Attorney-Verified Articles of Incorporation Document for Texas State

Common mistakes

-

Incorrect Business Name: Failing to ensure the business name is unique and not already in use by another entity in Texas can lead to rejection of the application.

-

Missing Registered Agent Information: Omitting the name and address of the registered agent can result in delays or denial. The registered agent must be a Texas resident or a business entity authorized to do business in Texas.

-

Improper Purpose Statement: Writing a vague or overly broad purpose statement can cause confusion. Clearly define the business activities to avoid issues.

-

Failure to Include Initial Directors: Not listing the initial directors of the corporation can lead to complications. Include their names and addresses to ensure compliance.

-

Inaccurate Duration: Specifying an incorrect duration for the corporation can create problems. If it’s intended to exist perpetually, state that clearly.

-

Neglecting to Sign the Form: Forgetting to sign the Articles of Incorporation will result in rejection. Ensure that the form is signed by the incorporator.

-

Insufficient Filing Fee: Submitting the wrong filing fee can delay processing. Verify the current fee schedule and include the correct amount.

-

Not Providing Contact Information: Failing to include a contact number or email can hinder communication with the state. Make sure to provide accurate contact details.

-

Ignoring State-Specific Requirements: Overlooking specific Texas requirements can lead to issues. Familiarize yourself with all state regulations before submission.

Learn More on This Form

-

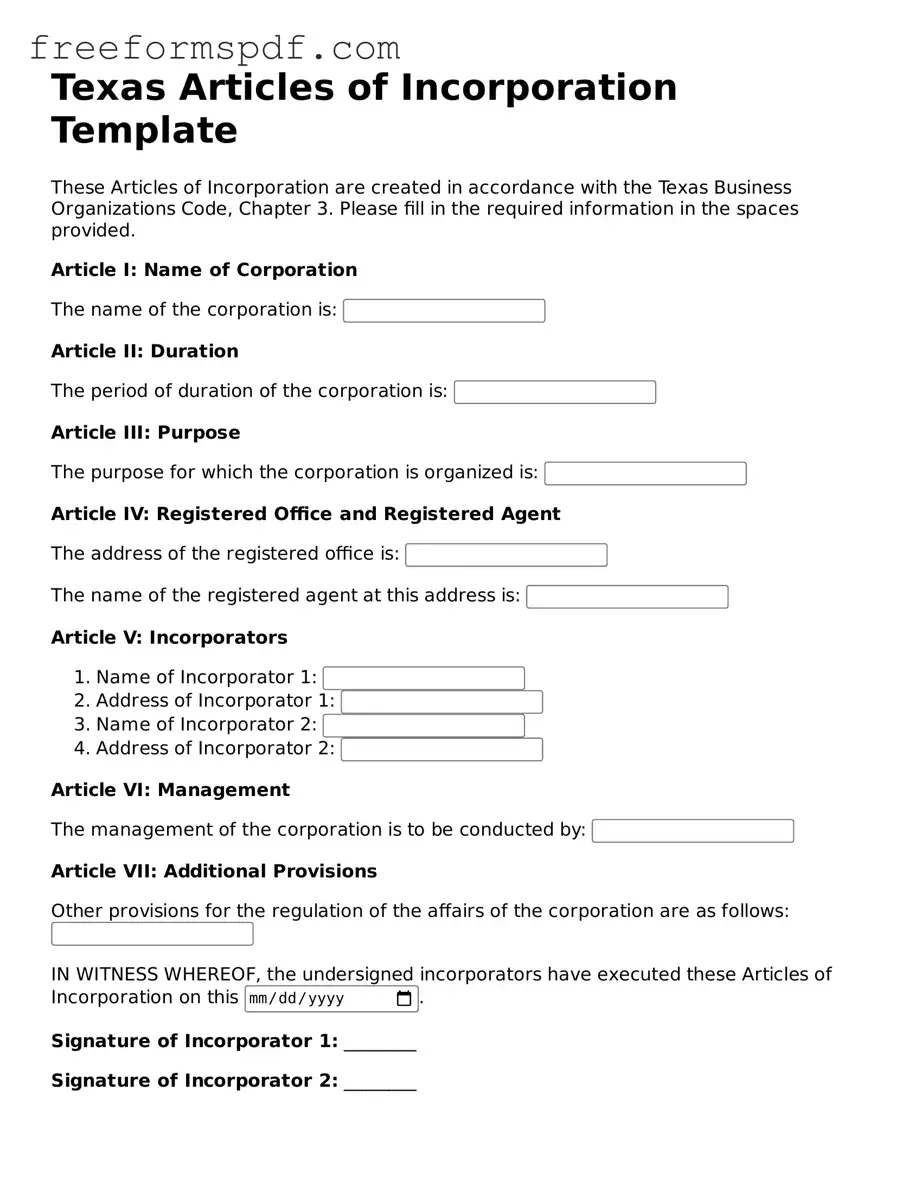

What are the Texas Articles of Incorporation?

The Texas Articles of Incorporation is a legal document required to establish a corporation in the state of Texas. This form outlines essential information about the corporation, such as its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this document with the Texas Secretary of State is a crucial step in the process of forming a corporation.

-

What information is needed to complete the Articles of Incorporation?

To fill out the Articles of Incorporation, you will need to provide several key pieces of information:

- The proposed name of the corporation, which must be unique and not already in use.

- The purpose of the corporation, which can be a general business purpose or a more specific one.

- The name and address of the registered agent, who will receive legal documents on behalf of the corporation.

- The number of shares the corporation is authorized to issue, along with any classes of shares if applicable.

- The names and addresses of the initial directors of the corporation.

-

How do I file the Articles of Incorporation in Texas?

Filing the Articles of Incorporation can be done online or by mail. If you choose to file online, you can visit the Texas Secretary of State's website and complete the form electronically. Alternatively, you can download a paper form, fill it out, and mail it to the appropriate address. Be sure to include the required filing fee, which can vary depending on the type of corporation you are forming.

-

What is the filing fee for the Texas Articles of Incorporation?

The filing fee for the Texas Articles of Incorporation typically ranges from $300 to $750, depending on the type of corporation being formed. For example, a for-profit corporation generally has a higher fee compared to a nonprofit corporation. It is important to check the Texas Secretary of State’s website for the most current fee schedule before submitting your application.

-

How long does it take to process the Articles of Incorporation?

The processing time for the Articles of Incorporation can vary. Typically, online submissions are processed faster than paper submissions. You can expect a turnaround time of about 3 to 5 business days for online filings, while paper filings may take longer, possibly up to 2 weeks. If expedited service is needed, there may be additional fees available for quicker processing.

Misconceptions

Misconceptions about the Texas Articles of Incorporation form can lead to confusion for individuals and businesses looking to establish a corporation. Below are five common misconceptions explained.

- Misconception 1: The Articles of Incorporation must be filed in person.

- Misconception 2: Only large businesses need to file Articles of Incorporation.

- Misconception 3: The form requires extensive legal knowledge to complete.

- Misconception 4: Filing the Articles of Incorporation guarantees approval for the corporation.

- Misconception 5: Once filed, the Articles of Incorporation cannot be amended.

This is not true. The Texas Articles of Incorporation can be submitted online, by mail, or in person. Many choose to file online for convenience.

This is incorrect. Any business entity, regardless of size, that wishes to operate as a corporation in Texas must file Articles of Incorporation.

While some sections may require careful attention, the form is designed to be user-friendly. Many individuals can complete it without legal assistance.

This is a misunderstanding. While filing is a necessary step, approval depends on meeting all legal requirements and regulations set forth by the state.

This is not accurate. The Articles of Incorporation can be amended after filing, provided the proper procedures are followed and the amendments are documented appropriately.

Some Other Articles of Incorporation State Templates

Oregon Incorporation - Nonprofits also must file similar documents to gain incorporation status.

The New York Trailer Bill of Sale form is a document that records the details of a transaction where a trailer is sold from one person to another. It acts as a proof of purchase, ensuring both the seller's right to sell and the buyer's ownership are clear. For those looking to download a template, you can visit https://newyorkform.com/free-trailer-bill-of-sale-template. This legal document is crucial for the registration or transfer of a trailer's title in New York.

Virginia Business License Cost - Describes any voting agreements among shareholders.