Attorney-Verified Real Estate Purchase Agreement Document for Pennsylvania State

Common mistakes

-

Incomplete Information: Failing to fill in all required fields can lead to confusion and delays. Make sure every section is addressed, including names, addresses, and property details.

-

Incorrect Property Description: It’s essential to provide an accurate legal description of the property. Mistakes here can create issues during the closing process.

-

Missing Signatures: Both the buyer and seller must sign the agreement. Omitting a signature can render the document invalid.

-

Not Specifying Contingencies: Contingencies protect buyers. Failing to include them can leave buyers vulnerable if something goes wrong, like issues with financing or inspections.

-

Ignoring Deadlines: The agreement often includes specific timelines for actions like inspections and financing. Missing these deadlines can jeopardize the transaction.

-

Overlooking Earnest Money Details: It’s crucial to clearly state the amount of earnest money and the conditions for its return. Ambiguities can lead to disputes later.

-

Failing to Review Addenda: If there are additional agreements or amendments, they must be referenced in the main document. Not doing so can create confusion about the terms.

-

Neglecting to Understand Terms: Some terms may be unfamiliar. It’s important to seek clarification on any language that isn’t clear to ensure all parties are on the same page.

-

Not Consulting a Professional: While it’s possible to fill out the agreement independently, seeking advice from a real estate professional can help avoid costly mistakes.

Learn More on This Form

-

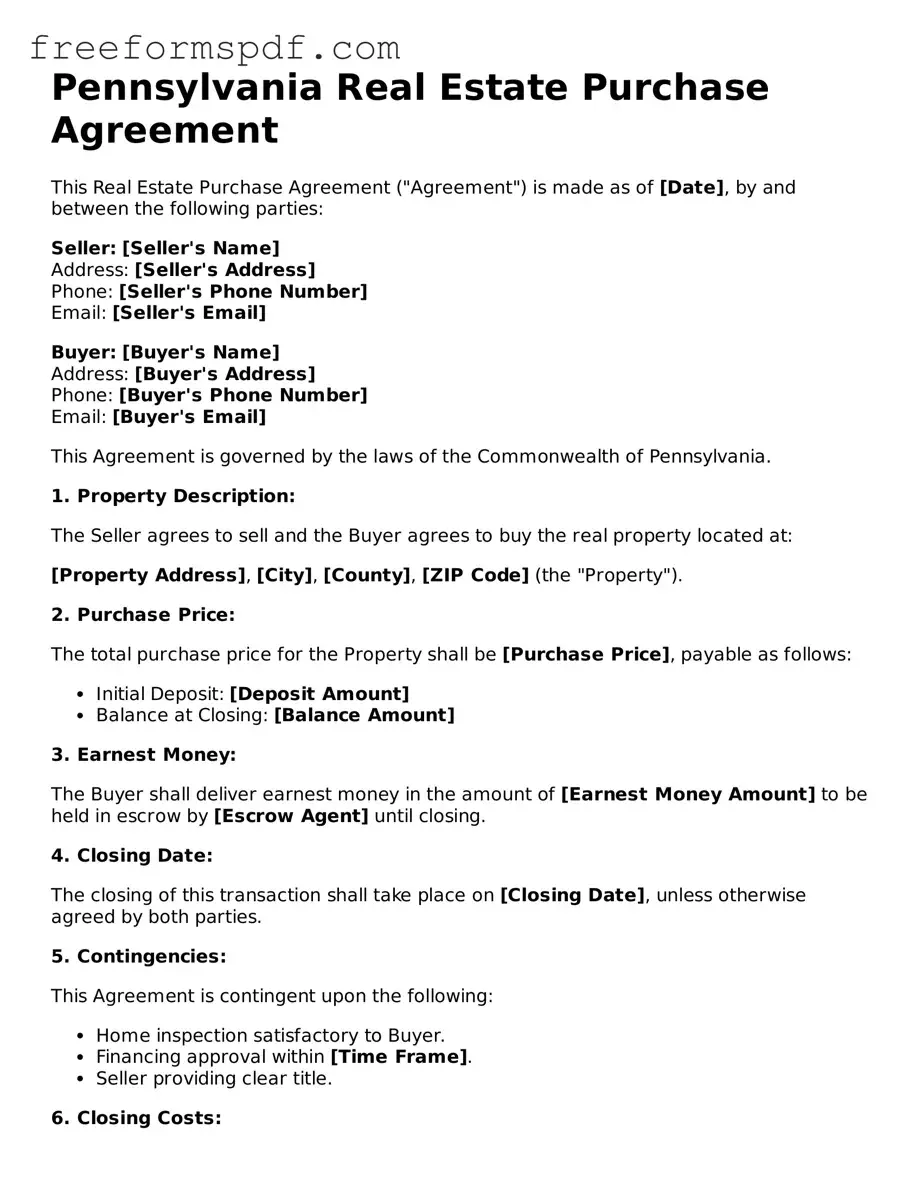

What is a Pennsylvania Real Estate Purchase Agreement?

The Pennsylvania Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement includes details such as the purchase price, closing date, and any contingencies that must be met before the sale is finalized.

-

What are the key components of this agreement?

Key components of the Pennsylvania Real Estate Purchase Agreement typically include:

- Identification of the buyer and seller

- Property description

- Purchase price

- Earnest money deposit

- Closing date

- Contingencies (such as financing, inspections, and appraisal)

- Disclosures and representations

-

What contingencies can be included?

Contingencies are conditions that must be met for the sale to proceed. Common contingencies in Pennsylvania include:

- Financing contingency: Allows the buyer to back out if they cannot secure a mortgage.

- Inspection contingency: Permits the buyer to conduct a home inspection and negotiate repairs or cancel the agreement based on the findings.

- Appraisal contingency: Protects the buyer if the property's appraised value is lower than the purchase price.

-

How is earnest money handled?

Earnest money is a deposit made by the buyer to demonstrate their commitment to purchasing the property. In Pennsylvania, this money is typically held in an escrow account until the transaction closes. If the sale goes through, the earnest money is applied to the purchase price. However, if the buyer backs out without a valid reason outlined in the agreement, they may forfeit this deposit.

-

Can the agreement be modified after signing?

Yes, the Pennsylvania Real Estate Purchase Agreement can be modified after it has been signed, but both parties must agree to any changes. Modifications should be documented in writing and signed by both the buyer and seller to ensure clarity and avoid disputes.

-

What happens if either party breaches the agreement?

If either party fails to fulfill their obligations under the agreement, it may be considered a breach. The non-breaching party may have several options, including:

- Seeking specific performance, which compels the breaching party to fulfill their contractual obligations.

- Claiming damages, which may include financial losses incurred due to the breach.

- Terminating the agreement, if allowed by the terms of the contract.

-

Is it advisable to have a lawyer review the agreement?

Yes, it is advisable to have a lawyer review the Pennsylvania Real Estate Purchase Agreement before signing. A legal expert can help ensure that the agreement is fair, that all necessary terms are included, and that the buyer's or seller's rights are protected throughout the transaction.

Misconceptions

Understanding the Pennsylvania Real Estate Purchase Agreement form is crucial for both buyers and sellers. However, several misconceptions can lead to confusion and potentially costly mistakes. Here are ten common misconceptions about this important document:

- It is a legally binding contract as soon as it is signed. Many believe that signing the agreement automatically makes it enforceable. In reality, the agreement may still be contingent on certain conditions, such as financing or inspections.

- All real estate transactions require a purchase agreement. While most do, some informal agreements or transactions between family members may not necessitate a formal purchase agreement.

- Once signed, the terms cannot be changed. This is not true. Parties can negotiate changes to the agreement, but all modifications must be documented and agreed upon by both parties.

- The seller must disclose all defects in the property. Sellers are required to disclose known issues, but they are not obligated to uncover every potential problem. Buyers should conduct their own inspections.

- The purchase agreement guarantees a specific closing date. While the agreement may include a target date, unforeseen circumstances can delay the closing process.

- Real estate agents are responsible for filling out the agreement. Agents can assist, but it is ultimately the responsibility of the parties involved to ensure the agreement accurately reflects their intentions.

- Only the buyer is responsible for closing costs. Both buyers and sellers may incur closing costs, and these should be clearly outlined in the agreement.

- The agreement is the same for every transaction. Each purchase agreement can vary significantly based on the specifics of the transaction, including price, contingencies, and local laws.

- Once the agreement is signed, the buyer cannot back out. Buyers may have the right to withdraw under certain conditions, such as failing to secure financing or unsatisfactory inspection results.

- The Pennsylvania Real Estate Purchase Agreement is a simple document. While it may seem straightforward, the legal implications and details require careful consideration and understanding.

By addressing these misconceptions, both buyers and sellers can navigate the real estate transaction process more effectively and with greater confidence.

Some Other Real Estate Purchase Agreement State Templates

Trec Website - Describes how the agreement can be amended or modified if necessary.

Oregon Real Estate Purchase Agreement - May include disclosures related to environmental hazards.

Purchase and Sale Agreement Washington State - It is advisable to consult a real estate professional when completing this form.

For anyone engaging in a vehicle sale, having the correct documentation is essential; that's where the Motor Vehicle Bill of Sale comes into play. This form acts as a vital record of the transaction, providing a complete account of the sale while protecting both the buyer and seller. To ensure you meet all requirements, consider using a template, which you can find at https://newyorkform.com/free-motor-vehicle-bill-of-sale-template/.

Virginia Real Estate Contract - This agreement is a vital tool for both parties to navigate the complexities of real estate transactions.