Attorney-Verified Deed in Lieu of Foreclosure Document for Pennsylvania State

Common mistakes

-

Failing to provide accurate property information. Ensure that the legal description of the property matches the records.

-

Not including all necessary parties. All individuals listed on the mortgage must sign the deed.

-

Omitting the date of execution. This date is crucial for establishing the timeline of the transaction.

-

Neglecting to have the document notarized. A notary's signature is often required for the deed to be legally binding.

-

Using incorrect terminology. Ensure that terms like "grantor" and "grantee" are used correctly to avoid confusion.

-

Not reviewing local laws and regulations. Different municipalities may have specific requirements for deeds.

-

Failing to consult with a legal advisor. Professional guidance can help avoid costly mistakes.

-

Overlooking potential tax implications. Understanding the tax consequences of a deed in lieu of foreclosure is essential.

-

Not keeping copies of the signed document. Retain a copy for personal records and future reference.

-

Assuming the lender will automatically accept the deed. Always confirm acceptance with the lender prior to submission.

Learn More on This Form

-

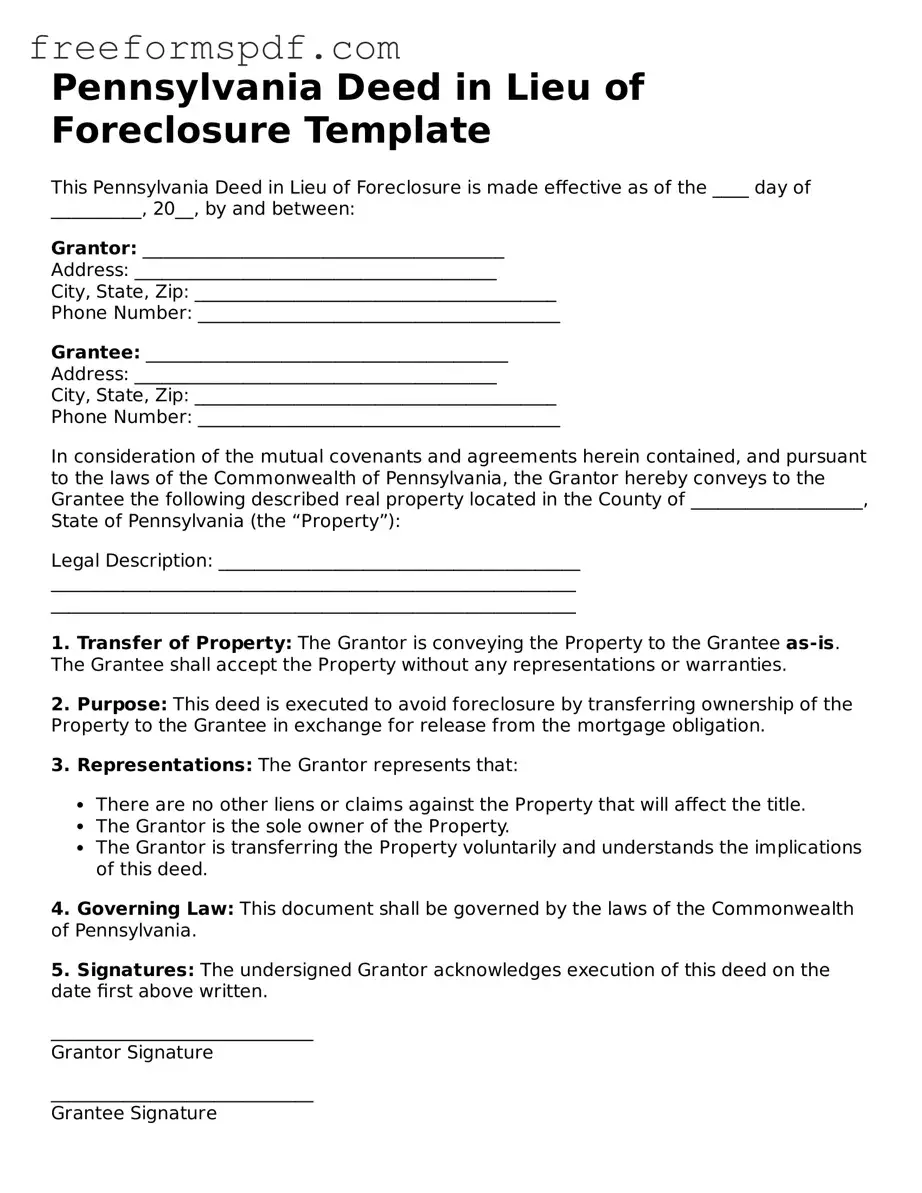

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer ownership of their property to the lender in order to avoid foreclosure. This option is often pursued when a homeowner is struggling to make mortgage payments and wants to mitigate the negative impact of foreclosure on their credit score. By agreeing to a deed in lieu, the homeowner can potentially walk away from the mortgage obligation and avoid the lengthy foreclosure process.

-

What are the benefits of choosing a Deed in Lieu of Foreclosure?

There are several benefits to consider:

- Credit Impact: A deed in lieu typically has a less severe impact on your credit score compared to a foreclosure.

- Time-Saving: The process is usually quicker than foreclosure, allowing homeowners to resolve their situation more efficiently.

- Relief from Debt: Homeowners can be released from their mortgage obligations, giving them a fresh start.

- Potential for Cash Incentives: Some lenders may offer cash incentives to homeowners who choose this option, helping with moving costs or other expenses.

-

What are the requirements to qualify for a Deed in Lieu of Foreclosure?

To qualify for a Deed in Lieu of Foreclosure, homeowners generally need to meet certain criteria, which may include:

- Proof of financial hardship, such as job loss or medical expenses.

- Documentation of the property’s current condition and market value.

- Demonstrating that the property is not encumbered by other liens or debts.

- Willingness to vacate the property and return it to the lender.

It's important to communicate openly with your lender and provide all necessary documentation to facilitate the process.

-

How does the process work?

The process for executing a Deed in Lieu of Foreclosure typically involves several steps:

- Contact the Lender: Reach out to your mortgage lender to express your interest in a deed in lieu.

- Submit Required Documentation: Provide financial information and any other documents requested by the lender.

- Property Evaluation: The lender may evaluate the property to determine its value and condition.

- Sign the Deed: If approved, both parties will sign the deed, transferring ownership from the homeowner to the lender.

- Vacate the Property: The homeowner must then vacate the property, leaving it in good condition.

Throughout this process, maintaining open lines of communication with your lender can help ensure a smoother transition.

Misconceptions

The Deed in Lieu of Foreclosure is a legal tool used by homeowners facing foreclosure. However, several misconceptions surround this process, particularly in Pennsylvania. Understanding these misconceptions can help homeowners make informed decisions. Below are seven common misunderstandings about the Pennsylvania Deed in Lieu of Foreclosure.

-

It eliminates all debt immediately.

Many believe that signing a Deed in Lieu automatically clears all mortgage debt. In reality, while it may relieve the homeowner from the mortgage obligation, it does not eliminate any other debts or liens associated with the property.

-

It is a quick and easy solution.

While a Deed in Lieu can be faster than traditional foreclosure, it still requires negotiation with the lender. The process can be lengthy and complicated, depending on the lender's policies and the homeowner's situation.

-

All lenders accept Deeds in Lieu.

Not all lenders are willing to accept a Deed in Lieu of Foreclosure. Some may prefer to proceed with foreclosure, particularly if they believe they can recover more through that process.

-

It has no impact on credit scores.

Homeowners often think that a Deed in Lieu will not affect their credit scores. However, it typically results in a negative impact, similar to a foreclosure, as it indicates to creditors that the borrower was unable to meet their mortgage obligations.

-

It is the same as a short sale.

A Deed in Lieu is not the same as a short sale. In a short sale, the property is sold for less than the amount owed on the mortgage, with the lender's approval. In contrast, a Deed in Lieu involves transferring ownership back to the lender without a sale.

-

It absolves the homeowner of all liability.

Homeowners may think that once they sign a Deed in Lieu, they are free from all liabilities. However, if there are other debts or liens on the property, those responsibilities may still remain.

-

It is only for homeowners in extreme financial distress.

While many homeowners seeking a Deed in Lieu are indeed facing financial hardship, it is not exclusively for those in dire situations. Homeowners who anticipate difficulties may also consider this option as a proactive measure.

Some Other Deed in Lieu of Foreclosure State Templates

Deed in Lieu Vs Foreclosure - Transparency with lenders is important when considering this deed to ensure a smooth transaction.

The New York Trailer Bill of Sale form is essential for anyone looking to sell or buy a trailer, providing a clear record of the transaction details. It serves not only as proof of purchase but also affirms the seller's right to sell and the buyer's ownership upon completion of the sale. For those interested in obtaining a template for this legal document, you can visit newyorkform.com/free-trailer-bill-of-sale-template/, which is crucial for the registration or transfer of a trailer's title in New York.

Deed in Lieu of Foreclosure Ny - The Deed in Lieu serves as a solution for distressed homeowners facing financial hardship.