Attorney-Verified Mobile Home Bill of Sale Document for Pennsylvania State

Common mistakes

-

Incorrect Owner Information: One common mistake is failing to provide accurate details about the current owner of the mobile home. This includes the name, address, and contact information. Double-checking this information ensures that the ownership transfer goes smoothly.

-

Missing Buyer Details: Just as it's important to list the seller's information, buyers must also be correctly identified. Omitting the buyer's name or providing incorrect details can lead to complications later on.

-

Omitting the VIN: The Vehicle Identification Number (VIN) is crucial for identifying the mobile home. Failing to include this number can create issues when registering the home or transferring ownership.

-

Not Specifying Payment Terms: It's essential to clearly outline the payment terms in the bill of sale. Whether it's a full payment upfront or an installment plan, clarity helps prevent misunderstandings.

-

Neglecting Signatures: Both the seller and buyer must sign the document. Forgetting to include signatures can invalidate the sale and create legal issues.

-

Failure to Date the Document: The date of the transaction is a key detail. Not including the date can lead to confusion about when the sale occurred, affecting warranties or other time-sensitive issues.

Learn More on This Form

-

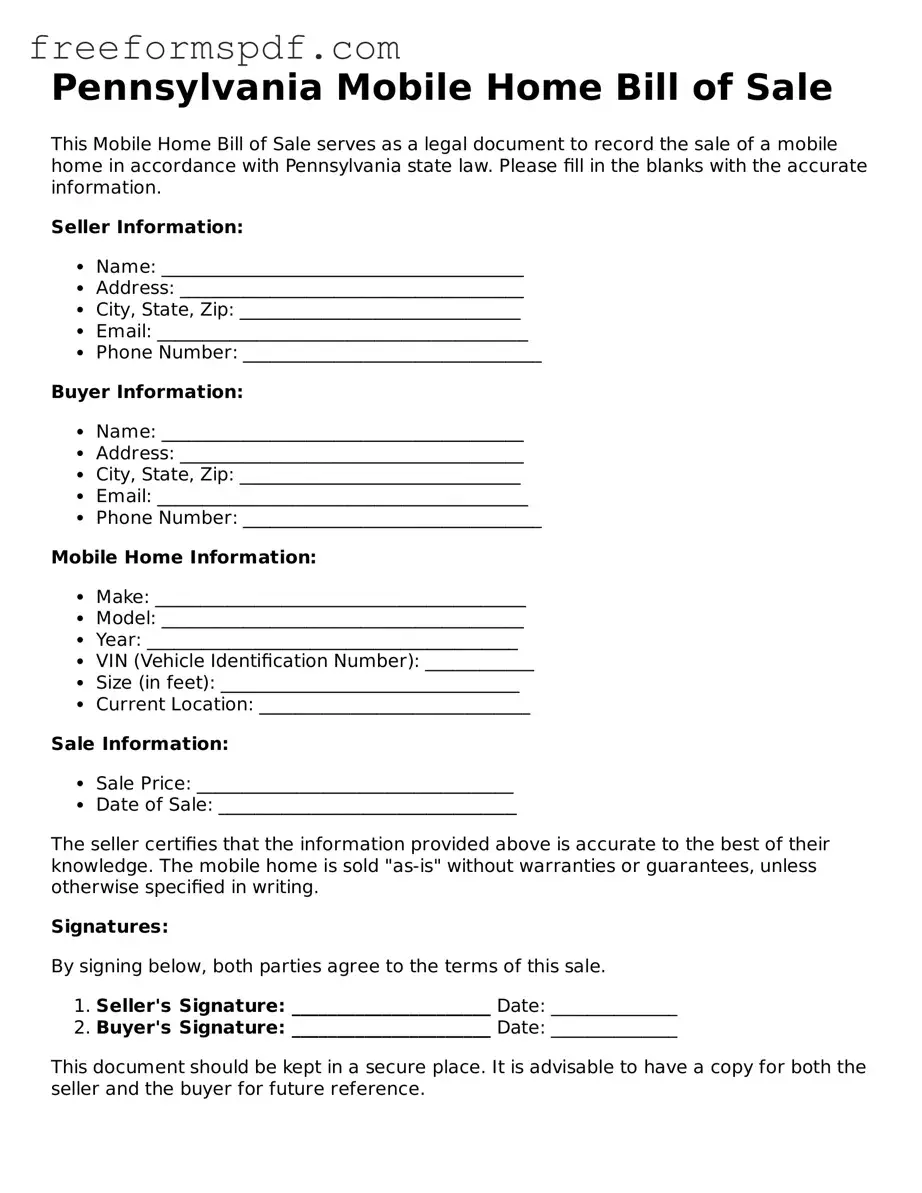

What is a Pennsylvania Mobile Home Bill of Sale?

A Pennsylvania Mobile Home Bill of Sale is a legal document that records the transfer of ownership of a mobile home from one party to another. This form serves as proof of the transaction and includes details about the mobile home, the buyer, and the seller.

-

Why do I need a Bill of Sale for my mobile home?

The Bill of Sale is important for several reasons. It provides a clear record of the transaction, protects both the buyer and seller, and is often required for registration and titling purposes with the state. It also helps establish the sale price and any terms agreed upon.

-

What information is included in the form?

The form typically includes the following information:

- The names and addresses of the buyer and seller

- The make, model, year, and identification number of the mobile home

- The sale price

- The date of the sale

- Any warranties or conditions of the sale

-

Is the Bill of Sale required by law in Pennsylvania?

While a Bill of Sale is not legally required for all mobile home transactions in Pennsylvania, it is highly recommended. Having a written record can help resolve disputes and is often necessary for titling the mobile home with the state.

-

How do I fill out the form?

To fill out the form, provide accurate information in each section. Ensure that all parties involved sign and date the document. It’s advisable to double-check all details for accuracy before finalizing the sale.

-

Do I need to have the Bill of Sale notarized?

Notarization is not typically required for a Pennsylvania Mobile Home Bill of Sale. However, having the document notarized can add an extra layer of authenticity and may be beneficial if disputes arise in the future.

-

Can I use a generic Bill of Sale form?

While a generic Bill of Sale can be used, it is best to use a form specifically designed for mobile homes. This ensures that all necessary information is included and complies with Pennsylvania regulations.

-

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should keep a copy for their records. The buyer may also need to take the document to their local Department of Transportation or relevant agency to register the mobile home in their name.

-

Where can I obtain a Pennsylvania Mobile Home Bill of Sale form?

You can obtain a Pennsylvania Mobile Home Bill of Sale form from various sources, including legal form websites, local government offices, or legal stationery stores. Ensure that the form you choose is compliant with Pennsylvania laws.

-

What if I have more questions?

If you have additional questions, consider consulting with a legal professional or your local government office. They can provide specific guidance tailored to your situation and ensure that you meet all legal requirements.

Misconceptions

Understanding the Pennsylvania Mobile Home Bill of Sale form is essential for anyone involved in the buying or selling of mobile homes. However, several misconceptions often cloud this topic. Below are eight common misunderstandings about the form, along with clarifications to help you navigate the process more effectively.

- 1. A Bill of Sale is not necessary for mobile home transactions. Some people believe that a Bill of Sale is optional. In Pennsylvania, it is a critical document that serves as proof of ownership and is necessary for registering the mobile home.

- 2. The form can be handwritten without any issues. While it might be tempting to jot down the details on a scrap piece of paper, using a standardized form is important. A properly completed form ensures all necessary information is included and reduces the risk of disputes.

- 3. Only the seller needs to sign the Bill of Sale. This is incorrect. Both the seller and the buyer must sign the document to validate the transaction and acknowledge the transfer of ownership.

- 4. The Bill of Sale does not need to be notarized. Many assume notarization is not required. However, having the document notarized can provide an additional layer of protection and authenticity, making it more credible in legal situations.

- 5. The form is the same for all mobile homes. Different types of mobile homes may require specific forms or additional information. It is essential to use the correct version that corresponds to the type of mobile home being sold.

- 6. The Bill of Sale is only for private sales. Some believe that this document is only necessary for transactions between private individuals. In reality, it is also required for sales through dealerships and other commercial entities.

- 7. The Bill of Sale does not affect taxes. This misconception can lead to unexpected tax liabilities. The Bill of Sale is often used to determine the taxable value of the mobile home, so it is crucial to report the sale accurately.

- 8. Once the Bill of Sale is signed, the transaction is complete. While signing the Bill of Sale is a significant step, it is not the final one. The buyer must also register the mobile home with the appropriate state agency to complete the transfer of ownership legally.

By dispelling these misconceptions, buyers and sellers can approach the mobile home transaction process with greater confidence and clarity.

Some Other Mobile Home Bill of Sale State Templates

Bill of Sale Mobile Home - Both the buyer and seller sign the mobile home bill of sale to validate the transaction.

The New York DTF-84 form is essential for businesses looking to secure sales tax benefits within designated Empire Zones, allowing them to thrive and grow while navigating the complexities of tax regulations. To gain these advantages, organizations must ensure they meet the necessary employment criteria, making the completion of the New York Dtf 84 form a critical step in accessing the support and resources available to Qualified Empire Zone Enterprises.

Manufactured Home Transfer of Ownership - Reinforces the legitimacy of the sale.