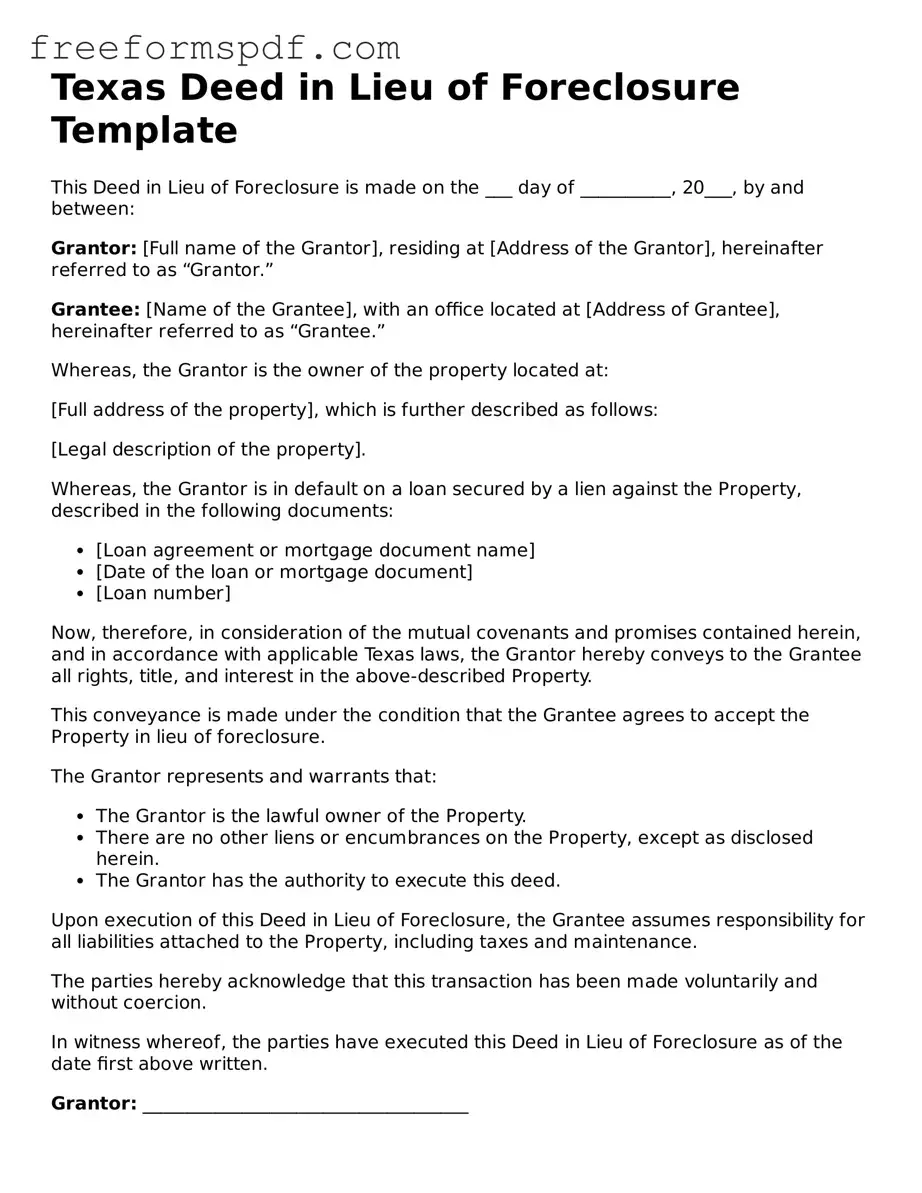

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This process allows the homeowner to relinquish their property and, in some cases, negotiate more favorable terms to settle their mortgage debt.

-

Who is eligible for a Deed in Lieu of Foreclosure?

Homeowners facing financial difficulties and unable to keep up with mortgage payments may qualify. Lenders typically require that the homeowner is in default or at risk of defaulting on their mortgage. Eligibility can vary by lender, so it is essential to discuss your specific situation with them.

-

What are the benefits of a Deed in Lieu of Foreclosure?

- It can help avoid the lengthy foreclosure process.

- It may minimize damage to the homeowner's credit score compared to a foreclosure.

- The homeowner may be able to negotiate the release from any remaining mortgage debt.

- It allows for a smoother transition out of the property.

-

Are there any drawbacks to consider?

Yes, there are potential drawbacks. A Deed in Lieu of Foreclosure may still impact your credit score, although typically less severely than a foreclosure. Additionally, not all lenders will agree to this option, and homeowners may lose any equity they have built up in the property.

-

What is the process for obtaining a Deed in Lieu of Foreclosure?

The process generally involves contacting your lender to express your interest in a Deed in Lieu of Foreclosure. You will need to provide documentation of your financial situation. If the lender agrees, you will sign the deed, and they will take ownership of the property.

-

Can I negotiate terms with my lender?

Yes, homeowners can often negotiate terms with their lender. This may include discussing the possibility of a cash incentive to leave the property or negotiating the release from any remaining debt. Open communication with the lender is key to achieving a favorable outcome.

-

What should I do after signing a Deed in Lieu of Foreclosure?

After signing, it is important to keep copies of all documents for your records. You should also confirm with the lender that the mortgage has been settled. Lastly, consider consulting a financial advisor to discuss your next steps and how to rebuild your credit.

Misconceptions

Understanding the Texas Deed in Lieu of Foreclosure can help homeowners navigate difficult financial situations. However, several misconceptions often arise regarding this legal process. Below are nine common misconceptions explained.

-

It eliminates all debts associated with the mortgage.

A deed in lieu of foreclosure does not automatically discharge all debts. If there are other liens on the property, such as second mortgages or tax liens, those obligations may still remain.

-

It is a quick and easy solution.

While a deed in lieu can be faster than foreclosure, it still involves a lengthy process. Homeowners must negotiate with their lender, which can take time and require extensive documentation.

-

It guarantees a favorable credit outcome.

A deed in lieu of foreclosure will still impact a homeowner's credit score. While it may be less damaging than a foreclosure, it will still appear on a credit report and can affect future borrowing.

-

Homeowners can stay in the property until the lender takes action.

Once a deed in lieu is executed, the homeowner typically must vacate the property. The lender will provide a timeline for moving out, and failure to comply can lead to further legal action.

-

It is only available for primary residences.

A deed in lieu of foreclosure can apply to any property type, including investment properties and vacation homes. However, lenders may have different policies regarding these types of properties.

-

All lenders accept deeds in lieu of foreclosure.

Not all lenders will agree to a deed in lieu. Some may prefer to pursue foreclosure, especially if the property value is significantly less than the outstanding mortgage balance.

-

It absolves homeowners from liability for the mortgage.

Homeowners may still be liable for any deficiency if the property's sale does not cover the mortgage balance. This means they could still owe money to the lender after the deed is executed.

-

It is the same as a short sale.

A deed in lieu of foreclosure is not the same as a short sale. In a short sale, the lender agrees to accept less than the amount owed on the mortgage, while a deed in lieu transfers ownership back to the lender without a sale.

-

Homeowners cannot negotiate terms.

Homeowners can negotiate terms with their lender. This may include asking for a waiver of deficiency or other concessions. Engaging with the lender can lead to a more favorable outcome.

By addressing these misconceptions, homeowners can make more informed decisions regarding their financial situations and the potential use of a deed in lieu of foreclosure.

Some Other Deed in Lieu of Foreclosure State Templates

Deed in Lieu of Foreclosure Ny - A Deed in Lieu may not be suitable for all homeowners facing foreclosure.

A New York Non-disclosure Agreement (NDA) is a legal document designed to protect sensitive information shared between parties. By signing this agreement, individuals or businesses commit to keeping specific details confidential, ensuring that proprietary information remains secure. Understanding the nuances of this form is essential for anyone looking to safeguard their intellectual property or trade secrets. For further assistance, you can refer to the NY Templates.