Attorney-Verified Quitclaim Deed Document for Pennsylvania State

Common mistakes

-

Not including the correct names of parties: It’s essential to accurately list the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property). Any misspellings or incorrect names can lead to complications.

-

Failing to provide a legal description of the property: A vague description can create confusion. Always include a precise legal description, which typically includes details like the lot number and county.

-

Neglecting to sign the document: Without the signature of the grantor, the deed is not valid. Ensure that the grantor signs the form in the appropriate section.

-

Not having the deed notarized: Pennsylvania requires that the Quitclaim Deed be notarized. Skipping this step can invalidate the document.

-

Overlooking the date of the transaction: The date when the deed is signed should be clearly indicated. This helps establish a timeline for the transfer of ownership.

-

Using the wrong form: Make sure you are using the correct Quitclaim Deed form for Pennsylvania. Each state may have specific requirements.

-

Failing to check for existing liens or encumbrances: Before transferring property, it’s crucial to verify that there are no outstanding debts or claims against it.

-

Not recording the deed: After filling out the Quitclaim Deed, it must be recorded at the county recorder’s office. Failing to do this means the transfer may not be recognized legally.

-

Ignoring state-specific requirements: Each state may have unique rules regarding Quitclaim Deeds. Familiarize yourself with Pennsylvania’s regulations to avoid mistakes.

-

Not consulting a professional: While it’s possible to fill out the form on your own, consulting a lawyer or real estate professional can help ensure everything is completed correctly.

Learn More on This Form

-

What is a Quitclaim Deed in Pennsylvania?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. In Pennsylvania, this type of deed does not guarantee that the property is free from claims or liens. Instead, it conveys whatever interest the grantor has in the property at the time of the transfer. This means that if the grantor does not have clear title, the grantee may not receive full ownership rights.

-

How do I complete a Quitclaim Deed in Pennsylvania?

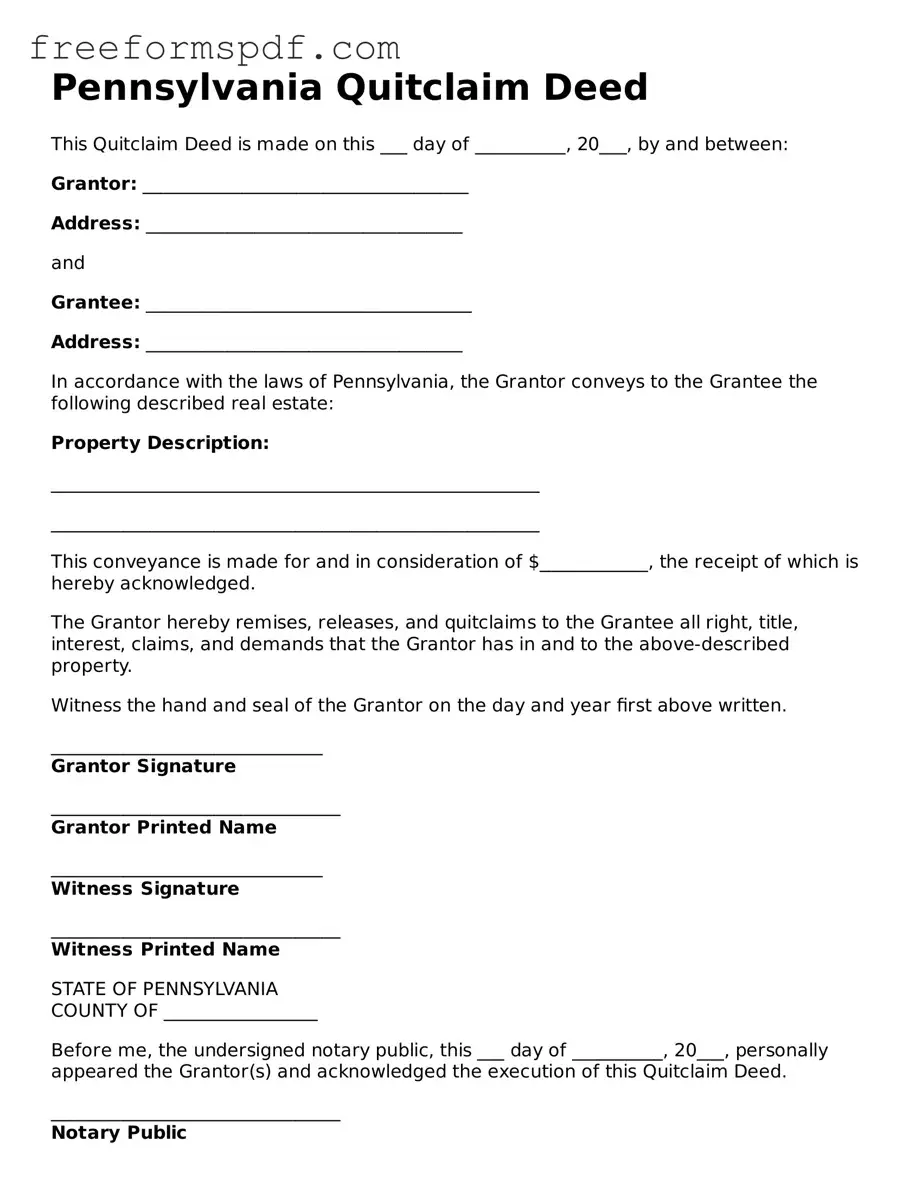

To complete a Quitclaim Deed in Pennsylvania, follow these steps:

- Obtain a Quitclaim Deed form, which can be found online or at local legal supply stores.

- Fill in the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide a legal description of the property being transferred. This description should match what is on the current deed.

- Sign the document in the presence of a notary public. Notarization is required for the deed to be legally valid.

-

Do I need to file the Quitclaim Deed with the county?

Yes, after completing the Quitclaim Deed, it must be filed with the county recorder of deeds where the property is located. This step is crucial for making the transfer official and ensuring that the new ownership is recognized publicly. There may be a filing fee, so it is advisable to check with the local office for specific requirements.

-

Are there any tax implications when using a Quitclaim Deed?

Using a Quitclaim Deed may have tax implications, particularly regarding transfer taxes. In Pennsylvania, a transfer tax is typically assessed on the transfer of real estate. The responsibility for paying this tax can vary, so it is important to clarify this with the parties involved. Consulting a tax professional or attorney can provide guidance specific to individual circumstances.

Misconceptions

Understanding the Pennsylvania Quitclaim Deed form can be challenging. Many people hold misconceptions about its purpose and use. Here are nine common misunderstandings:

- It transfers ownership without any guarantees. A quitclaim deed does transfer ownership, but it does so without any warranties. This means the grantor does not guarantee that they have clear title to the property.

- It is only used between family members. While quitclaim deeds are often used among family members, they can be used in various situations, including between strangers, in divorce settlements, or during estate planning.

- It is the same as a warranty deed. A warranty deed provides guarantees about the title, while a quitclaim deed does not. This key difference can have significant implications for the buyer.

- It is a complicated legal document. In reality, the quitclaim deed is relatively simple. It typically requires basic information about the parties involved and the property being transferred.

- It must be notarized to be valid. While notarization is recommended for a quitclaim deed to be accepted by the county, it is not strictly required for the document to be valid.

- It can be used to clear title defects. A quitclaim deed does not clear defects in the title. If there are issues with the title, a different type of deed or legal action may be necessary.

- It is not legally binding. A properly executed quitclaim deed is legally binding. It effectively transfers ownership from the grantor to the grantee once recorded.

- It does not need to be recorded. Recording the quitclaim deed is crucial. While it may not be legally required, failing to record it can lead to disputes about ownership.

- It can only be used for residential properties. Quitclaim deeds can be used for any type of property, including commercial real estate and vacant land, not just residential properties.

Understanding these misconceptions can help individuals make informed decisions when dealing with property transfers in Pennsylvania.

Some Other Quitclaim Deed State Templates

How to File a Quitclaim Deed in Virginia - Quitclaim Deeds are typically used when the exact value of the property remains uncertain.

For those seeking guidance on the legal aspects of vehicle transactions, the necessary Motor Vehicle Bill of Sale documentation is critical. This document not only serves to formalize the sale but also aids in complying with local regulations, ensuring a clear transfer of ownership rights.

Texas Quitclaim Deed Form - If no payment is exchanged, a Quitclaim Deed can still be valid.

Printable Quit Claim Deed Form - It is wise to consult a professional if there are unclear property ownership issues before using a Quitclaim Deed.

Quitclaim Deed Washington - By signing a Quitclaim Deed, the grantor effectively says, “I give you what I have.”