Attorney-Verified Motor Vehicle Bill of Sale Document for Pennsylvania State

Common mistakes

-

Incomplete Information: Failing to fill in all required fields can lead to issues. Every section must be addressed, including the buyer's and seller's names, addresses, and vehicle details.

-

Incorrect Vehicle Identification Number (VIN): Double-check the VIN. A simple typo can cause confusion and may complicate the registration process.

-

Omitting Signatures: Both the buyer and seller must sign the document. Without signatures, the bill of sale is not valid.

-

Not Including the Date: The date of the transaction is crucial. Leaving it blank can lead to disputes about when the sale occurred.

-

Ignoring Odometer Reading: The odometer reading must be accurately recorded. This protects both parties and ensures compliance with state regulations.

-

Using Incorrect Payment Details: Clearly state the payment method and amount. Vague or incorrect information can lead to misunderstandings.

-

Not Keeping Copies: After completing the form, both parties should retain copies. This provides proof of the transaction and can be important for future reference.

-

Failing to Check Local Regulations: Different counties may have specific requirements. Always verify local rules to ensure compliance.

Learn More on This Form

-

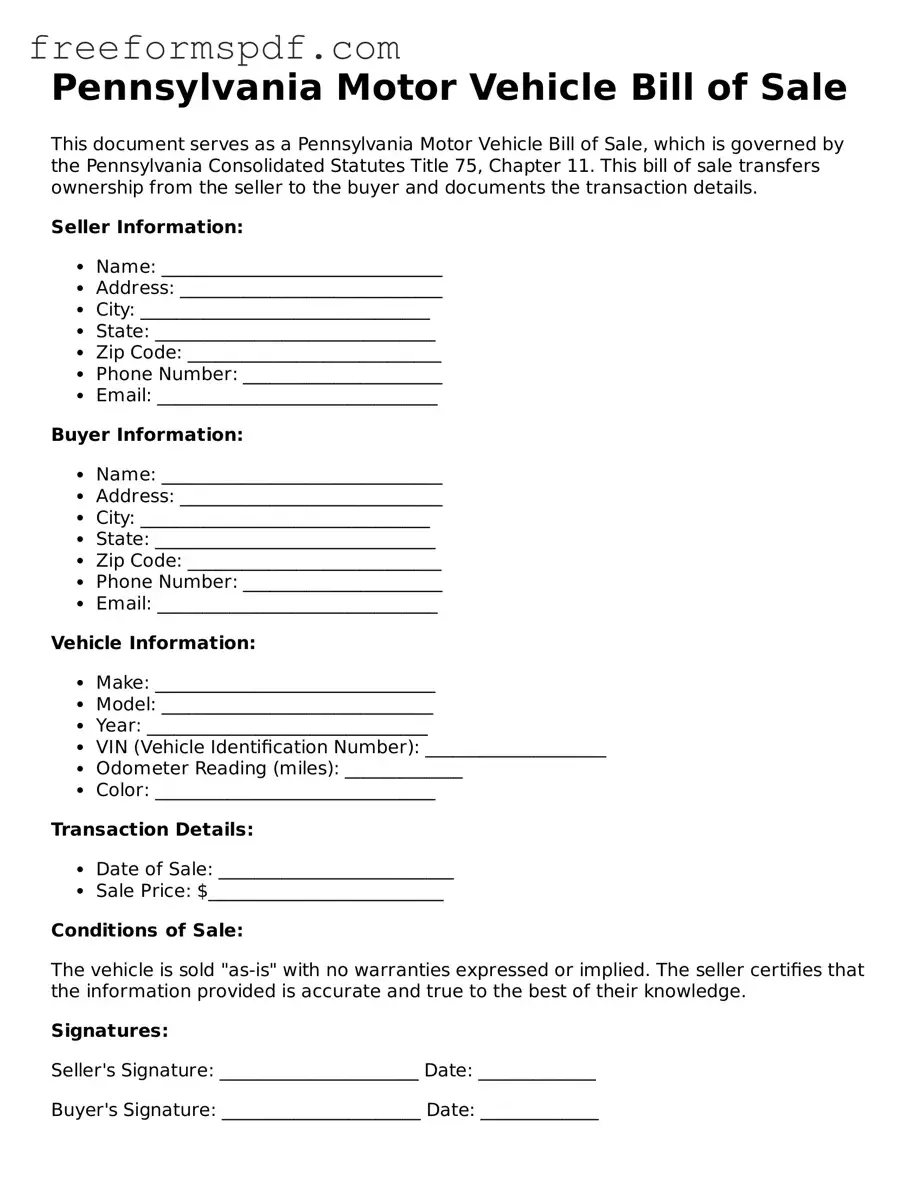

What is a Pennsylvania Motor Vehicle Bill of Sale?

The Pennsylvania Motor Vehicle Bill of Sale is a legal document that records the transfer of ownership of a vehicle from one party to another. This form serves as proof of the transaction and includes essential details about the vehicle, the buyer, and the seller.

-

Why do I need a Bill of Sale?

A Bill of Sale is important for several reasons. It protects both the buyer and the seller by providing a written record of the transaction. This document can also be used to establish ownership when registering the vehicle with the state, and it may be required for tax purposes.

-

What information is required on the Bill of Sale?

The Bill of Sale should include the following information:

- The names and addresses of both the buyer and the seller

- The vehicle identification number (VIN)

- The make, model, and year of the vehicle

- The sale price

- The date of the sale

-

Is the Bill of Sale required to register my vehicle?

Yes, when registering a vehicle in Pennsylvania, a Bill of Sale is typically required. This document helps establish that the buyer has legally acquired the vehicle and is necessary for the registration process.

-

Can I create my own Bill of Sale?

While you can create your own Bill of Sale, it is recommended to use a standard form to ensure that all necessary information is included and that it complies with Pennsylvania laws. Many resources are available online that provide templates for this document.

-

Do I need to have the Bill of Sale notarized?

In Pennsylvania, notarization is not typically required for a Bill of Sale. However, having the document notarized can add an extra layer of security and legitimacy to the transaction.

-

What if the vehicle has a lien?

If there is a lien on the vehicle, it is crucial to address it before completing the sale. The seller must ensure that the lien is satisfied, or the buyer should be made aware of it. The Bill of Sale should clearly state any existing liens to avoid future complications.

-

How do I obtain a copy of the Bill of Sale?

Both the buyer and seller should keep a copy of the Bill of Sale for their records. After the sale, it is advisable to make copies of the signed document, ensuring that both parties have access to the information contained within it.

-

What should I do if I lose my Bill of Sale?

If the Bill of Sale is lost, the parties involved may need to create a new document to replace it. Both the buyer and seller should agree on the details and sign the new Bill of Sale. It is important to keep a secure copy to avoid future issues.

Misconceptions

The Pennsylvania Motor Vehicle Bill of Sale form is a crucial document for anyone buying or selling a vehicle in the state. However, several misconceptions often arise regarding its use and requirements. Here are four common misunderstandings:

- It is not necessary for private sales. Many people believe that a Bill of Sale is optional for private vehicle transactions. In Pennsylvania, a Bill of Sale is actually recommended, as it provides proof of the transaction and can protect both the buyer and seller in case of disputes.

- Only the seller needs to sign the form. Some assume that only the seller's signature is required on the Bill of Sale. In reality, both the buyer and seller should sign the document to validate the sale and acknowledge the transfer of ownership.

- The form must be notarized. There is a misconception that the Bill of Sale must be notarized to be valid. While notarization can add an extra layer of authenticity, it is not a legal requirement in Pennsylvania for the Bill of Sale to be effective.

- It is only necessary for used vehicles. Many people think that the Bill of Sale is only relevant for used cars. However, it is equally important for new vehicle purchases, as it serves as a record of the transaction and can be useful for warranty purposes and future registrations.

Understanding these misconceptions can help facilitate smoother transactions and ensure that both parties are adequately protected during the sale of a vehicle.

Some Other Motor Vehicle Bill of Sale State Templates

Washington Bill of Sale No Title - Clarifying the payment method in the form can help provide transparency.

How to Sell Your Car in Oregon - Can highlight any liens on the vehicle if applicable.

For those looking to streamline their hiring processes, the Employment Verification form is an indispensable tool for confirming employment status. This document is vital in ensuring that relevant information is accurately verified, aiding in making informed hiring decisions. You can find an excellent resource to help you with this form at customized Employment Verification template.

Vehicle Bill of Sale Virginia - The document may also include any conditions agreed upon during the sale process.