Release of Promissory Note Document

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to delays. Ensure that all fields are filled out completely, including names, addresses, and dates.

-

Incorrect Signatures: Signatures must match the names on the document. If the wrong person signs, the release may be invalid.

-

Missing Dates: Dates are crucial for establishing the timeline of the release. Omitting them can create confusion regarding when the release is effective.

-

Not Notarizing: Some jurisdictions require notarization for the release to be legally binding. Failing to have the document notarized can render it unenforceable.

-

Ignoring State-Specific Requirements: Each state may have different rules regarding promissory notes. Be aware of local laws to avoid mistakes.

-

Overlooking Additional Documentation: Sometimes, other documents must accompany the release. Check if any supporting paperwork is necessary.

-

Not Keeping Copies: After submission, always retain a copy of the signed release for your records. This can be vital for future reference.

-

Assuming All Parties Understand: Clear communication is essential. Ensure all involved parties understand the release and its implications.

-

Failing to Review the Document: A thorough review before submission can catch errors. Take the time to read through the entire form carefully.

Learn More on This Form

-

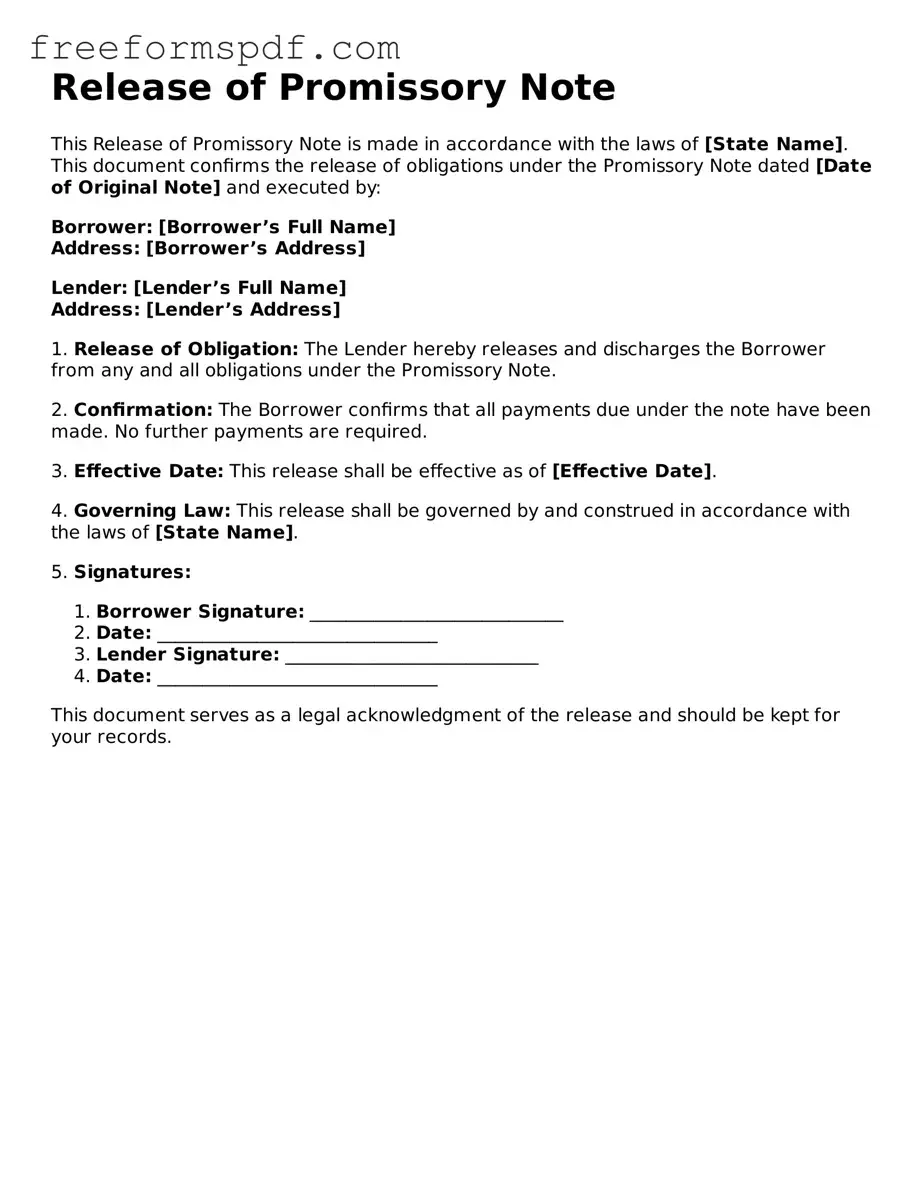

What is a Release of Promissory Note form?

The Release of Promissory Note form is a legal document used to indicate that a borrower has fully repaid their debt to a lender. Once completed, it serves as proof that the borrower is no longer obligated to make any payments under the terms of the original promissory note.

-

Why is it important to have a Release of Promissory Note?

This form is crucial because it protects both the borrower and the lender. For the borrower, it provides clear evidence that the debt has been settled. For the lender, it signifies that the loan has been paid in full, preventing any future claims regarding the same debt.

-

Who should complete the Release of Promissory Note form?

Both the borrower and the lender should be involved in completing this form. The borrower will sign to acknowledge that they have paid off the loan, while the lender will sign to confirm the release of the obligation.

-

What information is typically included in the form?

The form generally includes the names of both parties, the date of the loan, the amount borrowed, and the date of repayment. It may also contain a statement confirming that the loan has been paid in full.

-

How do I know if I need to file this form?

If you have taken out a loan and have made all the required payments, you should consider filing this form. It’s especially important if you plan to apply for new credit or if there are any potential disputes regarding the loan in the future.

-

Is there a fee associated with filing the Release of Promissory Note?

Typically, there is no fee to complete the Release of Promissory Note form itself. However, if you choose to have an attorney draft or review the document, there may be legal fees involved.

-

Can I create my own Release of Promissory Note form?

Yes, you can create your own form, but it’s advisable to use a standard template or consult with a legal professional to ensure that it meets all necessary legal requirements. Properly drafted forms help avoid potential misunderstandings in the future.

-

What happens if I don’t file this form after repaying my loan?

If you do not file the Release of Promissory Note form, the lender may still have the right to claim that the debt is outstanding. This can lead to complications, especially if you seek new credit or if disputes arise regarding the loan.

-

Where should I keep the completed Release of Promissory Note?

Once completed and signed, it’s important to keep the Release of Promissory Note in a safe place. Both parties should retain a copy for their records. This document may be needed in the future to prove that the loan has been satisfied.

Misconceptions

Understanding the Release of Promissory Note form can be challenging due to various misconceptions. Here are seven common misunderstandings:

- It is only necessary for large loans. Many believe that a release is only relevant for significant sums of money. In reality, any loan, regardless of size, can benefit from a formal release to clarify the status of the debt.

- The form is only needed at the end of a loan. Some think the release is only required when a loan is fully paid off. However, it can also be useful during the loan term if the borrower and lender agree to modify the terms or settle the debt early.

- It automatically cancels the debt. A release form does not inherently cancel the debt. It simply acknowledges that the borrower has fulfilled their obligations. The terms of the release must be clearly outlined to avoid confusion.

- Only the lender needs to sign the release. This is a misconception. Both parties—the borrower and the lender—should sign the release to ensure mutual agreement and acknowledgment of the debt's status.

- It is a legally binding document. While a release can have legal implications, its enforceability depends on how it is drafted and the jurisdiction in which it is used. Proper legal advice is recommended to ensure its validity.

- It does not need to be filed with any authority. Some believe that a release form is only an internal document. In certain cases, it may need to be filed with a court or recorded with a local authority to be effective, especially in real estate transactions.

- Once signed, it cannot be changed. This is incorrect. If both parties agree, the terms of the release can be modified before it is finalized. Changes should be documented in writing to maintain clarity.

Addressing these misconceptions can help individuals navigate the complexities of the Release of Promissory Note form more effectively.

Other Types of Release of Promissory Note Forms:

Online Promissory Note - It lays out the framework of an accountable system for existing vehicle loans.

A New York Promissory Note is a written promise to pay a specified amount of money to a designated party at a predetermined time. This legal document serves as a critical tool in various financial transactions, providing clarity and security for both lenders and borrowers. For those looking for a structured template to create this important document, resources like NY Templates can be invaluable in ensuring compliance and understanding its requirements.