Promissory Note Document

Promissory Note - Customized for Each State

Promissory Note Document Subtypes

Common mistakes

-

Incomplete Information: Many individuals forget to fill out all required fields. This includes names, addresses, and the loan amount. Omitting any of this information can lead to delays or complications.

-

Incorrect Interest Rates: Some people mistakenly enter the wrong interest rate. It's crucial to double-check this figure, as it directly affects the total amount to be repaid.

-

Missing Signatures: A common oversight is neglecting to sign the document. Both the borrower and the lender must sign the Promissory Note for it to be legally binding.

-

Failure to Specify Terms: Not clearly outlining the repayment terms can lead to misunderstandings. It is important to specify when payments are due and the method of payment.

Learn More on This Form

-

What is a Promissory Note?

A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. It serves as a legal document that outlines the terms of the loan, including the principal amount, interest rate, and repayment schedule.

-

Who uses a Promissory Note?

Promissory notes are commonly used by individuals and businesses. They can be utilized in various situations, such as personal loans between friends or family, business loans, or even real estate transactions. Essentially, anyone needing to formalize a loan agreement can benefit from using a promissory note.

-

What are the key components of a Promissory Note?

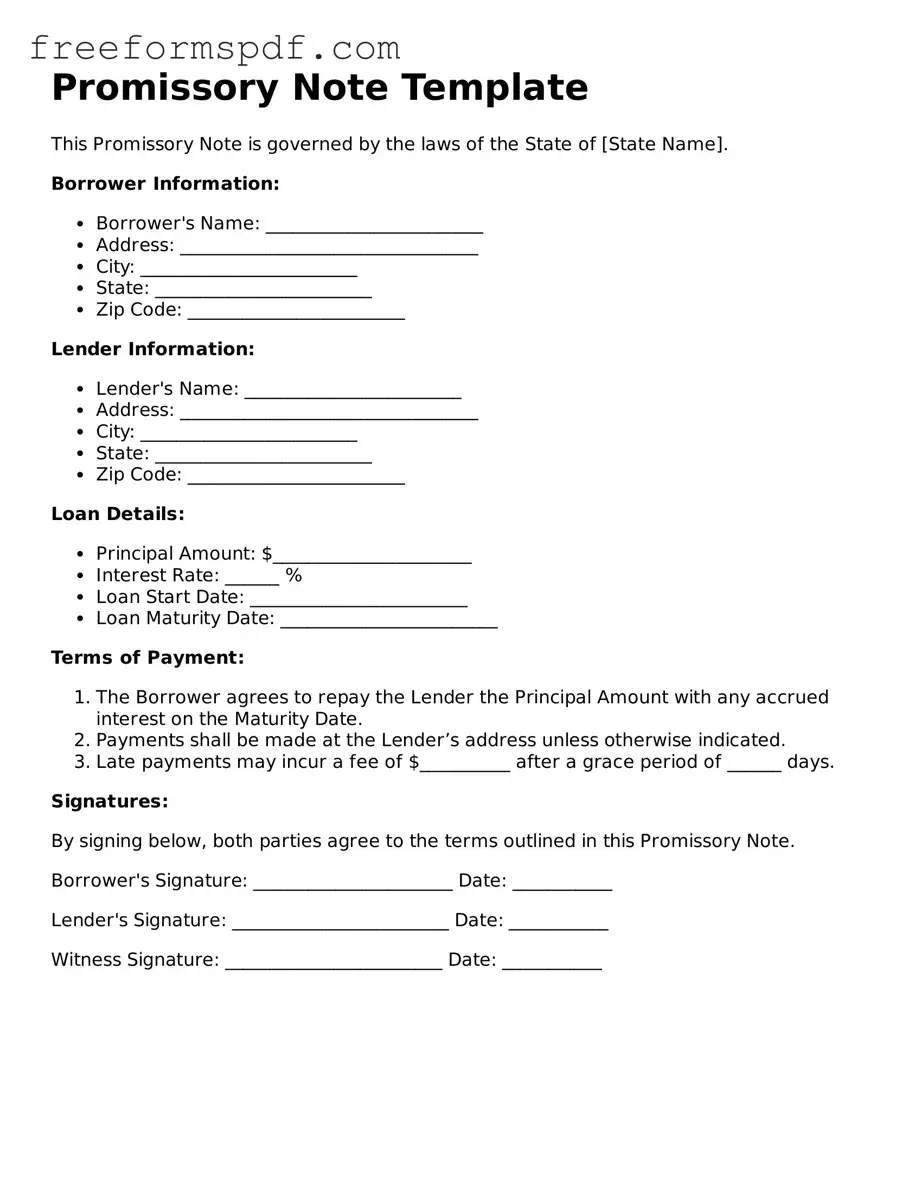

A well-crafted promissory note typically includes the following key components:

- The names and addresses of the borrower and lender

- The principal amount being borrowed

- The interest rate (if applicable)

- The repayment schedule, including due dates

- Any late fees or penalties for missed payments

- Signatures of both parties

-

Is a Promissory Note legally binding?

Yes, a promissory note is a legally binding document. Once signed by both parties, it creates an obligation for the borrower to repay the loan according to the terms outlined in the note. If the borrower fails to repay, the lender has the right to pursue legal action to recover the owed amount.

-

Can a Promissory Note be modified?

Yes, a promissory note can be modified if both parties agree to the changes. This may involve altering the repayment schedule, interest rate, or any other terms. It’s essential to document any modifications in writing and have both parties sign the updated agreement to ensure clarity and legality.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, meaning they fail to make payments as agreed, the lender can take several actions. This may include charging late fees, initiating collection efforts, or pursuing legal action to recover the owed amount. The specific steps depend on the terms outlined in the promissory note and applicable laws.

-

Do I need a lawyer to create a Promissory Note?

While it’s not strictly necessary to hire a lawyer to create a promissory note, it can be beneficial, especially for more complex agreements. A legal professional can help ensure that the document meets all legal requirements and adequately protects your interests. For simple loans, templates are often available online.

-

How should I store my Promissory Note?

Once signed, it’s important to store the promissory note in a safe place. Both the borrower and lender should keep a copy. Digital copies can also be helpful, but ensure that they are securely stored to prevent unauthorized access. Maintaining clear records will be vital if any disputes arise in the future.

Misconceptions

Understanding the Promissory Note form is crucial for anyone engaging in lending or borrowing money. However, several misconceptions can lead to confusion. Here are ten common misconceptions, along with clarifications.

- All Promissory Notes are the Same: Many believe that all promissory notes are identical. In reality, they can vary significantly in terms of terms, interest rates, and repayment schedules.

- Promissory Notes Must Be Notarized: Some think notarization is mandatory for a promissory note to be valid. While notarization can add credibility, it is not a legal requirement in most cases.

- Only Banks Use Promissory Notes: It’s a common belief that only banks or financial institutions utilize promissory notes. Individuals can also create and use them for personal loans.

- A Verbal Agreement is Enough: Some assume a verbal agreement suffices. However, having a written promissory note provides legal protection and clarity for both parties.

- Promissory Notes are Unenforceable: There’s a misconception that promissory notes lack enforceability. In fact, they are legally binding documents that can be enforced in court.

- Interest Rates Must Be Included: Many think that interest rates are mandatory in a promissory note. While they are common, a note can be valid without specifying an interest rate.

- They Can’t Be Transferred: Some believe that once a promissory note is created, it cannot be transferred. However, they can be sold or assigned to another party.

- They Are Only for Large Loans: It is a misconception that promissory notes are only for significant amounts. They can be used for any loan size, regardless of the amount.

- Defaulting on a Promissory Note is No Big Deal: Some borrowers think defaulting is inconsequential. In reality, it can lead to serious legal consequences and damage credit ratings.

- All Promissory Notes Are Legal in Every State: There’s a belief that any promissory note is universally accepted. However, laws governing promissory notes can vary by state, affecting their validity.

By addressing these misconceptions, individuals can better understand the importance and function of promissory notes in financial agreements.

Popular Forms:

Odometer Disclosure Form - It is specifically important for vehicles sold in Texas.

Residence Affidavit - This document is critical for any address verification process.

Submitting the NYC Housing Application Form not only helps individuals navigate the complexities of public housing in New York City but also equips them with the necessary tools to understand their options, such as utilizing resources from NY Templates to find the right templates and guidance for their applications.

Free Employee Handbook Template - It assists HR in tracking employee engagement with company policies.