Attorney-Verified Bill of Sale Document for Texas State

Common mistakes

-

Incomplete Information: One common mistake is failing to fill out all required fields. Ensure that both the buyer's and seller's names, addresses, and contact information are provided. Leaving out any details can lead to confusion later.

-

Incorrect Item Description: Accurately describing the item being sold is crucial. Many people either omit important details or provide vague descriptions. Include specifics like make, model, year, and condition to avoid disputes.

-

Not Including the Sale Price: It’s essential to clearly state the sale price of the item. Omitting this information can lead to misunderstandings regarding the transaction's value.

-

Failure to Sign: Both the buyer and seller must sign the document for it to be valid. Sometimes, individuals forget this step, which can invalidate the agreement.

-

Not Notarizing the Document: While not always required, notarizing the Bill of Sale can add an extra layer of protection. Many overlook this step, which could help in case of future disputes.

-

Using Inaccurate Dates: Providing the wrong date of the transaction can create confusion. Always double-check to ensure the date reflects when the sale actually occurred.

-

Ignoring Local Laws: Different areas may have specific requirements for a Bill of Sale. Failing to check local regulations can lead to an invalid document.

-

Not Keeping Copies: After completing the Bill of Sale, it’s important to keep copies for both the buyer and seller. Many people neglect this step, which can lead to issues if questions arise later.

Learn More on This Form

-

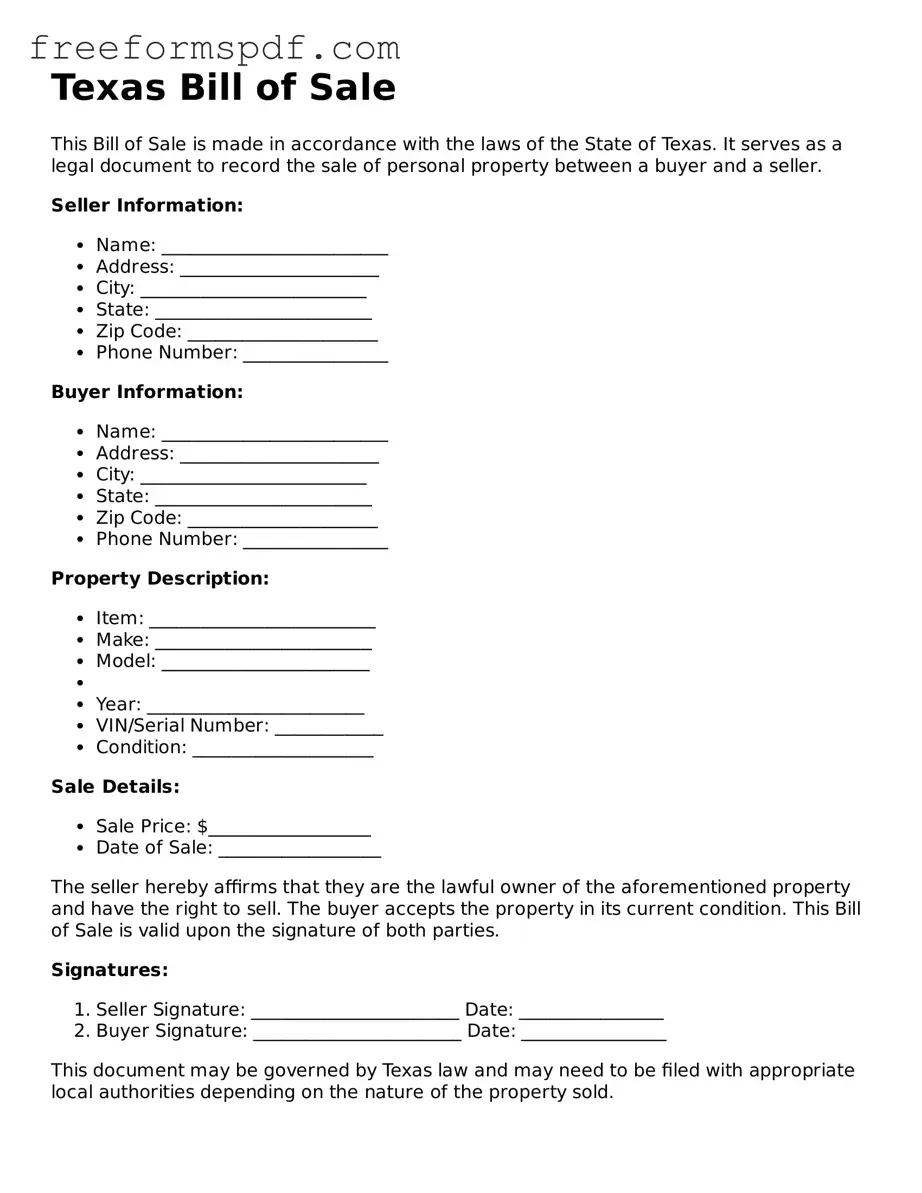

What is a Texas Bill of Sale?

A Texas Bill of Sale is a legal document that serves as proof of a transaction between a buyer and a seller. It details the sale of personal property, such as vehicles, boats, or equipment, and includes important information about the items being sold, the parties involved, and the terms of the sale.

-

When do I need a Bill of Sale in Texas?

You typically need a Bill of Sale when transferring ownership of personal property. While it is not always required by law, having one can protect both the buyer and seller by providing clear documentation of the transaction. This is especially important for high-value items like vehicles, where registration and title transfer are necessary.

-

What information should be included in a Texas Bill of Sale?

A comprehensive Bill of Sale should include:

- The full names and addresses of both the buyer and seller.

- A detailed description of the item being sold, including make, model, year, and VIN for vehicles.

- The sale price and payment method.

- The date of the transaction.

- Any warranties or guarantees, if applicable.

-

Is a Bill of Sale required for vehicle sales in Texas?

While a Bill of Sale is not legally required to sell a vehicle in Texas, it is highly recommended. It provides a record of the transaction and can be useful for tax purposes or if any disputes arise later. Additionally, the Texas Department of Motor Vehicles (DMV) requires a Bill of Sale for certain transactions, especially if the vehicle is being registered in a new owner’s name.

-

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale. There are many templates available online that you can customize to fit your needs. Just ensure that you include all necessary information to make the document valid and enforceable.

-

Do I need to have the Bill of Sale notarized?

Notarization is not a requirement for a Bill of Sale in Texas. However, having it notarized can add an extra layer of authenticity and may be beneficial if there are disputes in the future. It’s a good practice to have both parties sign the document in the presence of a notary.

-

What if I lose my Bill of Sale?

If you lose your Bill of Sale, it may be challenging to prove ownership of the item sold. If you are the seller, you may want to keep a copy for your records. If you are the buyer, you can request a copy from the seller. If that’s not possible, you may need to create a new Bill of Sale that both parties can sign again.

-

Can a Bill of Sale be used for gifts?

Yes, a Bill of Sale can also be used for gifts, especially if the item is of significant value. In such cases, it should clearly state that the item is being given as a gift and include any relevant details. This documentation can help clarify ownership and avoid potential disputes in the future.

Misconceptions

Understanding the Texas Bill of Sale form can be challenging due to various misconceptions that often arise. Here are four common misunderstandings:

-

A Bill of Sale is only necessary for vehicle transactions.

This belief is inaccurate. While many people associate a Bill of Sale primarily with the sale of vehicles, it is also applicable to numerous other transactions. This includes the sale of personal property, such as furniture, electronics, and even livestock. In Texas, a Bill of Sale can serve as a record for any transfer of ownership.

-

A Bill of Sale must be notarized to be valid.

While notarization can add an extra layer of authenticity, it is not a legal requirement for a Bill of Sale in Texas. The form is valid as long as it is signed by both the buyer and the seller. However, having it notarized may help in resolving disputes in the future.

-

A Bill of Sale protects the seller from all liability.

This misconception can lead to misunderstandings about liability. A Bill of Sale does provide some level of protection for the seller, particularly regarding the transfer of ownership. However, it does not completely absolve the seller from all potential liabilities, especially if there are undisclosed defects or issues with the item sold.

-

The Texas Bill of Sale form is a one-size-fits-all document.

This is misleading. While there are standard templates available, the specifics of each transaction can vary significantly. It is important for both parties to customize the Bill of Sale to accurately reflect the details of the sale, including the item description, sale price, and any terms or conditions.

Some Other Bill of Sale State Templates

Does a Bill of Sale Have to Be Notarized in Virginia - A Bill of Sale is often required for registering vehicles or transferring titles in many states.

To ensure a smooth incorporation process, you can conveniently access the necessary documents online, such as the California Articles of Incorporation form, which you can find at Fill PDF Forms. Completing this form accurately is essential to avoid any potential delays in establishing your corporation.

Vehicle Bill of Sale Template - Parties involved in the sale can include individuals, businesses, or organizations.

Nys Dmv Bill of Sale - It can cover transactions involving antiques and collectibles as well.