Attorney-Verified Transfer-on-Death Deed Document for Pennsylvania State

Common mistakes

-

Not understanding the purpose of the deed. Many people fill out the Transfer-on-Death Deed without fully grasping its function. This deed allows you to transfer property directly to a beneficiary upon your death, bypassing probate.

-

Failing to include all necessary information. Omitting details such as the legal description of the property can lead to complications. It's crucial to provide accurate and complete information to ensure the deed is valid.

-

Not signing the deed correctly. The deed must be signed by the owner(s) in the presence of a notary. Forgetting this step can invalidate the deed, causing delays in the transfer process.

-

Choosing an unqualified beneficiary. Selecting a beneficiary who may not be able to manage the property or who has legal issues can create future problems. Consider the capabilities and reliability of your chosen beneficiary.

-

Ignoring state-specific requirements. Each state has its own rules regarding Transfer-on-Death Deeds. Failing to adhere to Pennsylvania's specific requirements can result in the deed being rejected.

-

Not recording the deed. After filling out the form, it must be recorded with the county recorder's office. Neglecting this step means the deed won't be recognized legally, and your intentions may not be honored.

-

Overlooking potential tax implications. Some individuals forget to consider how the transfer may affect taxes. Understanding the tax consequences can help avoid unexpected financial burdens for your beneficiary.

-

Not consulting with a professional. Many people assume they can fill out the deed without guidance. However, consulting with an attorney or a qualified professional can help clarify any uncertainties and ensure the deed is executed correctly.

-

Failing to update the deed. Life changes, such as marriage, divorce, or the death of a beneficiary, can affect your original intentions. Regularly reviewing and updating the deed is essential to reflect your current wishes.

-

Assuming it’s a one-time task. Many individuals believe that once the deed is filled out and recorded, it’s done. However, ongoing communication with beneficiaries about the deed and its implications is vital.

Learn More on This Form

-

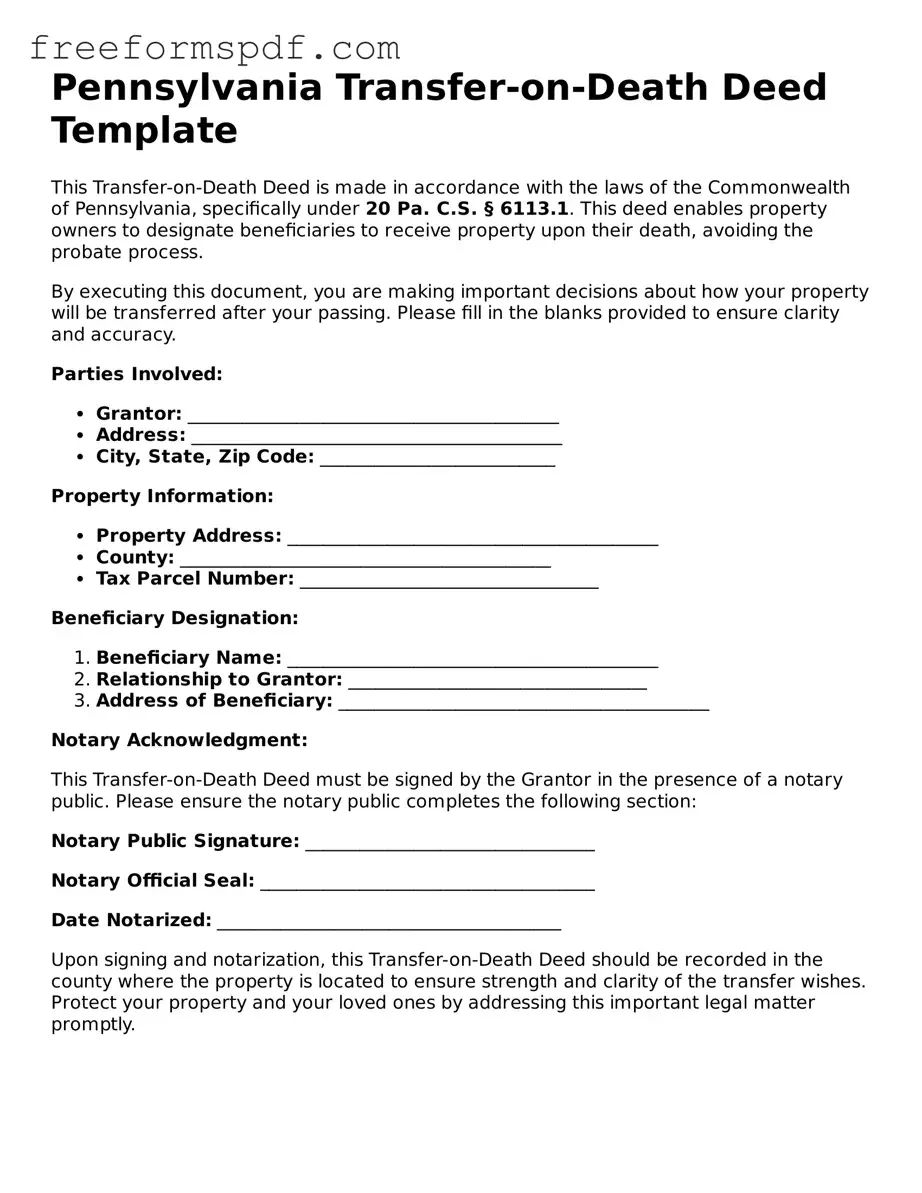

What is a Transfer-on-Death Deed in Pennsylvania?

A Transfer-on-Death Deed (TOD) is a legal document that allows property owners in Pennsylvania to transfer their real estate directly to a designated beneficiary upon their death. This type of deed helps avoid the probate process, which can be time-consuming and costly. The property remains under the owner's control during their lifetime, and they can sell or change the beneficiary at any time.

-

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed in Pennsylvania, you must fill out the appropriate form, which includes details about the property and the beneficiary. It is crucial to ensure that the deed is signed, dated, and notarized. Once completed, you must record the deed with the county recorder of deeds in the county where the property is located. This recording is essential for the deed to be valid and enforceable.

-

Can I change the beneficiary after creating the Transfer-on-Death Deed?

Yes, you can change the beneficiary at any time while you are alive. To do this, you need to create a new Transfer-on-Death Deed that names the new beneficiary and record it with the county recorder of deeds. It is important to note that the previous deed will remain valid until the new one is recorded, so you should ensure that the old deed is revoked or replaced to avoid confusion.

-

What happens if the beneficiary predeceases me?

If the designated beneficiary dies before you, the Transfer-on-Death Deed does not automatically transfer the property to that beneficiary's heirs. Instead, the property will remain in your estate and will be distributed according to your will or, if there is no will, according to Pennsylvania's intestacy laws. To prevent this situation, consider naming an alternate beneficiary in the deed.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger any immediate tax consequences for the property owner. The property is not considered a gift until the owner passes away. However, the beneficiary may be responsible for property taxes and other expenses associated with the property after the transfer occurs. It is advisable to consult with a tax professional to understand any potential implications fully.

-

Can I use a Transfer-on-Death Deed for all types of property?

In Pennsylvania, a Transfer-on-Death Deed can only be used for real estate, such as land and buildings. It cannot be used for personal property like vehicles or bank accounts. If you wish to transfer other types of assets, you may need to explore different estate planning options, such as wills or trusts.

Misconceptions

Understanding the Pennsylvania Transfer-on-Death Deed (TODD) form is crucial for anyone considering estate planning. However, several misconceptions can cloud the clarity of this important tool. Below is a list of ten common misconceptions, along with explanations to help clarify the realities of the TODD form.

- The TODD form eliminates the need for a will. Many believe that by using a TODD, they no longer need a will. In reality, a TODD only addresses the transfer of specific property. A will is still necessary for other assets and to outline final wishes.

- Property transferred via a TODD is not subject to taxes. Some assume that properties transferred through a TODD are exempt from estate taxes. This is incorrect; the property may still be included in the taxable estate of the deceased.

- The TODD form can be revoked at any time. While it is true that a TODD can be revoked, it must be done in a specific manner. A simple verbal statement does not suffice; the revocation must be executed properly to be valid.

- The TODD form is only for real estate. Many people think that the TODD can only be used for real estate. However, it can also be applied to certain types of personal property, depending on the state's laws.

- All heirs must agree to the TODD. There is a misconception that all heirs must consent to a TODD. In fact, the property owner can designate beneficiaries without needing approval from other heirs.

- The TODD form transfers ownership immediately. Some believe that signing a TODD form transfers ownership right away. In truth, the transfer occurs only upon the death of the property owner.

- A TODD is a complicated legal document. Many think that the TODD form is overly complex and requires extensive legal knowledge to complete. In reality, it is designed to be straightforward and accessible for property owners.

- The TODD form can be used for any type of property. While the TODD is versatile, it cannot be used for all property types. Certain assets, such as those held in a trust, are not eligible for transfer via a TODD.

- Once a TODD is filed, it cannot be changed. Some individuals believe that a TODD is set in stone once filed. However, property owners can update or change the beneficiaries as long as they follow the correct procedures.

- The TODD form is only beneficial for wealthy individuals. There is a misconception that only those with significant assets should consider a TODD. In fact, it can be a useful tool for anyone wanting to simplify the transfer of property upon death, regardless of their wealth.

By addressing these misconceptions, individuals can make more informed decisions regarding the use of the Pennsylvania Transfer-on-Death Deed form in their estate planning efforts.

Some Other Transfer-on-Death Deed State Templates

Virginia Transfer on Death Deed - It can facilitate faster transitions of property to heirs, reducing administrative burdens on families.

For those seeking to understand liability protections, our guide on the "Arizona Hold Harmless Agreement" offers valuable insights into the legal framework that shields parties from potential risks related to various activities. This document can be essential when navigating contracts and agreements, ensuring that all participants are aware of their rights and responsibilities. For more details, visit this informational source.

Transfer on Death Deed Washington - Property owners should check state-specific rules, as regulations about Transfer-on-Death Deeds can vary.

Where Can I Get a Tod Form - It provides a simple way to convey ownership of property after passing.