Attorney-Verified Articles of Incorporation Document for Pennsylvania State

Common mistakes

-

Incorrect Entity Name: Choosing a name that is already in use or does not comply with Pennsylvania naming requirements can lead to rejection. Ensure the name is unique and includes the appropriate designator, such as "Inc." or "Corporation."

-

Missing Registered Office Address: Failing to provide a complete and accurate address for the registered office can cause delays. This address must be a physical location in Pennsylvania, not a P.O. Box.

-

Inaccurate Purpose Statement: The purpose of the corporation must be clearly defined. Vague or overly broad statements may not meet state requirements. Specify the business activities the corporation will engage in.

-

Omitting Incorporators' Information: All incorporators must be listed with their names and addresses. Missing this information can lead to the rejection of the application.

-

Failure to Include Initial Directors: If the corporation will have a board of directors, the initial directors must be named in the Articles. Omitting this information can create complications in governance.

-

Improper Signature: The Articles must be signed by an authorized incorporator. If the signature is missing or not from a qualified individual, the submission may be invalid.

-

Neglecting Filing Fees: Not including the correct filing fee can delay the incorporation process. Verify the fee amount and ensure payment is submitted with the application.

Learn More on This Form

-

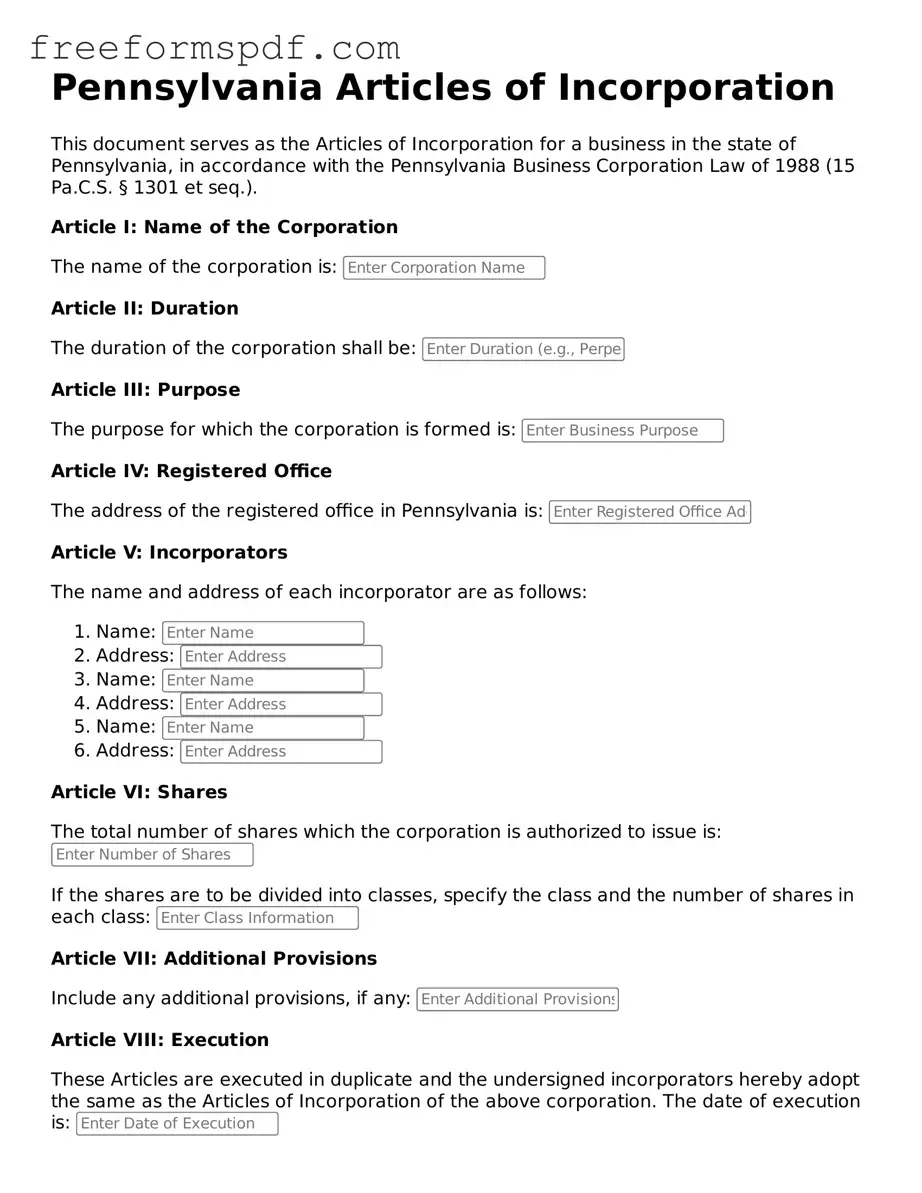

What is the Pennsylvania Articles of Incorporation form?

The Pennsylvania Articles of Incorporation form is a legal document that establishes a corporation in the state of Pennsylvania. It outlines essential information about the corporation, including its name, purpose, registered office address, and details about its incorporators.

-

Who needs to file the Articles of Incorporation?

Any individual or group wishing to form a corporation in Pennsylvania must file the Articles of Incorporation. This includes businesses, non-profits, and other organizations that seek to operate as a corporation under state law.

-

What information is required on the form?

The form typically requires the following information:

- The name of the corporation

- The purpose of the corporation

- The address of the registered office

- The names and addresses of the incorporators

- Details about the shares the corporation is authorized to issue

-

How do I file the Articles of Incorporation?

You can file the Articles of Incorporation online or by mail. If filing online, visit the Pennsylvania Department of State's website to access the appropriate forms. If filing by mail, complete the form and send it to the Department of State along with the required filing fee.

-

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation varies depending on the type of corporation being formed. Generally, the fee is around $125, but it is advisable to check the latest fee schedule on the Pennsylvania Department of State's website for the most accurate information.

-

How long does it take to process the Articles of Incorporation?

The processing time can vary. Typically, online filings are processed more quickly, often within a few business days. Mail submissions may take longer, sometimes up to several weeks. For expedited processing, additional fees may apply.

-

Do I need an attorney to file the Articles of Incorporation?

While it is not legally required to have an attorney, consulting with one can be beneficial. An attorney can help ensure that the Articles of Incorporation are completed accurately and that all necessary legal requirements are met.

-

What happens after the Articles of Incorporation are filed?

Once the Articles of Incorporation are approved, the corporation is officially formed. You will receive a certificate of incorporation from the state. After this, you will need to comply with other requirements, such as obtaining an Employer Identification Number (EIN) and creating corporate bylaws.

Misconceptions

Misconceptions about the Pennsylvania Articles of Incorporation form can lead to confusion and mistakes during the incorporation process. Here are five common misunderstandings:

- All businesses must file Articles of Incorporation. Many believe that every business entity requires this form. However, only corporations need to file Articles of Incorporation. Sole proprietorships and partnerships do not.

- Filing Articles of Incorporation guarantees tax-exempt status. Some assume that once they file, their corporation will automatically receive tax-exempt status. This is not true. Organizations must apply separately for tax-exempt status under IRS regulations.

- Articles of Incorporation can be filed without a registered agent. A common misconception is that a registered agent is optional. In reality, Pennsylvania law requires every corporation to designate a registered agent to receive legal documents.

- Changes to the Articles of Incorporation are easy and can be done informally. Many think that they can make changes to their Articles without a formal process. However, any amendments must be filed with the state and follow specific procedures.

- The Articles of Incorporation are the only requirement for starting a corporation. Some believe that filing this document is the sole step in forming a corporation. In fact, additional steps, such as obtaining necessary licenses and permits, are also required.

Some Other Articles of Incorporation State Templates

Washington Sos Business Search - The document may require the signatures of all incorporators.

For individuals seeking clarity in rental agreements, understanding the various aspects of a fundamental Lease Agreement is crucial. This document not only details the obligations of both landlords and tenants, but it also assists in fostering a transparent rental relationship.

Nys Division of Corporations - Outlines provisions for handling corporate debt.