Fill in a Valid Payroll Check Template

Common mistakes

-

Inaccurate Personal Information: Many individuals fail to double-check their name, address, or Social Security number. This can lead to significant delays in processing payroll and may even result in tax complications.

-

Incorrect Pay Rate: Some people mistakenly enter the wrong hourly wage or salary. This error can lead to underpayment or overpayment, creating issues for both the employee and the employer.

-

Omitting Required Signatures: It is common for individuals to forget to sign the form. A missing signature can render the entire document invalid, delaying payroll processing.

-

Failure to Update Tax Withholdings: Employees sometimes neglect to review and update their tax withholding preferences. Changes in personal circumstances, such as marriage or the birth of a child, may necessitate adjustments.

-

Not Keeping a Copy: Many individuals do not retain a copy of the submitted Payroll Check form. Without a record, it becomes challenging to track discrepancies or resolve issues that may arise later.

Learn More on This Form

-

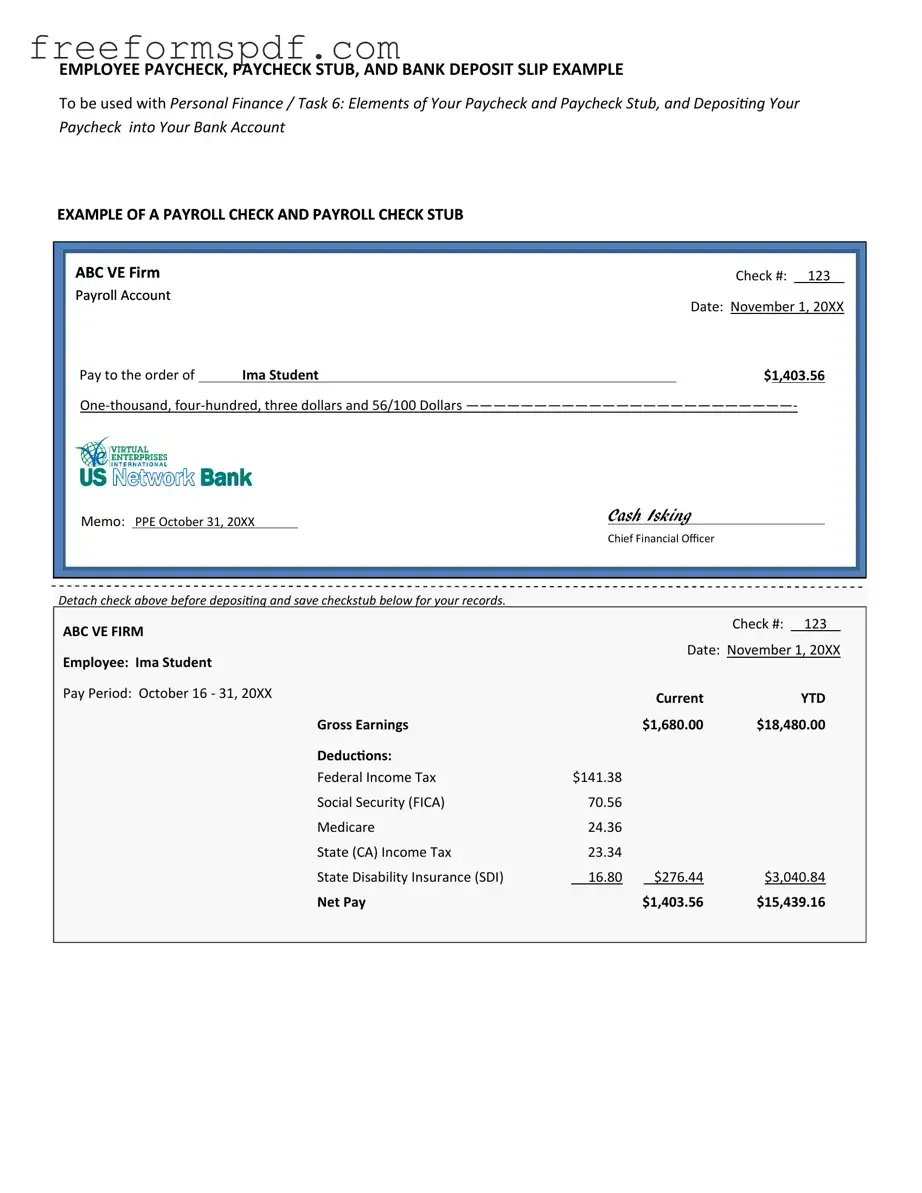

What is the Payroll Check form?

The Payroll Check form is a document used to process employee payments. It includes essential details such as the employee's name, payment amount, and pay period. This form ensures that employees receive their wages accurately and on time.

-

Who needs to fill out the Payroll Check form?

Typically, the Payroll Check form must be completed by the employer or payroll department. Employees do not fill it out themselves. However, employees may need to provide information for the form, such as their name and payment details.

-

How often is the Payroll Check form submitted?

The frequency of submission depends on the company's payroll schedule. Some companies process payroll weekly, bi-weekly, or monthly. The form must be submitted according to this schedule to ensure timely payments.

-

What information is required on the Payroll Check form?

The form typically requires the following information:

- Employee's full name

- Employee ID or Social Security Number

- Pay period dates

- Gross pay amount

- Deductions (if any)

- Net pay amount

-

What should I do if I notice an error on the Payroll Check form?

If an error is found, it is important to notify the payroll department immediately. They can correct the mistake and issue a revised check if necessary. Prompt communication helps avoid payment delays.

-

Can the Payroll Check form be submitted electronically?

Many companies now allow electronic submission of the Payroll Check form. Check with your employer to see if this option is available. Electronic submission can streamline the process and reduce paperwork.

-

What happens if the Payroll Check form is not submitted on time?

Late submission of the Payroll Check form can result in delayed payments. Employees may not receive their wages until the next payroll cycle. It is crucial to adhere to submission deadlines to avoid this issue.

-

How can I track the status of my payment after submitting the Payroll Check form?

To track payment status, employees should contact the payroll department. They can provide updates on processing times and any issues that may have arisen. Some companies may also offer online portals for tracking payroll status.

-

Is there a specific format for the Payroll Check form?

The format of the Payroll Check form may vary by company. However, it generally follows a standard layout that includes sections for employee information, payment details, and signatures. Employers should provide a template or guidelines for completion.

-

What should I do if I lose my Payroll Check?

If a Payroll Check is lost, report it to the payroll department immediately. They can issue a stop payment on the lost check and provide a replacement. It is important to act quickly to prevent any potential issues.

Misconceptions

Understanding the Payroll Check form is essential for both employers and employees. However, several misconceptions can lead to confusion. Here are seven common misconceptions about the Payroll Check form, along with clarifications to help clear up any misunderstandings.

- All deductions are mandatory. Many believe that every deduction on their paycheck is required by law. In reality, while some deductions like federal taxes are mandatory, others, such as health insurance or retirement contributions, may be optional based on the employer's offerings and the employee's choices.

- Payroll checks are always issued bi-weekly. Some assume that payroll checks must follow a bi-weekly schedule. However, the frequency of payroll checks can vary widely. Employers may choose to pay employees weekly, bi-weekly, semi-monthly, or monthly, depending on their policies.

- Overtime pay is automatically calculated. It is a common belief that overtime pay is automatically included in payroll calculations. While many payroll systems do calculate overtime, it is crucial for employees to verify that their hours are recorded correctly and that the calculations align with labor laws.

- Employees receive the full amount of their salary on the check. Some individuals think that the amount on their paycheck reflects their total salary. In reality, the amount received is often less due to various deductions, including taxes, insurance, and retirement contributions.

- Payroll checks cannot be corrected once issued. There is a misconception that once a payroll check is issued, it cannot be altered. In fact, if an error occurs, employers can issue corrected checks or adjustments in the following pay period to rectify the mistake.

- Only full-time employees receive payroll checks. Many assume that only full-time employees are eligible for payroll checks. However, part-time employees, freelancers, and contractors can also receive payroll checks, depending on their work arrangements and agreements with the employer.

- Payroll forms are the same for all states. Some people think that payroll forms and regulations are uniform across the country. In truth, each state has its own tax laws and regulations, which can affect how payroll forms are completed and what information is required.

By dispelling these misconceptions, individuals can better understand the Payroll Check form and its implications for their earnings and deductions.

Browse More Forms

Esa Letter for Anxiety - The letter plays a role in helping others understand the importance of your animal.

For those interested in a seamless transaction, understanding the key aspects of the Motorcycle Bill of Sale form is vital. This document not only simplifies the transfer of ownership but also ensures both parties are legally protected. To learn more about this essential procedure, you can visit the Arizona Motorcycle Bill of Sale guide.

Planned Parenthood Abortion Receipt Template - Patients are reminded that their choice to seek services is voluntary and can be reconsidered at any time.