Quitclaim Deed Document

Quitclaim Deed - Customized for Each State

Common mistakes

-

Incorrect Names: It is crucial to ensure that the names of all parties involved are spelled correctly and match the names on their legal documents. Any discrepancies can lead to complications.

-

Missing Signatures: All parties must sign the Quitclaim Deed. Failing to obtain the necessary signatures can invalidate the document.

-

Improper Notarization: A Quitclaim Deed typically requires notarization. If the notarization is missing or not done correctly, the deed may not be legally recognized.

-

Incorrect Property Description: The property must be described accurately, including the address and legal description. Omitting details can create confusion regarding the property being transferred.

-

Failure to Record: After completing the Quitclaim Deed, it must be recorded with the appropriate county office. Not doing so can leave the transfer unrecognized by third parties.

-

Not Understanding the Implications: Individuals may overlook the consequences of using a Quitclaim Deed. It is essential to understand that this type of deed does not guarantee clear title.

-

Leaving Out Additional Information: Some forms may require additional information, such as the date of transfer or consideration paid. Omitting this information can lead to delays or rejection.

-

Using an Outdated Form: Always ensure that the most current version of the Quitclaim Deed form is being used. Using an outdated form may result in legal issues or rejection.

Learn More on This Form

-

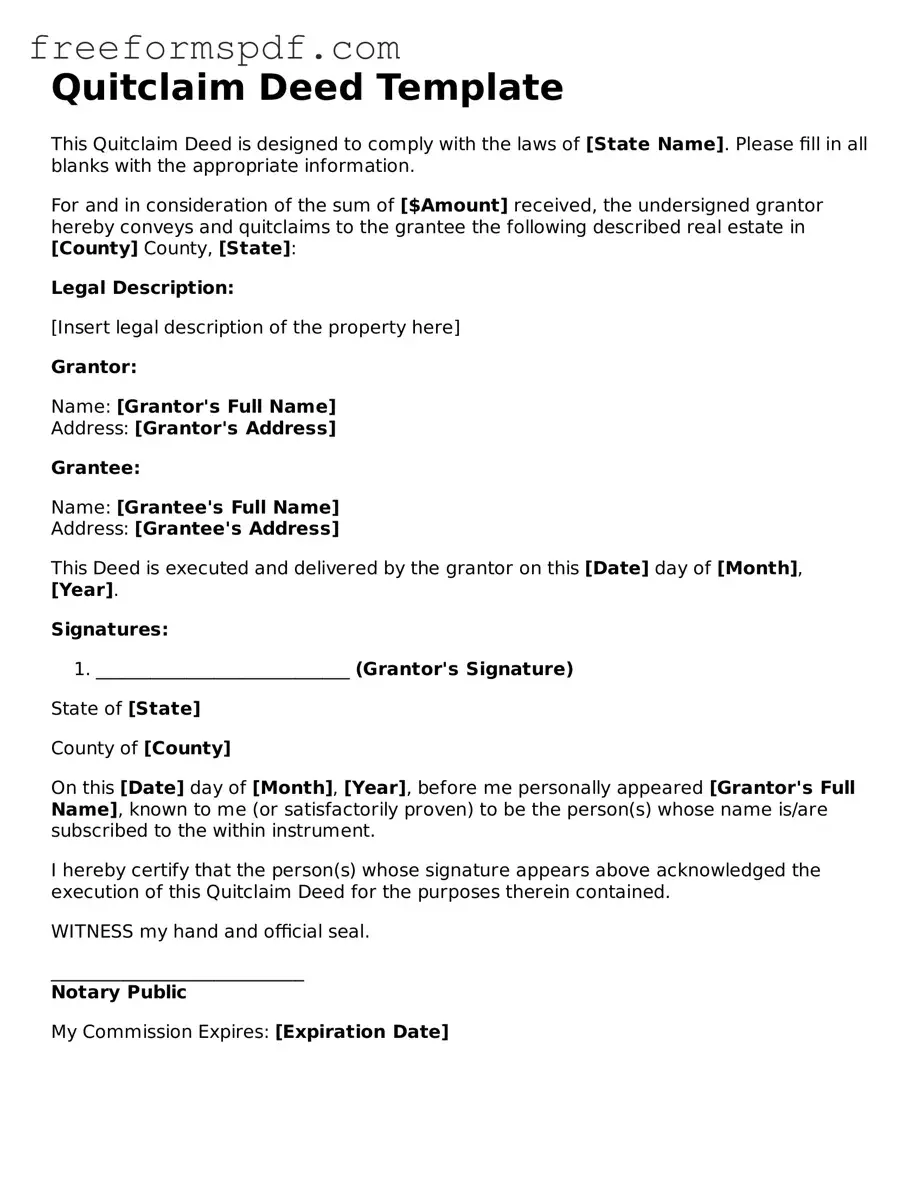

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the grantor has clear title to the property. Instead, it simply conveys whatever interest the grantor may have in the property, if any.

-

When should I use a Quitclaim Deed?

This type of deed is commonly used in situations where the parties know each other, such as between family members, divorcing spouses, or in cases of property transfers between partners. It is also used to clear up title issues or to relinquish any claim to a property.

-

What are the advantages of using a Quitclaim Deed?

One of the main advantages is the simplicity of the process. Quitclaim Deeds are generally easier and faster to prepare than other types of deeds. Additionally, they can be a cost-effective way to transfer property without the need for extensive legal procedures.

-

Are there any disadvantages to using a Quitclaim Deed?

Yes, the primary disadvantage is the lack of warranty. Since the grantor does not guarantee that they hold clear title, the grantee assumes the risk of any claims against the property. This means that if there are any liens or other encumbrances, the grantee may be responsible for addressing those issues.

-

How do I complete a Quitclaim Deed?

To complete a Quitclaim Deed, the grantor must provide their name, the grantee's name, a description of the property, and the date of transfer. It is essential to sign the document in the presence of a notary public. After signing, the deed should be filed with the appropriate county office to ensure it is recorded.

-

Do I need an attorney to create a Quitclaim Deed?

While it is not legally required to have an attorney, consulting one is advisable, especially if there are complexities involved, such as existing liens or disputes. An attorney can help ensure that the deed is properly executed and that the transfer is legally sound.

-

Can a Quitclaim Deed be revoked?

A Quitclaim Deed, once executed and recorded, cannot be revoked unilaterally. However, the grantor can create another legal document to clarify or alter the terms of the original deed, but this may require additional legal processes.

-

Is a Quitclaim Deed the same as a Warranty Deed?

No, they are not the same. A Warranty Deed provides guarantees from the grantor regarding the title and ownership of the property, ensuring that the property is free from claims. In contrast, a Quitclaim Deed does not offer such assurances, making it a more straightforward but riskier option for transferring property.

-

What happens after I file a Quitclaim Deed?

After filing, the Quitclaim Deed becomes a public record. This means that anyone can access the information regarding the transfer of ownership. It is advisable for the grantee to keep a copy of the recorded deed for their records, as it serves as proof of ownership.

Misconceptions

Understanding the Quitclaim Deed form is essential for anyone involved in property transactions. However, several misconceptions often arise regarding its use and implications. Below are five common misconceptions clarified for better understanding.

- A Quitclaim Deed transfers ownership of property. This is not entirely accurate. While a Quitclaim Deed does transfer any interest the grantor may have in the property, it does not guarantee that the grantor holds any actual ownership. If the grantor has no ownership interest, the recipient receives nothing.

- A Quitclaim Deed is the same as a Warranty Deed. Many people mistakenly believe these two types of deeds are interchangeable. A Warranty Deed provides a guarantee that the grantor has a clear title to the property and will defend against any claims. In contrast, a Quitclaim Deed offers no such assurances, making it riskier for the recipient.

- A Quitclaim Deed can only be used between family members. This is a common misconception. While Quitclaim Deeds are often used in family transactions, they can be utilized by anyone transferring property interests. They are particularly useful in situations such as divorce settlements or clearing up title issues.

- Using a Quitclaim Deed eliminates all potential claims against the property. This is misleading. A Quitclaim Deed does not remove liens or other encumbrances on the property. If there are existing debts or claims against the property, the new owner may still be liable for them.

- A Quitclaim Deed does not need to be recorded. Although it is not legally required to record a Quitclaim Deed, doing so is highly advisable. Recording the deed provides public notice of the ownership transfer, which can help protect the new owner’s interests against future claims.

By addressing these misconceptions, individuals can make more informed decisions regarding property transfers and understand the implications of using a Quitclaim Deed.

Other Types of Quitclaim Deed Forms:

Deed in Lieu of Foreclosure Template - This process can help avoid the lengthy foreclosure process for homeowners in financial trouble.

The NYC Housing Application Form is a crucial document for individuals seeking public housing in New York City. It allows applicants to express their interest in available units across the city's five boroughs, ensuring they meet eligibility criteria based on income and family structure. For those looking for a convenient way to start this process, the use of templates can be helpful, such as the one provided by NY Templates. Completing this form accurately is the first step toward securing affordable housing in a city where demand often exceeds supply.

United States Tod - Over time, these deeds can contribute to clearer successor planning, which can ease stress during difficult times.

California Corrective Deed - Homeowners may need a Corrective Deed during property sales or transfers.