Owner Financing Contract Document

Common mistakes

-

Neglecting to Include Accurate Property Details: One common mistake is failing to provide complete and accurate information about the property. This includes the address, legal description, and any relevant identifiers. Incomplete details can lead to confusion and potential disputes.

-

Omitting Buyer and Seller Information: It is crucial to include full names and contact information for both the buyer and seller. Missing this information can complicate communication and the enforcement of the contract.

-

Incorrectly Stating the Purchase Price: The purchase price must be clearly defined. Errors in this figure can create misunderstandings regarding the financial obligations of both parties.

-

Ignoring Financing Terms: The contract should outline the specific terms of financing, including interest rates, payment schedules, and any balloon payments. Failing to clarify these terms may lead to unexpected financial burdens.

-

Not Specifying Default Consequences: It is essential to address what happens in the event of a default. Without clear consequences, parties may find themselves in complicated legal situations.

-

Overlooking Signatures and Dates: A contract is not valid without the proper signatures and dates. Omitting these can render the agreement unenforceable.

-

Failing to Consult with Professionals: Many individuals attempt to complete the contract without professional guidance. This can lead to significant oversights. Consulting with a real estate attorney or financial advisor can provide valuable insights and help avoid costly mistakes.

Learn More on This Form

-

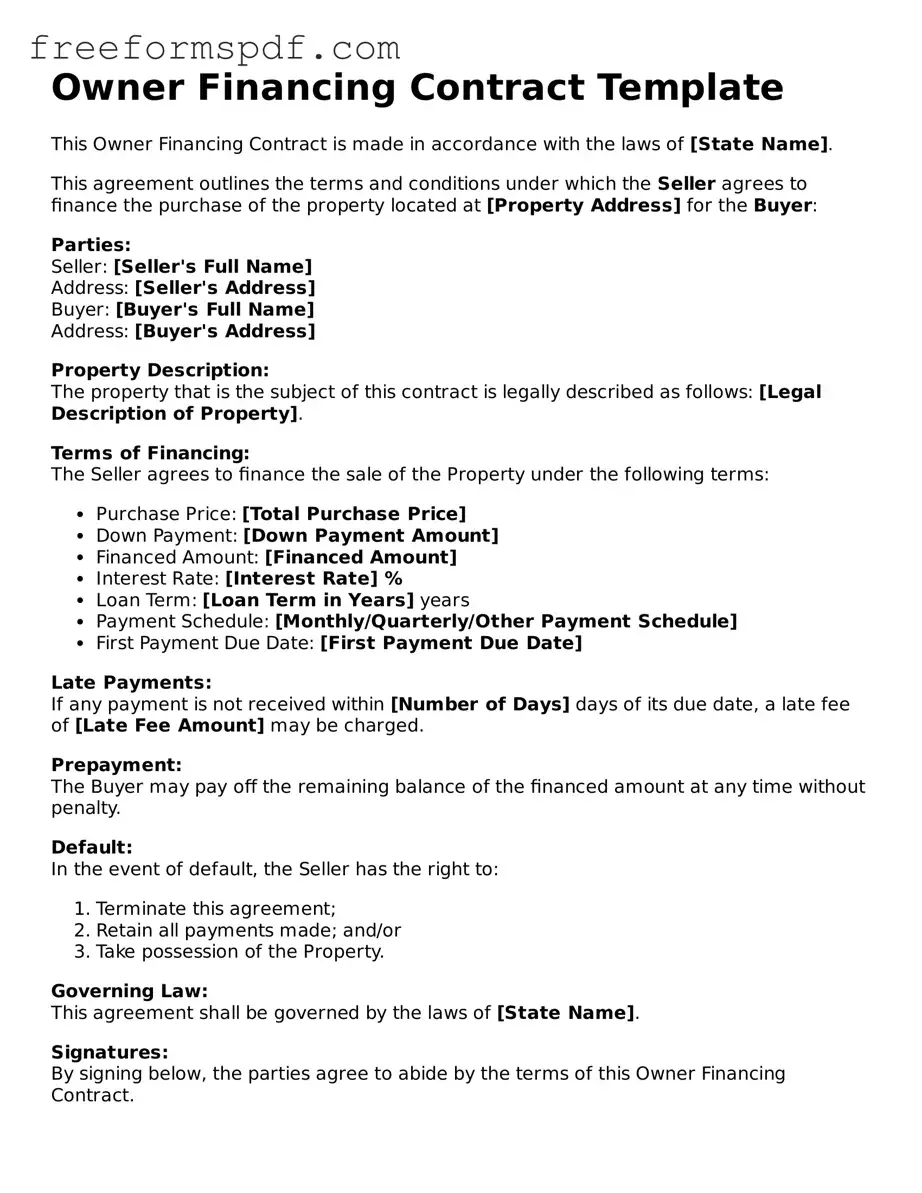

What is an Owner Financing Contract?

An Owner Financing Contract is an agreement between a seller and a buyer where the seller provides financing to the buyer to purchase the property. Instead of the buyer securing a loan from a traditional lender, the seller allows the buyer to make payments directly to them. This type of arrangement can be beneficial for both parties, especially if the buyer has difficulty obtaining financing through conventional means.

-

What are the benefits of using Owner Financing?

There are several advantages to owner financing:

- Flexible terms: The seller and buyer can negotiate terms that work for both parties, such as interest rates, payment schedules, and down payment amounts.

- Quicker transactions: Without the need for bank approvals, the closing process can often be faster.

- Attracts more buyers: Properties with owner financing may appeal to buyers who struggle to secure traditional financing.

-

What should be included in an Owner Financing Contract?

To ensure clarity and protect both parties, an Owner Financing Contract should include:

- The purchase price of the property.

- The down payment amount and payment schedule.

- The interest rate and loan term.

- Consequences for late payments or default.

- Any additional terms or conditions agreed upon by both parties.

-

Are there any risks associated with Owner Financing?

Yes, there are some risks to consider. For sellers, there’s the possibility that the buyer may default on the loan, leading to potential financial loss. Buyers may face challenges if they are unable to secure financing later, which could affect their ability to own the property long-term. It’s important for both parties to fully understand their obligations and consider consulting with a real estate professional or attorney before entering into an agreement.

Misconceptions

Owner financing can be a beneficial arrangement for both buyers and sellers, but several misconceptions often cloud the understanding of this process. Here are four common misconceptions:

- Owner financing is only for buyers with poor credit. Many people believe that owner financing is a last resort for those who cannot secure traditional financing. In reality, this option can appeal to a wide range of buyers, including those with good credit who prefer the flexibility and potential cost savings associated with owner financing.

- Owner financing is always a risky option for sellers. While there are risks involved, such as the possibility of buyer default, sellers can mitigate these risks through careful screening of buyers and structuring the contract with protective clauses. When done correctly, owner financing can provide a steady income stream and a quicker sale.

- The terms of an owner financing contract are always negotiable. While many aspects of the contract can be negotiated, certain elements may be less flexible. For example, local laws and regulations can dictate specific terms that must be adhered to, which may limit the extent of negotiation.

- Owner financing eliminates the need for legal documentation. Some believe that owner financing is an informal agreement that doesn’t require formal documentation. However, a well-drafted contract is essential to protect both parties' interests and ensure clarity regarding the terms of the agreement.

Understanding these misconceptions can help both buyers and sellers make informed decisions when considering owner financing as an option in real estate transactions.

Other Types of Owner Financing Contract Forms:

Purchase Agreement Addendum - Serves to clarify terms for better mutual understanding.

The importance of having a well-structured agreement cannot be overstated, as it ensures that both parties are clear on their responsibilities and rights throughout the transaction process. Utilizing resources like Minnesota PDF Forms can be invaluable in drafting a thorough and effective purchase agreement that meets all legal requirements and protects the interests of both buyers and sellers.

How to Fire a Realtor Example Letter - A straightforward method to cancel a pending real estate agreement.