Attorney-Verified Promissory Note Document for Pennsylvania State

Common mistakes

-

Incomplete Borrower Information: Failing to provide all necessary details, such as full name, address, and contact information, can lead to confusion later.

-

Missing Lender Information: Just like the borrower, the lender's information must be complete. Omitting details can complicate the agreement.

-

Incorrect Loan Amount: Entering an incorrect figure for the loan amount can create disputes. Ensure the amount is accurate and clearly stated.

-

Failure to Specify Interest Rate: Not including an interest rate, or mistakenly writing it as zero, can lead to misunderstandings regarding repayment terms.

-

Omitting Payment Schedule: A clear payment schedule is crucial. Without it, both parties may have different expectations about when payments are due.

-

Neglecting to Include Late Fees: If applicable, late fees should be specified. Failing to do so might result in financial losses for the lender.

-

Not Signing the Document: The absence of signatures from both parties renders the document invalid. Ensure all required signatures are present.

-

Ignoring Witness or Notary Requirements: Depending on the situation, a witness or notary may be necessary. Not adhering to these requirements can invalidate the note.

-

Using Ambiguous Language: Vague terms can lead to misinterpretation. Clarity is essential in all sections of the document.

-

Failing to Keep Copies: Not retaining a copy of the signed promissory note can complicate future reference. Both parties should have a signed copy for their records.

Learn More on This Form

-

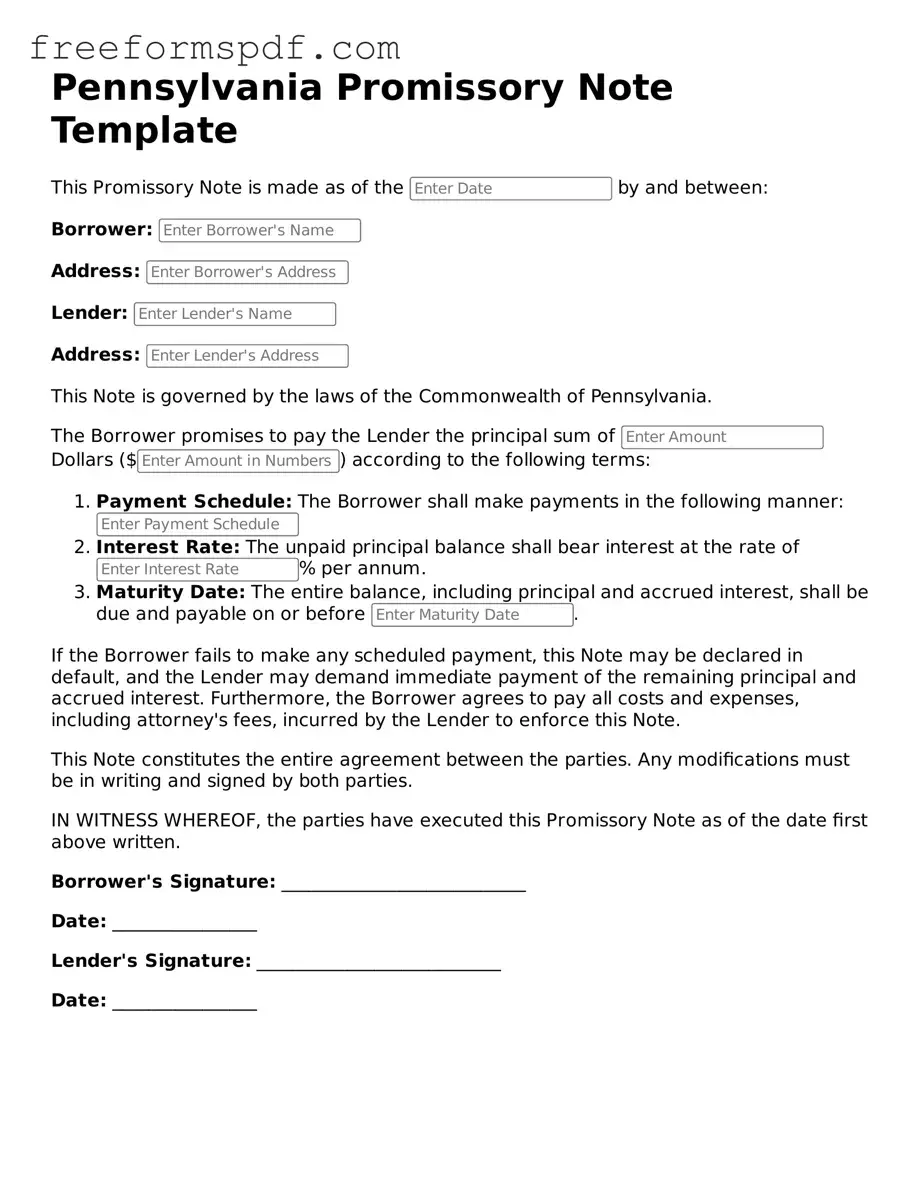

What is a Pennsylvania Promissory Note?

A Pennsylvania Promissory Note is a written agreement in which one party promises to pay a specific amount of money to another party at a predetermined time. It serves as a legal document that outlines the terms of the loan, including interest rates and repayment schedules.

-

Who can use a Promissory Note in Pennsylvania?

Any individual or business can use a Promissory Note in Pennsylvania. This includes personal loans between friends or family, as well as formal agreements between businesses and clients. It is essential that both parties understand the terms before signing.

-

What are the key components of a Promissory Note?

- The names and addresses of both the borrower and lender.

- The amount of money being borrowed.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Any collateral involved, if applicable.

- Signatures of both parties.

-

Is a Promissory Note legally binding?

Yes, a Promissory Note is legally binding as long as it meets certain criteria. Both parties must agree to the terms, and the document must be signed. If either party fails to adhere to the terms, the other party may take legal action to enforce the agreement.

-

Do I need a lawyer to create a Promissory Note?

While it's not required to have a lawyer, consulting one can be beneficial. A legal professional can help ensure that the note complies with Pennsylvania laws and meets your specific needs. However, many templates are available online for those who prefer to draft their own.

-

Can I modify a Promissory Note after it is signed?

Yes, you can modify a Promissory Note after it is signed, but both parties must agree to the changes. It’s best to document any modifications in writing and have both parties sign the amended agreement to avoid future disputes.

-

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has the right to take legal action. This may include filing a lawsuit to recover the owed amount. If the Promissory Note included collateral, the lender may also seek to seize the collateral to satisfy the debt.

-

Is there a statute of limitations on Promissory Notes in Pennsylvania?

Yes, in Pennsylvania, the statute of limitations for enforcing a Promissory Note is four years. This means that the lender has four years from the date of default to file a lawsuit to recover the debt.

-

Can I use a Promissory Note for business loans?

Absolutely. Promissory Notes are commonly used for business loans. They can help establish clear terms between lenders and businesses, ensuring that both parties understand their obligations and rights.

-

Where can I find a template for a Pennsylvania Promissory Note?

Templates for Pennsylvania Promissory Notes can be found online. Many legal websites offer free or paid templates that you can customize. Ensure that any template you choose complies with Pennsylvania laws and meets your specific needs.

Misconceptions

Understanding the Pennsylvania Promissory Note form is crucial for anyone involved in lending or borrowing money. Unfortunately, several misconceptions can lead to confusion and potential legal issues. Here are eight common misunderstandings:

- It must be notarized. Many believe that a promissory note needs to be notarized to be valid. In Pennsylvania, notarization is not required for the note to be enforceable, although having it notarized can provide additional legal protection.

- Only banks can issue promissory notes. This is not true. Individuals can create promissory notes as well, allowing for personal loans between friends, family, or business partners.

- Verbal agreements are sufficient. While verbal agreements can be legally binding, they are difficult to enforce. A written promissory note provides clear evidence of the terms agreed upon.

- All promissory notes are the same. Promissory notes can vary significantly in terms of interest rates, repayment schedules, and other conditions. It's essential to tailor the document to fit the specific agreement.

- They can only be used for large sums of money. Promissory notes can be used for any amount, whether it's a few hundred dollars or thousands. The key is that both parties agree to the terms.

- Once signed, a promissory note cannot be changed. While it's true that modifications can complicate things, parties can amend the terms of a promissory note if both agree and sign the changes.

- Promissory notes are only for personal loans. These notes are also commonly used in business transactions, making them versatile tools in both personal and commercial lending.

- Defaulting on a promissory note has no consequences. Failing to repay a promissory note can lead to serious repercussions, including legal action and damage to credit scores. It's vital to understand the obligations involved.

By clearing up these misconceptions, individuals can approach promissory notes with greater confidence and understanding. Always consider consulting with a legal professional to ensure that your promissory note meets all necessary requirements and protects your interests.

Some Other Promissory Note State Templates

Promissory Note Template Washington State - It ensures that both parties have a written record of the agreement, reducing ambiguity.

The NYCERS F170 form is essential for eligible EMT members seeking to make informed retirement decisions. It enables Tier 1 and Tier 4 members to utilize the Optional 25-Year Retirement Program, allowing for a streamlined transition into retirement. For those interested in further exploring the requirements and procedure, it's advisable to visit resources like NY Templates for comprehensive guidance.

New York Promissory Note - Borrowers are encouraged to seek advice if they do not fully understand the document.