Fill in a Valid P 45 It Template

Common mistakes

-

Using Incorrect Capitalization: Always fill out the P45 form using capital letters. Failing to do so can lead to confusion and errors in processing.

-

Omitting National Insurance Number: Make sure to include the employee's National Insurance number. Leaving this blank can delay important tax-related processes.

-

Incorrect Tax Code: Ensure the tax code is accurate at the time of leaving. An incorrect code can result in overpayment or underpayment of taxes.

-

Not Indicating Week 1/Month 1: If the employee is on a Week 1 or Month 1 basis, it is crucial to mark 'X' in the appropriate box. Missing this step can lead to incorrect tax deductions.

-

Neglecting to Certify Details: The form must be certified as correct. Failing to do this can lead to complications and potential penalties.

-

Leaving Out Important Dates: Always include the leaving date and the employee’s date of birth. Missing these dates can result in processing delays.

-

Forgetting to Provide Copies: Remember to hand over Parts 1A, 2, and 3 to the employee. Not providing these can affect their tax situation.

-

Ignoring Special Cases: If the employee has died, it’s essential to mark 'D' in the designated box and send the form immediately. Delays can cause serious issues for the estate.

Learn More on This Form

-

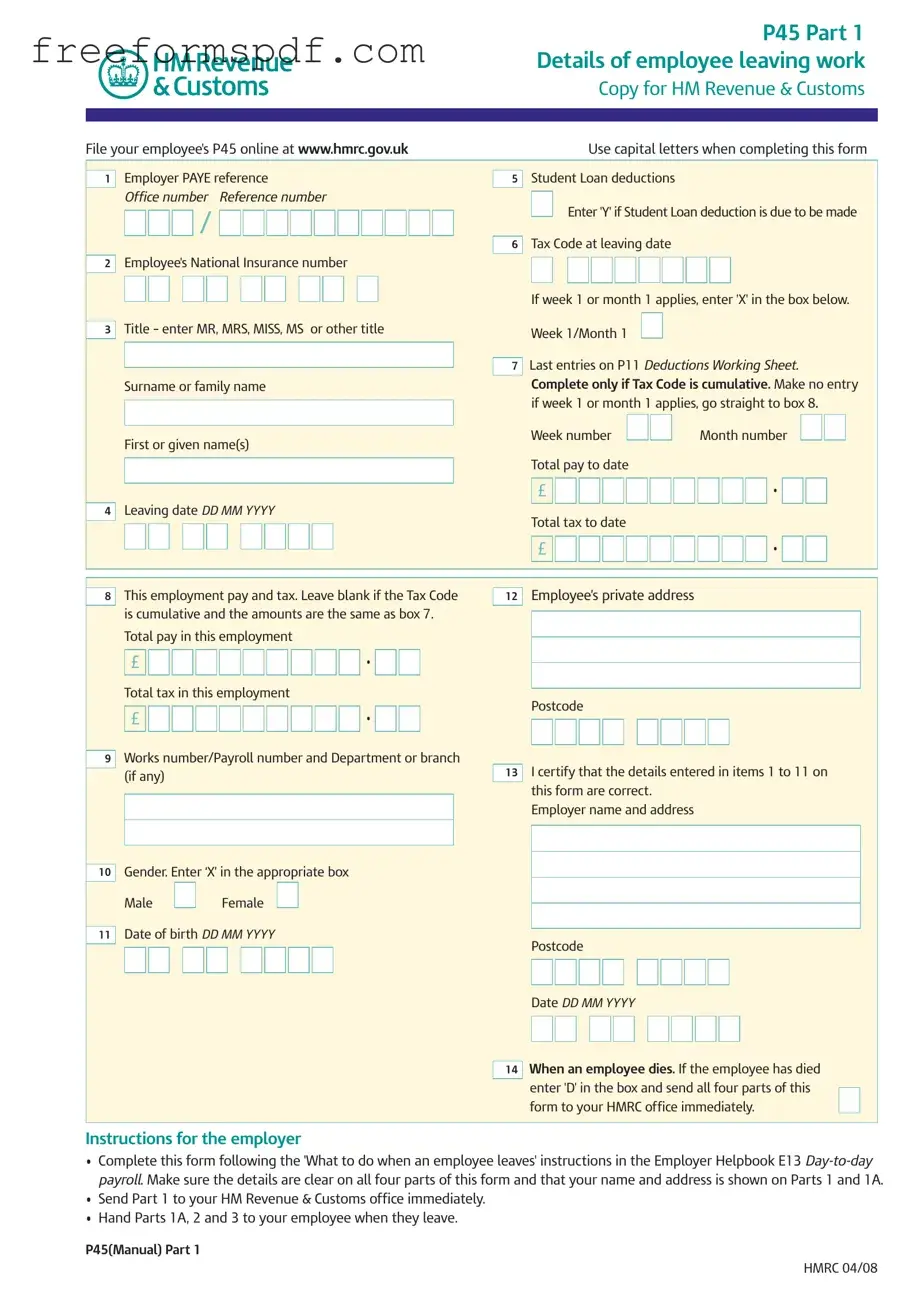

What is a P45 form?

The P45 form is an important document issued by an employer when an employee leaves their job. It contains details about the employee's pay and tax deductions during their time of employment. The form is divided into three parts: Part 1 is sent to HM Revenue & Customs (HMRC), while Parts 1A and 2 are given to the employee. Part 3 is for the new employer if the employee starts a new job. This form helps ensure that the employee pays the correct amount of tax in their new position.

-

What information is included on the P45 form?

The P45 form includes several key pieces of information. It provides the employee's name, National Insurance number, and leaving date. Additionally, it details the total pay and tax deducted up to the leaving date. The tax code and any student loan deductions are also included. This information is crucial for the employee's next employer to correctly calculate tax and deductions.

-

What should an employee do with their P45?

Upon receiving the P45, the employee should keep Part 1A safe, as it is necessary for tax purposes. If they start a new job, they must provide Parts 2 and 3 to their new employer. This ensures that the new employer has the correct information to avoid emergency tax codes, which could result in overpayment of taxes. If the employee is not starting a new job, they may need to use the P45 when filing a tax return or claiming tax refunds.

-

What happens if an employee loses their P45?

If an employee loses their P45, they should contact their former employer to request a replacement. Employers are required to keep records and may be able to provide a duplicate. If this is not possible, the employee can still report their income and tax information to HMRC. It’s important to act quickly to ensure that tax matters are handled correctly and to avoid any potential issues with tax refunds or payments.

Misconceptions

Understanding the P45 form can be confusing, especially with the various misconceptions surrounding it. Here are five common misunderstandings, along with clarifications to help clear things up.

- Misconception 1: The P45 form is only necessary for employees who are leaving a job permanently.

- Misconception 2: You cannot receive your P45 until your final paycheck is processed.

- Misconception 3: The P45 form is not important for tax purposes.

- Misconception 4: You can get a replacement P45 easily if you lose it.

- Misconception 5: You don’t need to worry about the P45 if you are self-employed.

This is not entirely true. While the P45 is commonly used when an employee leaves a job, it can also be relevant in temporary job situations. If an employee changes jobs, they will still need to provide their new employer with the P45.

Actually, employers should provide the P45 on or before the last working day. This ensures that employees have the necessary documentation to give to their new employer or for tax purposes.

This is a significant misunderstanding. The P45 contains crucial information regarding an employee's earnings and tax deductions. It is essential for ensuring that the correct tax code is applied in future employment, preventing overpayment or underpayment of taxes.

While it is possible to request a replacement, it is not as straightforward as it seems. Employers are not required to keep copies of P45 forms, and they may not have a record of the information needed to issue a new one. Therefore, it is advisable to keep the P45 in a safe place.

This is misleading. If you were previously employed and are now self-employed, you may still need your P45 for tax purposes. It helps in calculating any tax refunds or liabilities from your previous employment.

Browse More Forms

Annual Physical Exam Form - Engage in discussions about preventive care during your examination.

The New York Certificate form is a legal document used to officially establish a corporation in New York State. It outlines essential details such as the corporation's name, purpose, and share structure. Filing this certificate is a crucial step in the incorporation process, ensuring compliance with state regulations. For templates and examples, you can visit NY Templates.

Dd Form 2656 March 2022 Fillable - The DD 2656 is often accompanied by documents that verify service time.