Fill in a Valid Tax POA dr 835 Template

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to delays. Ensure that names, addresses, and identification numbers are filled out accurately.

-

Incorrect Signatures: The form must be signed by the taxpayer. If someone else signs without proper authorization, the form may be rejected.

-

Not Specifying the Tax Matters: Clearly indicate which tax matters the Power of Attorney covers. Omitting this information can create confusion and limit the agent's authority.

-

Failure to Date the Form: Not dating the form can raise questions about its validity. Always include the date of signing.

-

Neglecting to Review State Requirements: Each state may have specific rules regarding the POA. Make sure to check local regulations to avoid complications.

Learn More on This Form

-

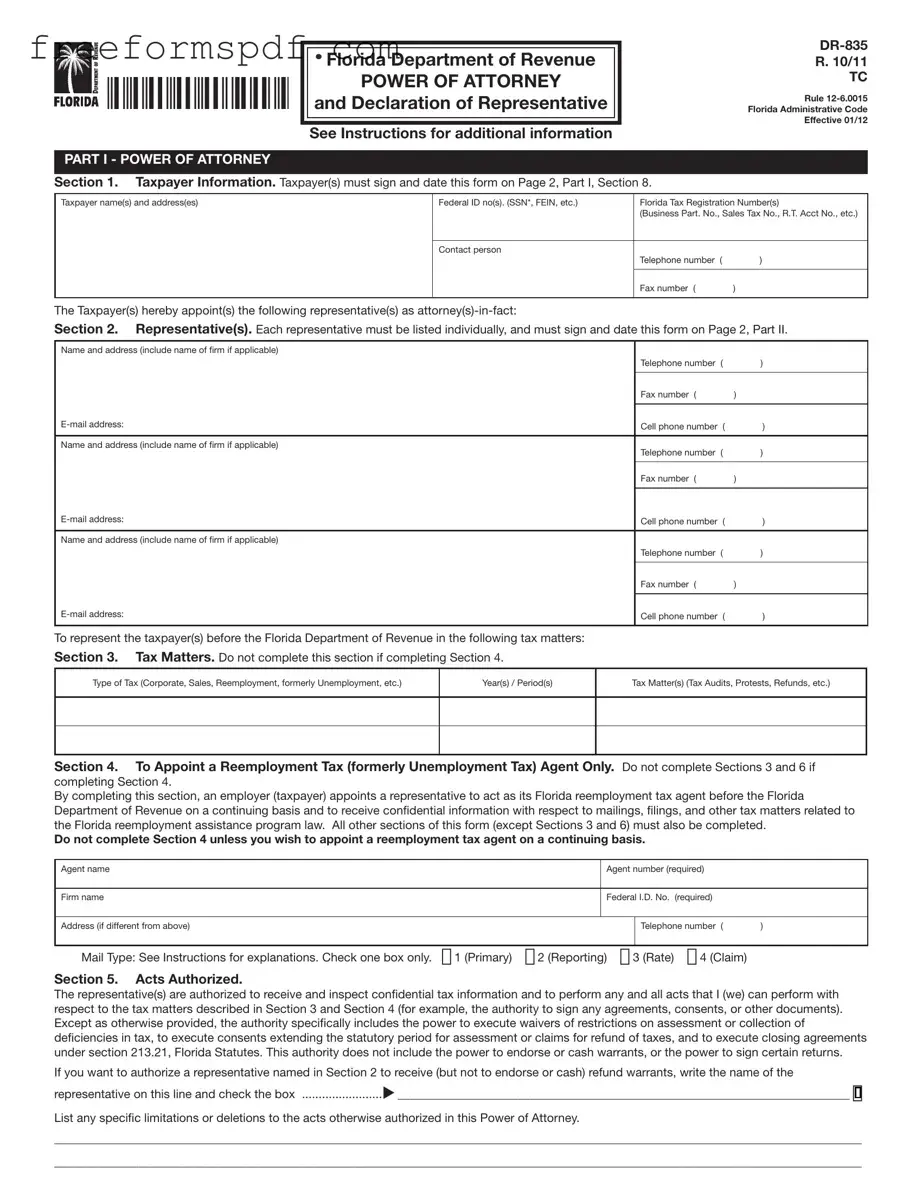

What is the Tax POA DR 835 form?

The Tax POA DR 835 form is a Power of Attorney document specifically designed for tax purposes in the United States. This form allows an individual or entity to designate another person to act on their behalf regarding tax matters. It is commonly used when a taxpayer needs assistance with filing tax returns, communicating with the IRS, or handling other tax-related issues.

-

Who can be designated as a representative on the Tax POA DR 835 form?

Any individual or entity can be designated as a representative on the Tax POA DR 835 form, as long as they are qualified to represent the taxpayer. This includes tax professionals, attorneys, or trusted family members. It is essential that the representative is someone the taxpayer trusts, as they will have access to sensitive financial information and the authority to make decisions regarding the taxpayer's tax matters.

-

How do I complete the Tax POA DR 835 form?

Completing the Tax POA DR 835 form involves several straightforward steps:

- Provide your personal information, including your name, address, and taxpayer identification number.

- Clearly identify the representative by including their name, address, and contact information.

- Specify the tax matters for which the Power of Attorney is granted, such as income tax or sales tax.

- Sign and date the form to validate it. If applicable, the representative must also sign to confirm their acceptance of the designation.

Once completed, the form should be submitted to the appropriate tax authority, such as the IRS or state tax agency, depending on the specific tax matters involved.

-

Is there a fee associated with filing the Tax POA DR 835 form?

Generally, there is no fee to file the Tax POA DR 835 form itself. However, if you are working with a tax professional or attorney to prepare the form, there may be associated fees for their services. It is advisable to clarify any potential costs upfront with your chosen representative.

-

How long is the Tax POA DR 835 form valid?

The validity of the Tax POA DR 835 form typically remains in effect until the taxpayer revokes it or the specific tax matters are resolved. Taxpayers can revoke the Power of Attorney at any time by submitting a written notice to the tax authority. It's important to keep a copy of the revocation for personal records.

Misconceptions

The Tax Power of Attorney (POA) Form DR 835 is often misunderstood. Here are ten common misconceptions about this important document.

- It is only for tax professionals. Many believe only tax professionals can use the form. In reality, anyone can designate a representative to handle their tax matters.

- It can only be used for federal taxes. Some think the form is limited to federal tax issues. However, it can also be used for state tax matters.

- Once filed, it cannot be revoked. Many assume that submitting the form is permanent. In fact, taxpayers can revoke the POA at any time by submitting a new form.

- It requires a notary signature. There is a common belief that the form must be notarized. However, notarization is not a requirement for the DR 835.

- It only covers current tax years. Some individuals think the form applies only to current tax years. In truth, it can address issues from previous years as well.

- Only one representative can be designated. A misconception exists that taxpayers can only choose one representative. In reality, multiple representatives can be appointed.

- It must be filed with the IRS. Many people think they need to send the form to the IRS. Instead, it should be kept with the taxpayer's records and provided to the representative when needed.

- It is only for individuals. Some believe that only individual taxpayers can use the form. However, businesses and organizations can also designate representatives.

- It covers all tax-related matters. There is a misconception that the POA covers every tax issue. In fact, the form has specific limitations and may not cover certain types of tax disputes.

- Filing the form guarantees representation. Many think that simply filing the form ensures that the representative can act on their behalf. The IRS must still approve the representative's authority to act in specific situations.

Understanding these misconceptions can help taxpayers navigate their tax responsibilities more effectively. Properly utilizing the Tax POA Form DR 835 can streamline communication with tax authorities and ensure that representation is handled appropriately.

Browse More Forms

Dd 214 - It’s a vital tool for veterans needing to navigate through the various benefits available to them.

When starting a new business in New York, it is essential to understand the requirements for the incorporation process, including the role of the New York Certificate form. This form serves to officially establish a corporation by outlining key details such as the corporation's name, purpose, and share structure. For further guidance on preparing this document, you can refer to resources like NY Templates, which offer helpful templates to simplify the process.

Gift Letter Sample - When applying for a mortgage, having a Gift Letter can significantly ease concerns of lenders.

Printable Timesheet - Time Cards help employers monitor attendance and punctuality.