Single-Member Operating Agreement Document

Common mistakes

-

Incomplete Information: Failing to provide all necessary details, such as the member's name and address, can lead to confusion and potential legal issues.

-

Incorrect Entity Name: Using an incorrect or inconsistent name for the business can create problems with official documents and registrations.

-

Neglecting to Specify Purpose: Omitting a clear statement of the business purpose can result in ambiguity regarding the company's activities.

-

Ignoring State Requirements: Each state has specific requirements for operating agreements. Failing to comply can invalidate the agreement.

-

Not Including a Dissolution Clause: Without a plan for dissolution, issues may arise if the owner decides to close the business.

-

Overlooking Member Rights: Not clearly defining the rights and responsibilities of the member can lead to misunderstandings in the future.

-

Failure to Update the Agreement: As the business evolves, the operating agreement should be updated. Neglecting this can result in outdated terms.

-

Not Signing the Agreement: An unsigned agreement may not hold up in court. Ensure that the document is properly executed.

-

Using Generic Templates: Relying on a one-size-fits-all template without customization can lead to critical omissions or errors.

Learn More on This Form

-

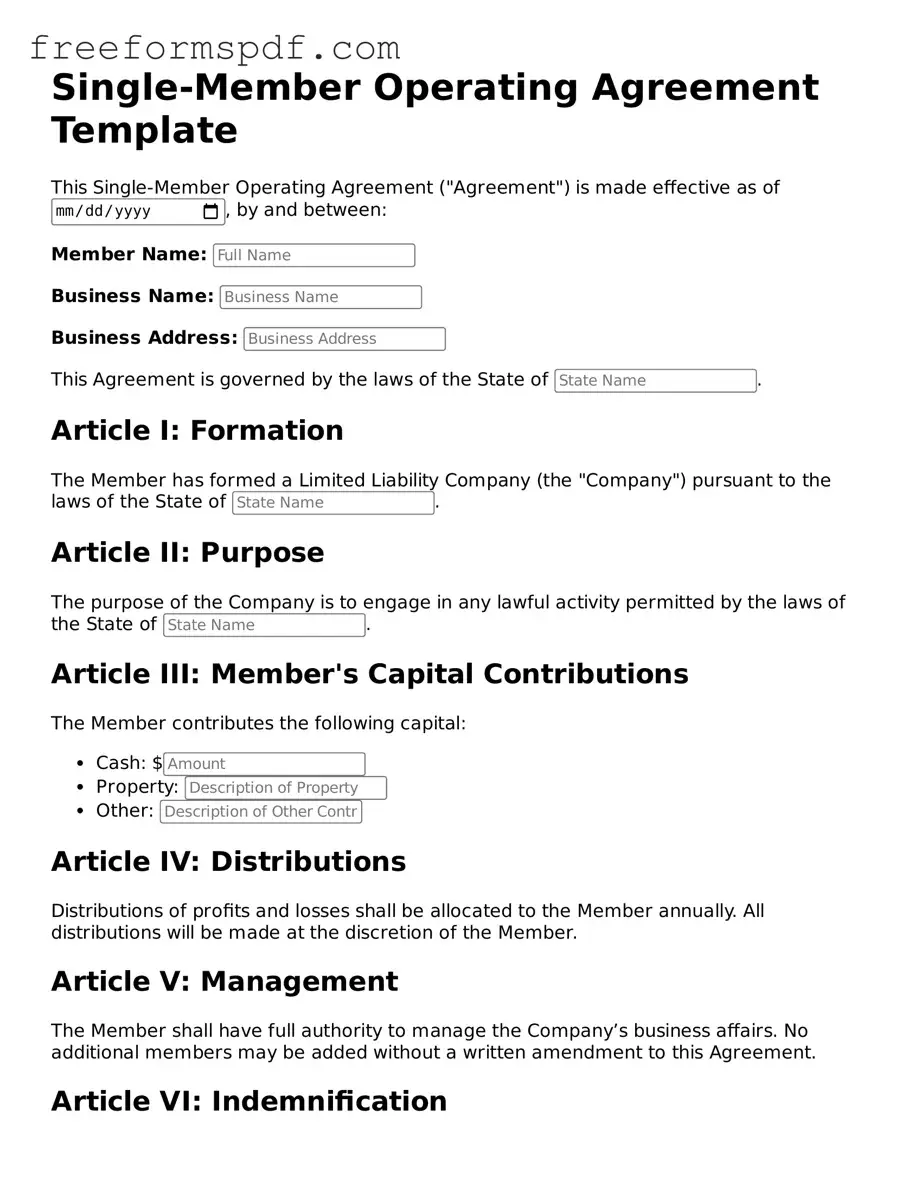

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a legal document that outlines the management structure and operational guidelines for a single-member limited liability company (LLC). This agreement serves as an internal document, helping the owner define how the business will be run, how profits and losses will be handled, and what happens in various situations, such as the sale of the business or the addition of new members.

-

Why is a Single-Member Operating Agreement important?

This agreement is crucial for several reasons. First, it establishes clear guidelines for the business's operations, which can help prevent misunderstandings or disputes in the future. Second, it can enhance the credibility of the LLC by demonstrating that it is a legitimate business entity. Additionally, having an operating agreement can help protect the owner's personal assets by reinforcing the separation between personal and business liabilities.

-

What should be included in a Single-Member Operating Agreement?

While the content can vary based on individual needs, a comprehensive Single-Member Operating Agreement typically includes:

- The name and address of the LLC

- The purpose of the business

- The name of the sole member

- Management structure and decision-making processes

- How profits and losses will be allocated

- Provisions for adding members or transferring ownership

- Procedures for dissolution of the LLC

-

Do I need to file the Single-Member Operating Agreement with the state?

No, the Single-Member Operating Agreement is not typically required to be filed with the state. It is an internal document meant for the owner’s reference and to clarify the operations of the LLC. However, maintaining a copy of the agreement is essential for personal records and may be requested by banks or other entities when opening business accounts or applying for loans.

-

Can I modify my Single-Member Operating Agreement?

Yes, the Single-Member Operating Agreement can be modified as needed. Since this document is created by the owner, any changes to the business structure, management, or operations can be reflected in an updated version of the agreement. It is advisable to document any amendments in writing to maintain clarity and ensure that all changes are recorded.

-

Is legal assistance necessary to create a Single-Member Operating Agreement?

While it is possible to create a Single-Member Operating Agreement without legal assistance, consulting with a legal professional is highly recommended. An attorney can provide guidance tailored to your specific business needs, ensuring that the agreement complies with state laws and effectively protects your interests.

Misconceptions

Understanding the Single-Member Operating Agreement is crucial for anyone operating a single-member LLC. However, several misconceptions can lead to confusion. Here are ten common myths and the truths behind them:

- It's not necessary for a single-member LLC. Many believe that because they are the sole owner, an operating agreement is optional. In reality, having one can help clarify your business structure and protect your limited liability status.

- It must be filed with the state. Some think that the operating agreement needs to be submitted to state authorities. In fact, it is an internal document and should be kept with your business records.

- It only needs to be created once. There's a misconception that once the agreement is drafted, it never needs to be updated. Changes in your business, such as new regulations or shifts in your operations, may require revisions.

- All operating agreements are the same. Many assume that a generic template will suffice. However, each agreement should reflect the specific needs and goals of your business.

- It’s only for legal protection. While it does provide legal safeguards, the operating agreement also serves to outline management procedures and operational guidelines, ensuring smooth business operations.

- It’s too complicated to create. Some individuals feel overwhelmed by the thought of drafting an agreement. In reality, it can be straightforward, especially with available resources and templates.

- Once signed, it cannot be changed. There’s a belief that an operating agreement is set in stone. However, it can and should be amended as your business evolves.

- It’s only important for tax purposes. While tax implications are significant, the agreement also addresses management structure, profit distribution, and decision-making processes, which are vital for overall business health.

- Only lawyers can draft it. Some think that legal expertise is necessary to create an operating agreement. While consulting a lawyer can be beneficial, many business owners successfully draft their own with the right guidance.

- It’s a one-size-fits-all document. Many assume that a standard agreement will meet their needs. In truth, tailoring the document to your specific business circumstances is essential for it to be effective.

By dispelling these myths, you can better understand the importance of a Single-Member Operating Agreement and ensure your business is set up for success.