Fill in a Valid Profit And Loss Template

Common mistakes

-

Not keeping accurate records of income and expenses. Many individuals underestimate the importance of maintaining precise financial records throughout the year. This can lead to inaccuracies when filling out the Profit and Loss form.

-

Failing to categorize expenses properly. It’s crucial to classify expenses correctly—whether they are operational, administrative, or marketing costs. Misclassification can distort the financial picture.

-

Overlooking one-time income or expenses. Sometimes, people forget to include irregular income or expenses that can significantly affect the overall financial results. These should not be ignored.

-

Neglecting to account for depreciation. Assets lose value over time, and failing to include depreciation can lead to an inflated view of profitability.

-

Not reconciling bank statements. Discrepancies between bank statements and recorded income or expenses can lead to errors. Regular reconciliation helps ensure accuracy.

-

Using estimates instead of actual figures. Relying on rough estimates can result in significant inaccuracies. Actual figures provide a more reliable representation of financial performance.

-

Ignoring personal expenses mixed with business expenses. When personal and business expenses are not separated, it can complicate the Profit and Loss statement and lead to misleading results.

-

Failing to update the form regularly. A Profit and Loss form should be updated frequently to reflect current financial status. Waiting until the end of the year can lead to lost information.

-

Not seeking professional help when needed. Some individuals may attempt to complete the form without adequate knowledge of accounting principles. Consulting with an accountant can help avoid common pitfalls.

-

Forgetting to include all revenue streams. Businesses often have multiple sources of income. Omitting any revenue stream can lead to an incomplete financial picture.

Learn More on This Form

-

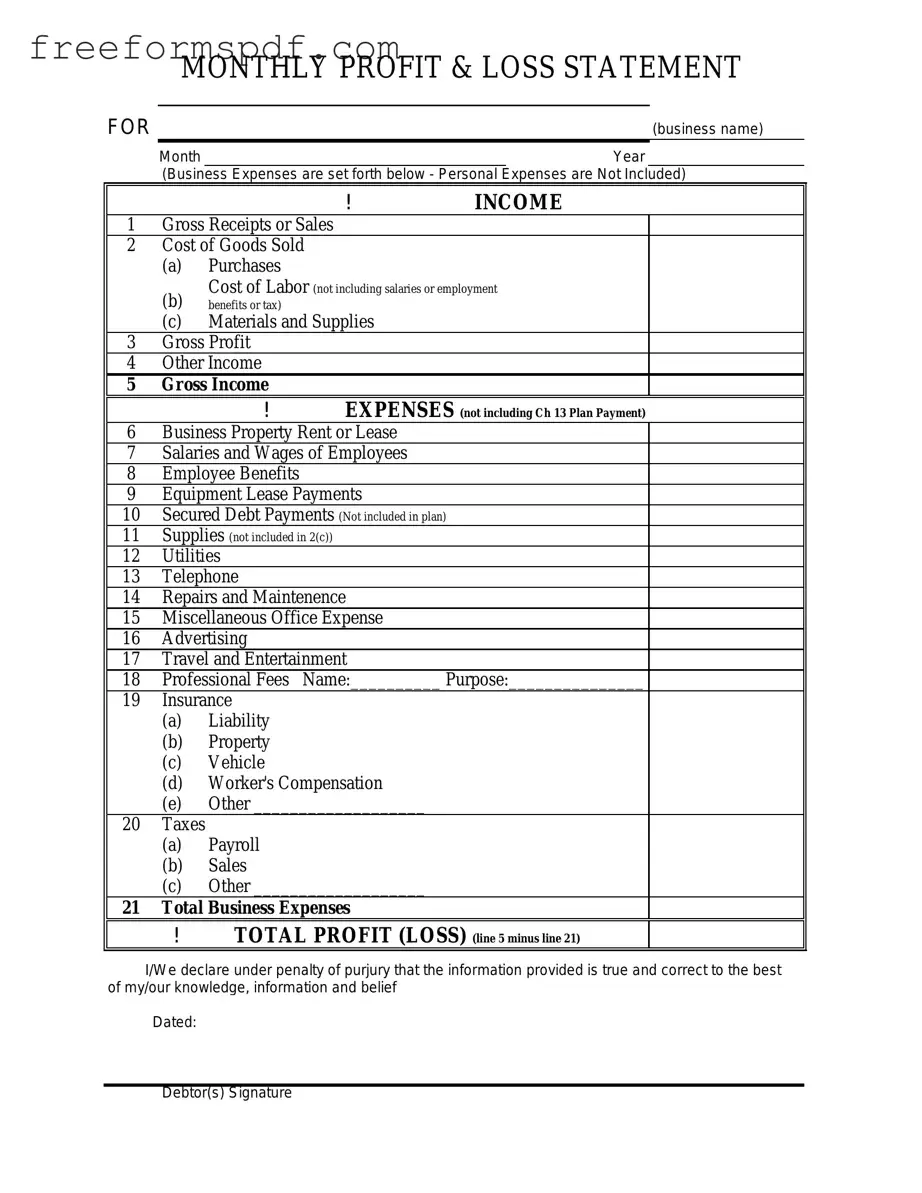

What is a Profit and Loss form?

A Profit and Loss form, often referred to as a P&L statement, is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period. It provides insight into a company's ability to generate profit by comparing income against expenses.

-

Why is the Profit and Loss form important?

The Profit and Loss form is crucial for various reasons. It helps business owners assess their financial performance, identify trends, and make informed decisions. Additionally, investors and lenders often review this document to evaluate a company's profitability and financial health.

-

What are the key components of a Profit and Loss form?

The main components of a Profit and Loss form include:

- Revenue: Total income generated from sales of goods or services.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Costs incurred in running the business, such as rent, utilities, and salaries.

- Net Profit: The final profit after all expenses have been deducted from total revenue.

-

How often should a Profit and Loss form be prepared?

Businesses typically prepare a Profit and Loss form on a monthly, quarterly, or annual basis. The frequency depends on the company's size, industry, and specific financial reporting needs. Regular updates can help track performance over time.

-

Who uses the Profit and Loss form?

Various stakeholders utilize the Profit and Loss form. Business owners and management use it for internal decision-making. Investors and creditors review it to assess the company’s financial viability. Accountants also rely on this document for tax preparation and compliance.

-

What is the difference between gross profit and net profit?

Gross profit refers to the income remaining after deducting the cost of goods sold from total revenue. In contrast, net profit is the amount left after all expenses, including operating costs, interest, and taxes, have been subtracted from total revenue. Understanding both metrics is essential for evaluating a business's profitability.

-

Can a Profit and Loss form show a loss?

Yes, a Profit and Loss form can indicate a loss. If total expenses exceed total revenue during the reporting period, the result is a net loss. This situation may prompt businesses to analyze their operations and make necessary adjustments.

-

How can I improve my Profit and Loss results?

Improving Profit and Loss results often involves increasing revenue or reducing expenses. Strategies may include enhancing marketing efforts, optimizing pricing, streamlining operations, or renegotiating supplier contracts. Regularly reviewing the P&L statement can help identify areas for improvement.

-

Where can I find a template for a Profit and Loss form?

Templates for Profit and Loss forms are widely available online. Many accounting software programs also offer built-in templates. These resources can simplify the process of creating a P&L statement and ensure that all necessary components are included.

Misconceptions

Understanding the Profit and Loss form can be challenging. Many people hold misconceptions that can lead to confusion. Here are eight common misconceptions explained:

- It is the same as a balance sheet. The Profit and Loss form shows income and expenses over a specific period, while a balance sheet provides a snapshot of assets, liabilities, and equity at a single point in time.

- Only large businesses need it. Small businesses and freelancers also benefit from using a Profit and Loss form to track their financial performance.

- It only includes revenue and expenses. The form can also include other items, such as gains and losses from investments, which affect overall profitability.

- It is only for tax purposes. While it is useful for taxes, the Profit and Loss form is essential for internal management decisions and financial planning.

- It reflects cash flow. The Profit and Loss form records income and expenses on an accrual basis, which may not accurately represent cash flow at any given time.

- It is a one-time document. The Profit and Loss form should be prepared regularly, such as monthly or quarterly, to monitor ongoing financial health.

- All expenses are deductible. Not all expenses listed on the form may be fully deductible for tax purposes; some may have limitations.

- Profit means cash in hand. Profit does not always equate to cash available; it can include credit sales or other non-cash transactions.

By addressing these misconceptions, individuals and businesses can better understand their financial situation and make informed decisions.

Browse More Forms

How to Get Your Marriage Certificate - Official record required for various legal and financial transactions.

Osha 301 Requirements - Report injuries to maintain compliance with workplace safety regulations.

Completing the NYCERS F552 form is a pivotal step for Tier 1 and Tier 2 members of the New York City Employees' Retirement System, as it allows them to make informed decisions regarding their pension payment options. For those looking for additional resources and templates related to this process, the NY Templates website offers valuable tools to assist in understanding and filling out the form correctly.

Fedx Freight - Various optional fees are outlined to ensure shippers are aware of potential additional costs.