Promissory Note for a Car Document

Common mistakes

-

Incorrect Personal Information: Failing to provide accurate details such as name, address, and contact information can lead to complications in communication and enforcement of the note.

-

Omitting Loan Amount: Not specifying the exact amount being borrowed can create confusion and disputes later on.

-

Neglecting Interest Rate: Leaving the interest rate blank or entering an incorrect figure can result in misunderstandings regarding repayment obligations.

-

Missing Payment Schedule: Failing to outline the payment schedule, including due dates and frequency, can lead to missed payments and potential penalties.

-

Ignoring Default Terms: Not including terms that define what constitutes a default and the subsequent consequences can leave parties unprotected.

-

Inadequate Signatures: Not having all necessary parties sign the document can invalidate the agreement and make it unenforceable.

-

Not Keeping Copies: Failing to retain copies of the signed Promissory Note can hinder future reference and enforcement of the agreement.

-

Overlooking State Laws: Ignoring specific state laws that may affect the terms of the Promissory Note can result in legal issues or an unenforceable contract.

Learn More on This Form

-

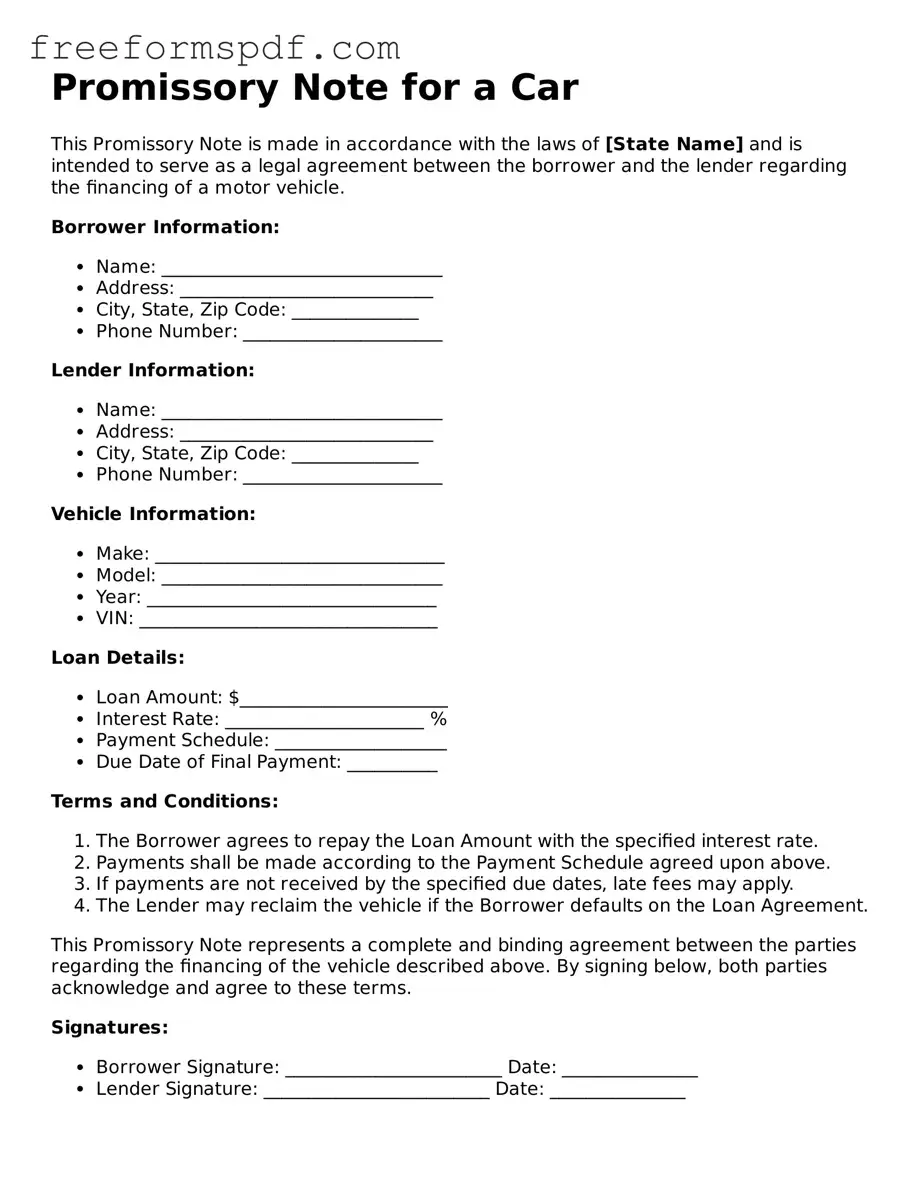

What is a Promissory Note for a Car?

A Promissory Note for a Car is a legal document that outlines the terms of a loan for purchasing a vehicle. It serves as a written promise from the borrower to repay the lender, detailing the amount borrowed, the interest rate, payment schedule, and any other conditions agreed upon by both parties.

-

Who typically uses a Promissory Note for a Car?

This document is commonly used by individuals who are financing a vehicle through a private lender, such as a friend or family member, rather than through a traditional bank or dealership. It helps protect both the lender's and borrower's interests by clearly stating the repayment terms.

-

What information is included in the Promissory Note?

The Promissory Note should include:

- The names and addresses of both the borrower and lender.

- The total amount of the loan.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Consequences of defaulting on the loan.

- Any collateral, if the loan is secured.

-

Is a Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding. It can be enforced in court if the borrower fails to make payments as agreed. Both parties should ensure they understand the terms before signing to avoid any disputes later on.

-

Do I need a lawyer to create a Promissory Note for a Car?

While it is not mandatory to hire a lawyer, consulting one can provide peace of mind. A legal professional can help ensure that the document complies with state laws and adequately protects your interests. Many templates are available online, but personal circumstances may require specific language or clauses.

-

What happens if I cannot make a payment?

If you miss a payment, it is crucial to communicate with the lender as soon as possible. The Promissory Note will outline the consequences of default, which may include late fees, increased interest rates, or even legal action. Open communication can often lead to a more favorable resolution.

-

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the updated agreement. This helps prevent misunderstandings in the future.

-

Where should I keep my Promissory Note?

Store the Promissory Note in a safe place, such as a locked file cabinet or a secure digital storage solution. Both the borrower and lender should retain copies of the document to reference as needed throughout the loan term.

Misconceptions

Here are nine common misconceptions about the Promissory Note for a Car form:

- It is only for new cars. The Promissory Note can be used for both new and used vehicles.

- It guarantees loan approval. Signing a Promissory Note does not guarantee that the loan will be approved; it is simply an agreement to repay.

- It is the same as a car loan contract. While related, a Promissory Note is a separate document that outlines the borrower's promise to repay the loan.

- It does not require any collateral. The car itself often serves as collateral, which means it can be repossessed if payments are not made.

- It can be ignored if the borrower changes their mind. Once signed, the borrower is legally obligated to follow through with the terms.

- Interest rates are fixed. Interest rates can vary based on the lender's terms and the borrower's creditworthiness.

- It is a one-size-fits-all document. The terms of the Promissory Note can be customized to fit the agreement between the buyer and seller.

- Only one signature is needed. Both the borrower and lender typically need to sign the document for it to be valid.

- It does not affect credit scores. Missing payments on a Promissory Note can negatively impact the borrower's credit score.

Other Types of Promissory Note for a Car Forms:

What Happens to a Promissory Note When the Lender Dies - Can aid in avoiding issues with future credit applications.

A New York Promissory Note is a written promise to pay a specified amount of money to a designated party at a predetermined time. This legal document serves as a critical tool in various financial transactions, providing clarity and security for both lenders and borrowers. Understanding its structure and requirements can help individuals navigate their financial obligations effectively. For more information or templates, you can visit NY Templates.