Fill in a Valid Sample Tax Return Transcript Template

Common mistakes

-

Incomplete Personal Information: Failing to provide complete names, Social Security Numbers (SSNs), or addresses can lead to processing delays. Ensure that all personal information is accurate and fully filled out.

-

Incorrect Tax Period: Selecting the wrong tax period can result in the submission being rejected. Always verify that the tax period matches the year for which the return is being filed.

-

Missing Signatures: Not signing the form can lead to automatic rejection. Always ensure that the taxpayer's signature is included, along with the date of signing.

-

Failure to Report All Income: Omitting any sources of income can lead to discrepancies and potential audits. Review all income sources, including wages, business income, and any other earnings.

-

Incorrectly Calculated Deductions: Miscalculating deductions can significantly affect tax liability. Double-check all calculations, particularly for standard deductions and adjustments to income.

-

Ignoring Filing Status: Selecting the incorrect filing status can result in higher taxes owed. Understand the implications of each filing status and choose the one that best fits the situation.

-

Not Keeping Copies: Failing to keep a copy of the submitted form can cause issues in the future. Always retain a copy for personal records in case of disputes or questions from the IRS.

Learn More on This Form

-

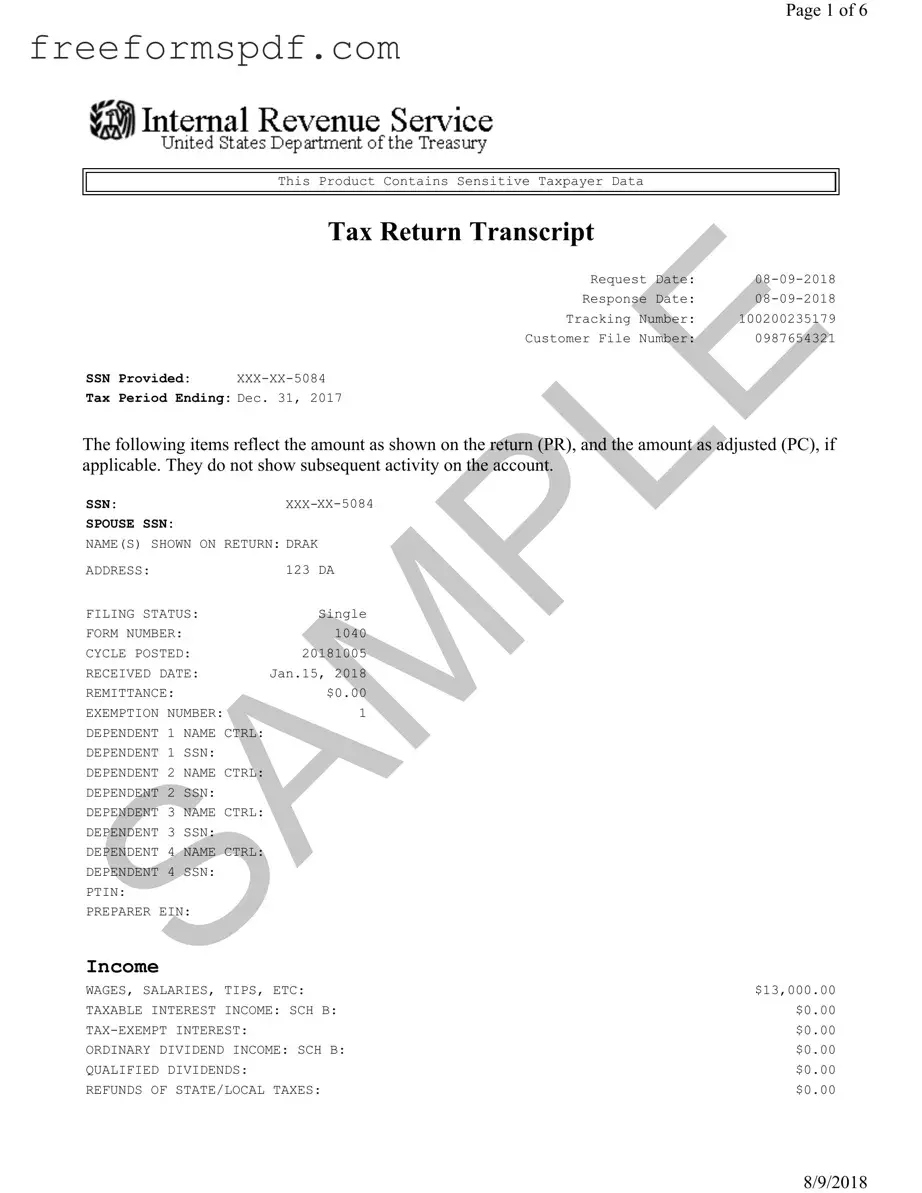

What is a Tax Return Transcript?

A Tax Return Transcript is a document that summarizes your tax return information as filed with the IRS. It includes details such as your income, filing status, and any adjustments made to your return. This document is often used for various purposes, including loan applications and verifying income.

-

How can I obtain a Tax Return Transcript?

You can request a Tax Return Transcript through several methods. The easiest way is to use the IRS's online tool, where you can access your transcript immediately. Alternatively, you can order a transcript by mail using Form 4506-T, or you can call the IRS directly. Be prepared to provide your Social Security number and other identifying information.

-

What information is included in a Tax Return Transcript?

A Tax Return Transcript includes key details from your tax return, such as your adjusted gross income, taxable income, and tax liability. It may also show any credits you claimed and your filing status. However, it does not include any additional documentation or schedules that may have been filed with your return.

-

Is a Tax Return Transcript the same as a Tax Account Transcript?

No, they are not the same. A Tax Return Transcript provides a summary of your tax return, while a Tax Account Transcript offers a more detailed view of your account, including changes made after the original return was filed. If you need information about your account history, a Tax Account Transcript may be more appropriate.

-

How long does it take to receive a Tax Return Transcript?

If you request your Tax Return Transcript online, you can typically access it immediately. If you order it by mail, it usually takes about 5 to 10 business days to arrive, depending on the time of year and the IRS's workload. Planning ahead is advisable if you need it for a specific deadline.

-

Are there any fees associated with obtaining a Tax Return Transcript?

No, there are no fees for obtaining a Tax Return Transcript. The IRS provides this service free of charge. Whether you request it online, by mail, or by phone, you should not incur any costs.

Misconceptions

- Misconception 1: The Sample Tax Return Transcript contains all account activity.

- Misconception 2: The form provides detailed personal information.

- Misconception 3: It is the same as a full tax return.

- Misconception 4: The transcript is only useful for filing taxes.

- Misconception 5: The transcript is available immediately after filing.

- Misconception 6: The Sample Tax Return Transcript is an official document.

- Misconception 7: You can request a transcript for any tax year at any time.

This form only reflects the amounts as shown on the return and any adjustments. It does not include subsequent activity on the account.

While it shows some taxpayer data, sensitive information like full Social Security Numbers is redacted for privacy.

The transcript is a summary of the tax return, not a complete document. It lacks supporting schedules and additional details.

It can also serve as proof of income for loans, mortgages, and other financial transactions.

There may be a waiting period after filing before the transcript is accessible, often several weeks.

While it is an IRS document, it is not considered an official tax return. It serves specific purposes, such as verification.

There are limits on how far back you can request transcripts, typically up to three years from the current tax year.

Browse More Forms

Geico Partners - Be sure to highlight any urgent issues in your comments section.

Form 1099 Nec - The 1099-NEC form is used to report nonemployee compensation to the IRS.

Creating a reliable plan for your legacy can begin with understanding the significance of a Last Will and Testament document. This form is pivotal in ensuring your preferences for asset distribution are recognized after your passing, providing peace of mind for you and your loved ones.

Abn Form Medicare - Medicare beneficiaries can use the notice to challenge non-coverage decisions if necessary.