Fill in a Valid Stock Transfer Ledger Template

Common mistakes

-

Incorrect Corporation Name: Many individuals fail to accurately enter the name of the corporation. This can lead to confusion and potential legal issues regarding ownership and stock rights.

-

Missing Certificate Information: Omitting details such as certificate numbers or the number of shares issued is a common error. This information is crucial for tracking ownership and ensuring proper record-keeping.

-

Failure to Specify Transfer Details: When transferring shares, individuals often neglect to clearly indicate the date of transfer and the parties involved. Without this information, the transaction may not be legally recognized.

-

Inaccurate Balance Reporting: Some people incorrectly report the number of shares held after the transfer. This can lead to discrepancies in ownership records and create complications in future transactions.

Learn More on This Form

-

What is the purpose of the Stock Transfer Ledger form?

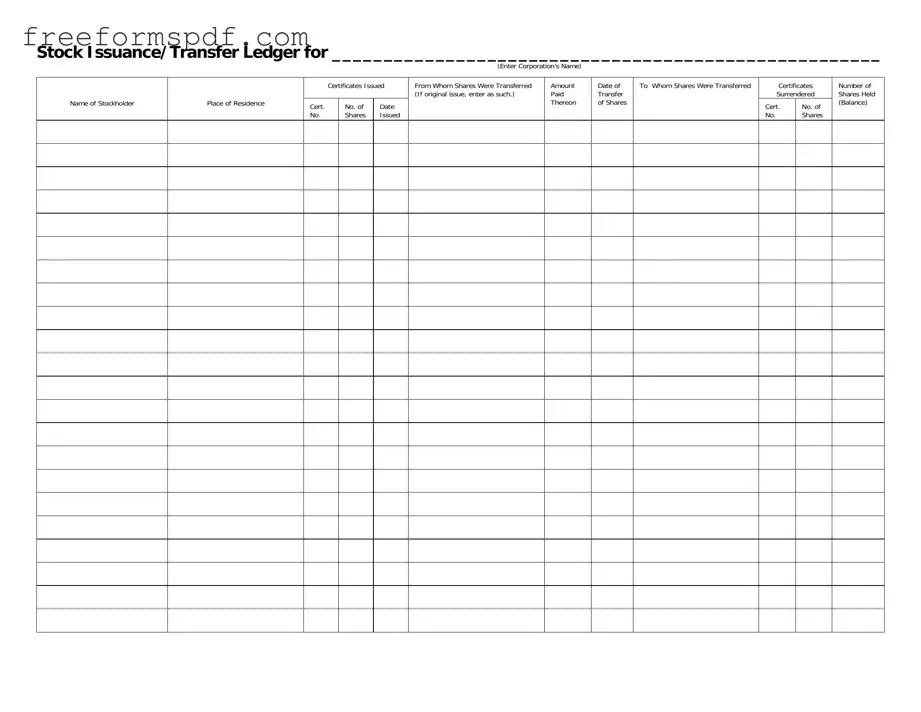

The Stock Transfer Ledger form serves as an official record for a corporation’s stock transactions. It tracks the issuance and transfer of shares among stockholders. This documentation is essential for maintaining accurate ownership records and ensuring compliance with corporate governance requirements.

-

What information is required on the form?

To complete the Stock Transfer Ledger form, you must provide several key details:

- The name of the corporation.

- The name of the stockholder.

- The place of residence of the stockholder.

- The number of certificates issued and their corresponding certificate numbers.

- The number of shares issued and the amount paid for those shares.

- The date of transfer and the name of the person to whom the shares were transferred.

- Any certificates that were surrendered during the transfer.

- The number of shares held after the transfer.

-

Who needs to fill out the Stock Transfer Ledger form?

The form must be filled out by the corporation’s designated officer or agent responsible for maintaining stock records. This could be the corporate secretary or another individual tasked with managing shareholder information. It’s crucial that this person is diligent in recording all transactions accurately.

-

How does one update the Stock Transfer Ledger after a transfer?

After a stock transfer occurs, the designated officer should promptly update the Stock Transfer Ledger. This involves entering the details of the transfer, including the date, the name of the new stockholder, and the number of shares transferred. Additionally, any surrendered certificates should be noted, and the balance of shares held by the original stockholder should be adjusted accordingly.

-

What happens if the Stock Transfer Ledger is not maintained properly?

Failure to maintain an accurate Stock Transfer Ledger can lead to significant issues. It may result in disputes over ownership, complications in future transfers, and potential legal ramifications for the corporation. Inaccurate records can also affect shareholder rights and the corporation's ability to comply with regulatory requirements.

-

Is the Stock Transfer Ledger a public document?

The Stock Transfer Ledger is generally considered a corporate record and is not typically available for public inspection. However, shareholders may have the right to request access to certain records, including the ledger, depending on state laws and corporate bylaws. It is advisable to consult with legal counsel to understand the specific rights and obligations related to access to corporate records.

Misconceptions

Misconceptions about the Stock Transfer Ledger form can lead to confusion and errors in record-keeping. Here are four common misunderstandings:

- It is only for new stock issuances. Many believe the Stock Transfer Ledger is solely for tracking new shares. In reality, it also records transfers of existing shares between stockholders.

- Only the corporation can fill it out. Some think that only corporate officers are authorized to complete the form. However, stockholders involved in the transfer can also provide necessary information.

- It is not necessary for small corporations. A misconception exists that small businesses don’t need a Stock Transfer Ledger. Regardless of size, maintaining accurate records is crucial for compliance and transparency.

- Once filled out, it doesn't need to be updated. Some individuals assume that the Stock Transfer Ledger is a one-time document. In fact, it should be regularly updated to reflect any changes in stock ownership.

Browse More Forms

Scrivener's Affidavit California - The Scrivener's Affidavit can facilitate smoother legal processes, reducing the likelihood of litigation.

I34 - Sponsors must attach supporting documents to the I-134 to prove their claims.

The New York Trailer Bill of Sale form is essential for anyone looking to buy or sell a trailer, as it serves to clarify the details of the transaction and protect both parties. This legal document assists in proving ownership and the right to sell, making it a vital step in the transfer of a trailer's title, especially in New York. For those interested, you can find a convenient template at https://newyorkform.com/free-trailer-bill-of-sale-template/.

Hazmat Bol - The form is vital for maintaining chain of custody for hazardous materials.