Attorney-Verified Operating Agreement Document for Pennsylvania State

Common mistakes

-

Not Including All Members: One common mistake is failing to list all members of the LLC. Every individual or entity that has a stake in the company should be included in the agreement.

-

Omitting Capital Contributions: Some individuals neglect to specify the capital contributions made by each member. This information is crucial as it establishes ownership percentages and financial responsibilities.

-

Ignoring Profit and Loss Distribution: Failing to outline how profits and losses will be distributed among members can lead to disputes later. Clearly defining this aspect helps manage expectations.

-

Not Addressing Management Structure: Many overlook the importance of detailing the management structure of the LLC. Whether it is member-managed or manager-managed should be clearly stated.

-

Missing Procedures for Adding New Members: Some agreements do not include procedures for admitting new members. Establishing a clear process can prevent confusion and conflict in the future.

-

Neglecting to Include Buyout Provisions: Not including buyout provisions can be a significant oversight. These provisions outline how a member can exit the LLC and how their share will be valued.

-

Failing to Update the Agreement: An outdated agreement can lead to problems. Members should regularly review and update the operating agreement to reflect any changes in the business or membership.

-

Not Seeking Legal Guidance: Some individuals attempt to fill out the form without seeking legal advice. Consulting with a professional can help ensure that the agreement meets all legal requirements.

-

Overlooking State-Specific Requirements: Each state has unique requirements for operating agreements. Failing to adhere to Pennsylvania's specific regulations can render the agreement ineffective.

Learn More on This Form

-

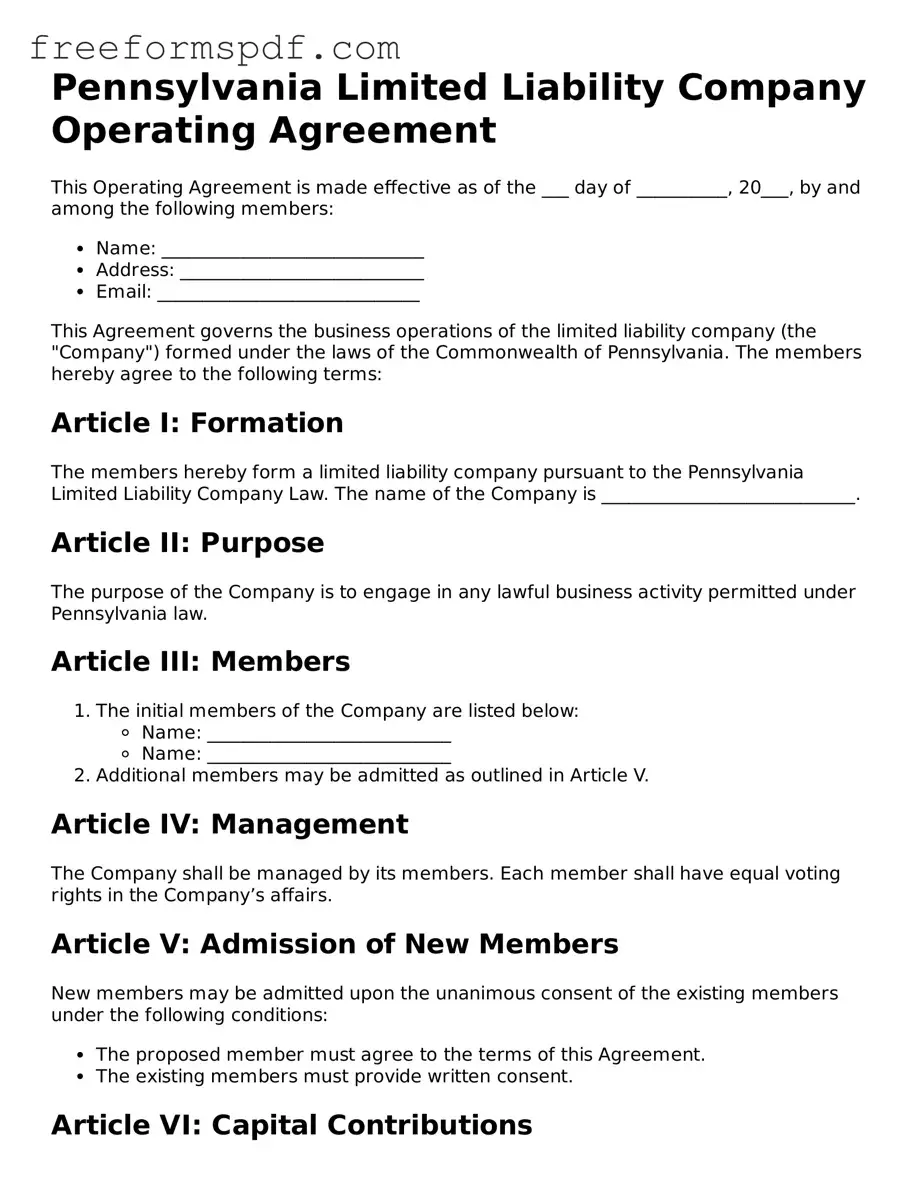

What is a Pennsylvania Operating Agreement?

A Pennsylvania Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Pennsylvania. It serves as a foundational agreement among the members of the LLC, detailing their rights, responsibilities, and obligations. This agreement is crucial for ensuring that all members are on the same page regarding the operations of the business.

-

Is an Operating Agreement required in Pennsylvania?

While Pennsylvania does not legally require LLCs to have an Operating Agreement, it is highly recommended. Having this document can help prevent misunderstandings among members and provide a clear framework for decision-making and conflict resolution. Without it, the LLC will be governed by state laws, which may not reflect the specific intentions of the members.

-

What should be included in the Operating Agreement?

An Operating Agreement should typically include:

- The name and address of the LLC

- The purpose of the LLC

- The names of the members and their respective ownership percentages

- Management structure (member-managed or manager-managed)

- Voting rights and procedures

- Distribution of profits and losses

- Procedures for adding or removing members

- Dispute resolution mechanisms

Including these elements will help ensure clarity and prevent future disputes.

-

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. The process for making changes should be outlined within the agreement itself. Typically, amendments require the approval of a certain percentage of the members, which should also be specified in the document. It is essential to follow the agreed-upon process to ensure that all members are aware of and consent to the changes.

-

How does the Operating Agreement affect the LLC's operations?

The Operating Agreement provides a roadmap for how the LLC will be managed and operated. It establishes rules for decision-making, profit distribution, and member responsibilities. By adhering to the Operating Agreement, members can avoid conflicts and ensure that the business runs smoothly. Additionally, having a well-drafted agreement can enhance the LLC's credibility with banks and investors.

-

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, it will be subject to Pennsylvania's default LLC laws. These laws may not align with the members' intentions and could lead to complications in management and profit-sharing. Moreover, the absence of a clear agreement may result in disputes that could have been easily avoided with a properly drafted document.

-

How can I create a Pennsylvania Operating Agreement?

Creating a Pennsylvania Operating Agreement can be done in several ways. Members can draft the agreement themselves, using templates available online, or they may choose to consult with an attorney for personalized assistance. Regardless of the method chosen, it is crucial to ensure that the agreement is comprehensive and tailored to the specific needs of the LLC and its members.

Misconceptions

Understanding the Pennsylvania Operating Agreement form is crucial for anyone involved in a limited liability company (LLC) in the state. However, several misconceptions can lead to confusion. Here are eight common misconceptions explained:

- It's a mandatory document for all LLCs. Many believe that an Operating Agreement is required by law in Pennsylvania. While it is not mandatory, having one is highly recommended to outline the management structure and operational procedures.

- Only large LLCs need an Operating Agreement. Some think that only bigger companies need this document. In reality, all LLCs, regardless of size, benefit from having clear guidelines established in an Operating Agreement.

- Operating Agreements are only for multi-member LLCs. This is a common misconception. Even single-member LLCs can and should have an Operating Agreement to clarify ownership and operational procedures.

- The Operating Agreement must be filed with the state. Many believe that the Operating Agreement needs to be submitted to the Pennsylvania Department of State. In fact, it is an internal document that remains with the LLC and is not filed with any state agency.

- Once created, the Operating Agreement cannot be changed. Some people think that an Operating Agreement is set in stone. However, it can be amended as needed, provided that all members agree to the changes.

- The Operating Agreement covers all legal aspects of the LLC. While it addresses many operational details, it does not replace other legal documents or compliance requirements. It is essential to understand that it works in conjunction with state laws and regulations.

- It only addresses financial matters. This misconception overlooks the broader scope of the Operating Agreement. It also covers management structure, member roles, and procedures for decision-making, among other important aspects.

- Creating an Operating Agreement is overly complicated. Many fear that drafting an Operating Agreement is a daunting task. In reality, it can be straightforward, especially with templates available and the option to consult professionals for guidance.

By clarifying these misconceptions, individuals can better appreciate the importance of an Operating Agreement and ensure their LLC operates smoothly and effectively.

Some Other Operating Agreement State Templates

Create an Operating Agreement - This document serves as a legal reference for the LLC.

How to Create an Operating Agreement - The Operating Agreement is an essential tool for long-term business planning.

Nyc Llc - An Operating Agreement protects the limited liability status of the LLC.

To facilitate the application process, prospective tenants can utilize resources like the NY Templates, which offer guidance on filling out the NYC Housing Application Form effectively. This support can help ensure that all necessary information is accurately provided, improving the chances of securing a unit in the competitive market of New York City.

Operating Agreement Llc Texas Template - An Operating Agreement reinforces the business's credibility.